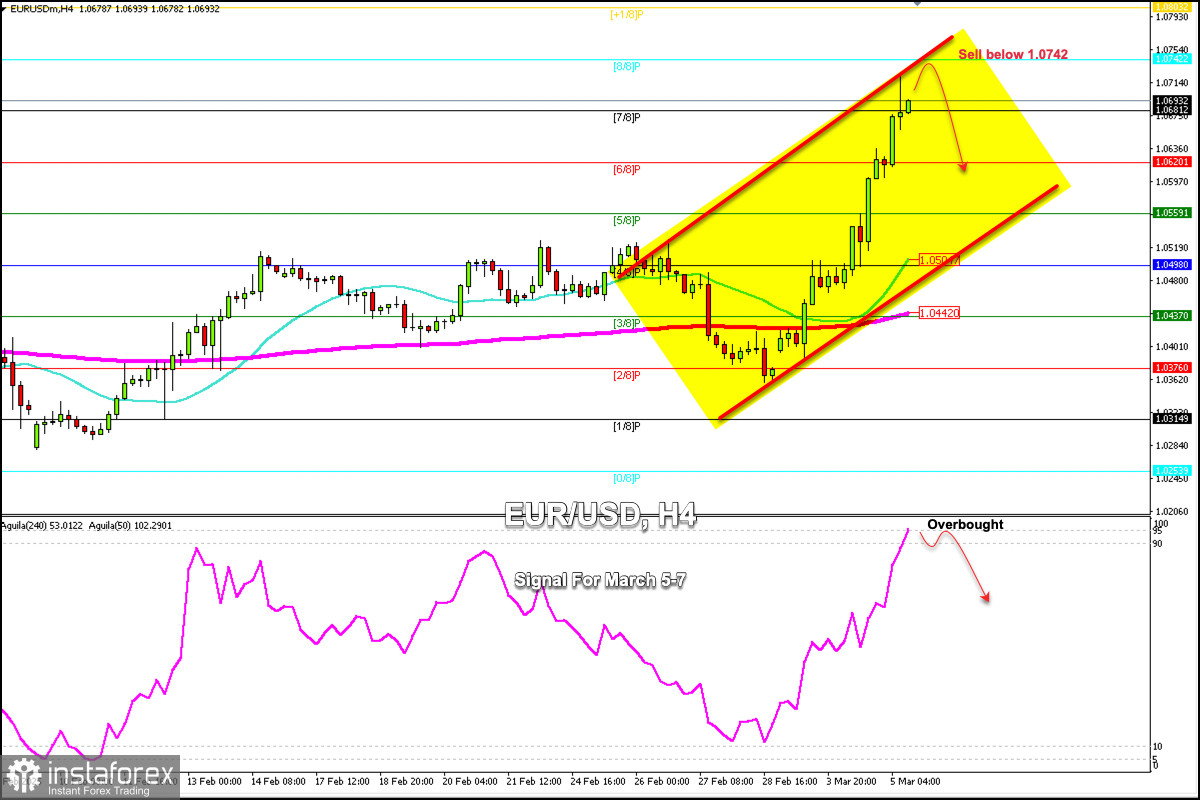

Early in the American session, the euro was trading around 1.0693, below 8/8 Murray. During the European session, the euro reached a weekly high around 1.0722, the level last seen last year in November.

If the euro continues to rise above 1.0680 in the next few hours, which represents good support, EUR/USD could reach the strong resistance of 1.0742. This level is worthy of attention as it coincides with the top of the uptrend channel.

Concerns about an economic recession in the United States caused a massive sell-off in the dollar, which favored the euro reaching resistance levels.

On the H4 chart, we can see that EUR/USD left a gap around 1.0375. This level could draw the euro since the gap has not been covered yet.

The Eagle indicator has reached overbought levels. If the euro trades below 1.0742 in the next few days, it will be seen as a signal to sell, with targets at 1.0620, at the psychological level of 1.0500, and finally at 2/8 Murray located at 1.0376 (GAP).

On the H4 chart, we can see that EUR/USD is showing signs of exhaustion. A technical correction is likely to occur in the coming days, so we will look for opportunities to sell below 1.0750.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română