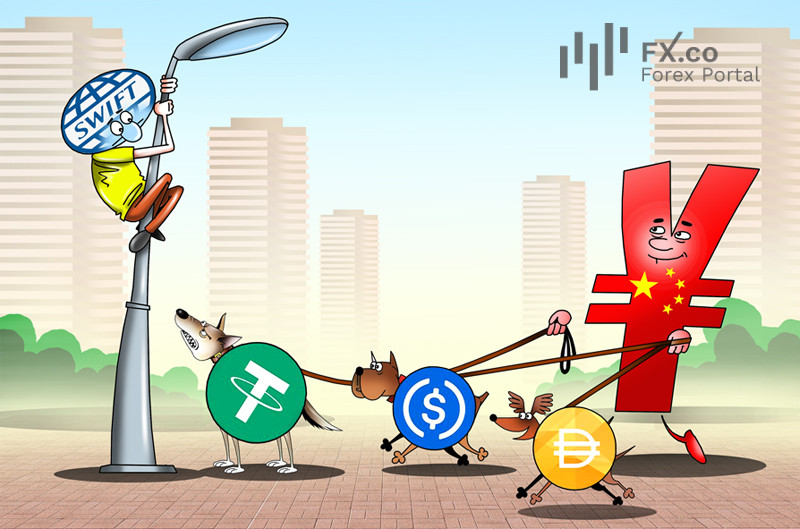

Some investors are convinced: stablecoins could serve as a springboard for the yuan’s entry into the global financial league. But at Bank of America, experts advise holding the applause. In a recent note, the bank’s analysts carefully reminded people that a currency’s global role is built not on hype, but on liquidity, trust, and a resilient infrastructure.

In their view, the worldwide recognition of the yuan is more likely to advance through bilateral settlement agreements in local currencies and improvements in the currency’s own stability, rather than through digital experiments. In other words, China does not need a new toy, it needs a reliable mechanism.

At first glance, the idea seems appealing: build a system that bypasses SWIFT and use stablecoins to boost demand for the yuan. Still, BofA sees more questions than answers. User adoption remains limited, the profitability of issuers is doubtful, and regulatory risks are growing faster than market capitalization.

The analysts do acknowledge that stablecoins could prove useful in cross-border payments — almost-instant transactions and low fees are indeed a strong argument. But there are challenges even here: the offshore CNH pool remains small, and blockchain fees become unpredictable as volumes rise.

In other areas, the potential is more modest. Consumer commerce in China already thrives on mobile payments, crypto trading is officially off-limits, and for storing value, investors still prefer currencies that do not fluctuate with every tweet.

BofA also points out the unexciting reality of yields: short-term government bonds offer just 1–2%, which is clearly not enough to make stablecoins a profitable business.

In the end, it all comes back to the obvious: the yuan’s form is not what matters. Its global future depends on trust, liquidity, and stability, but not on what blockchain it is recorded.

The bank concluded: expand swap lines, sign settlement agreements, and leave stablecoins to those who still believe in overnight revolutions.

Български

Български

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română