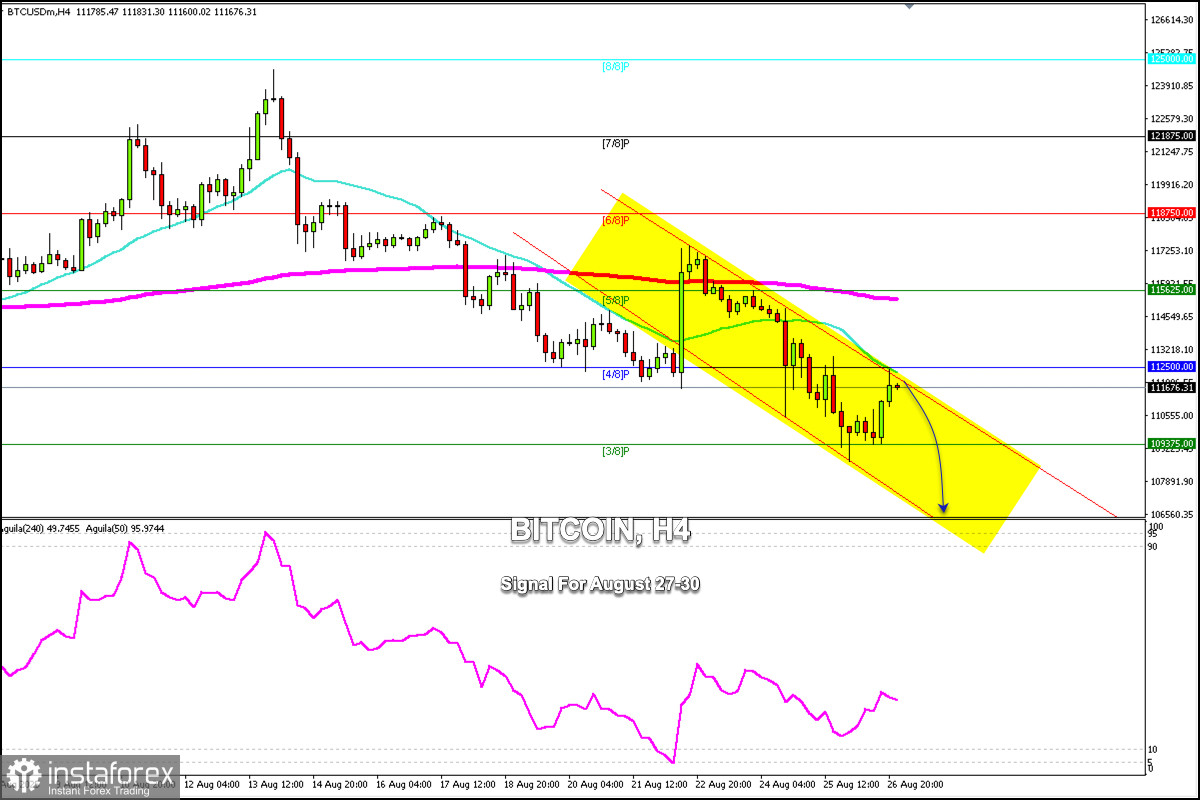

Bitcoin is trading around $111,676 under a slight technical correction after reaching the 4/8 Murray level around $112,500. This strong resistance level combines the 21SMA with the 4/8 Murray level, and the top of the bearish trend channel also converges at this level, which could prove to be a strong barrier for Bitcoin.

A failed break of the BTC price above this level could lead to a continuation of its bearish cycle, potentially reaching $106,530 around the 2/8 Murray level.

If Bitcoin breaks and consolidates above $112,500, this could be seen as a new bullish sequence, and Bitcoin could reach the 200 EMA around $115,000 and the 5/8 Murray level located at $115,625.

Given that Bitcoin is under downward pressure, our strategy will be to continue selling in the coming hours, with targets at 3/8 Murray around the psychological level of $110,000. If this level is broken, we could continue short positions with targets at 106,500.

The technical chart suggests that Bitcoin could be under downward pressure below 112,500, so any unsuccessful attempt to break above this area will be seen as a signal to sell in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română