Huw Pill, the Bank of England's chief economist, has signaled that it is time to revise the pace of monetary easing. According to him, the central bank is now poised to cut interest rates more gradually than previously expected. The reason is simple: inflation is not giving up.

Huw Pill, one of the Monetary Policy Committee’s avid hawks, reminded the public that core inflation remains “too persistent.” As the central bank has already begun easing, it will now need to proceed with more caution.

It is time to acknowledge that inflationary pressure has not disappeared. This is not a halt, but just a more cautious step forward, Huw Pill said during his speech at the Institute of Chartered Accountants in England and Wales.

He admitted that interest rates may be lowered further over the coming year, provided that the economy behaves “according to plan.” As we all know, plans rarely survive contact with reality. That is why the policymaker stressed that easing too quickly or too aggressively could reignite inflation.

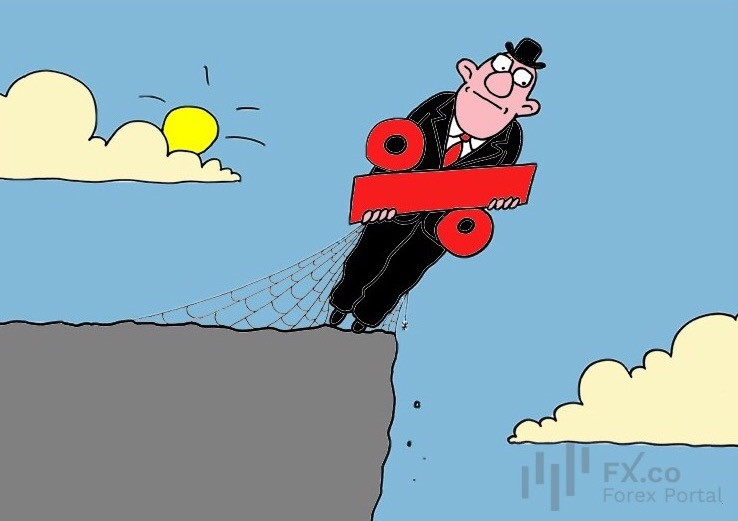

To sum up, this pause is not a surrender, but a breather for the Bank of England. This is “a skip, not a stop” on the path to policy normalization as Huw Pill defines it.

Still, his tone carried more concern than calm. Inflation expectations have now become entrenched and can no longer be ignored.

The message was clear: the Bank of England will proceed with caution, even if the markets want a show. Those who were hoping for a rapid series of rate cuts may need to adjust their expectations. From now on, monetary easing is going to be slower and entirely data-dependent, especially as economic data frequently defies forecasts.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română