The euro and the pound managed to resume their growth, but after reaching a new weekly high, pressure on the euro returned, while the British pound did not even reach that level.

Extremely weak U.S. consumer confidence data for February put pressure on the U.S. dollar, triggering a rise in the euro and the British pound. The consumer confidence index, which reflects Americans' willingness to spend, fell to its lowest levels in several months, signaling a potential slowdown in U.S. economic growth. Investors started selling off the dollar, concerned about the American economy's outlook.

The increasing signs of weakness in the U.S. economy could force the Federal Reserve to ease its monetary policy further, which would weaken the dollar even more. At the same time, improvements in European economic indicators have not yet provided strong support for the euro. A further strengthening of the euro is possible, but for this scenario to materialize, a positive trend in Germany's leading consumer sentiment index is necessary. Given the current pessimistic expert forecasts, the euro will only regain support if the data exceeds expectations.

As for the pound, as mentioned earlier, bears prevented the GBP/USD pair from reaching its weekly high, which is a strong technical signal. The absence of significant economic news or geopolitical events today means that traders will rely more on technical levels and overall market sentiment.

In the short term, any impact may arise from statements made by Swati Dhingra, a member of the BoE's Monetary Policy Committee. However, this is unlikely to be significant.

If the data aligns with economists' expectations, it is advisable to follow the Mean Reversion strategy. Conversely, if the data considerably exceeds or falls short of expectations, the Momentum strategy would be more appropriate.

Momentum Strategy (on breakout):

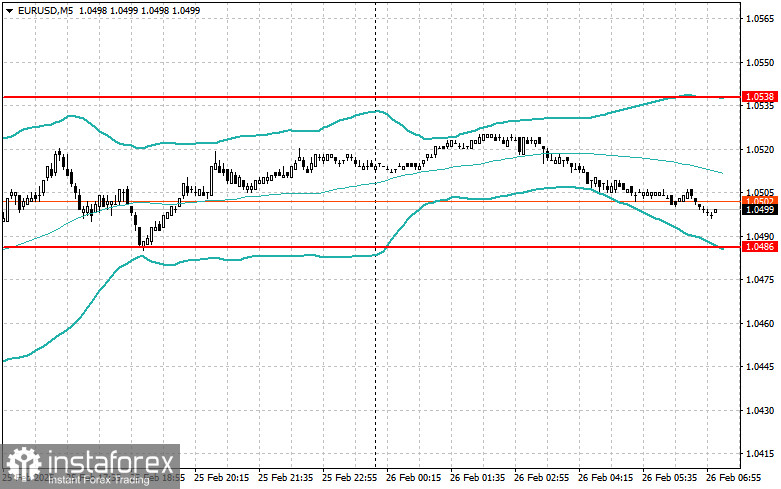

EUR/USD

Buying on a breakout above 1.0508 could lead to an increase toward 1.0525 and 1.0560.

Selling on a breakout below 1.0480 could lead to a decline toward 1.0460 and 1.0430.

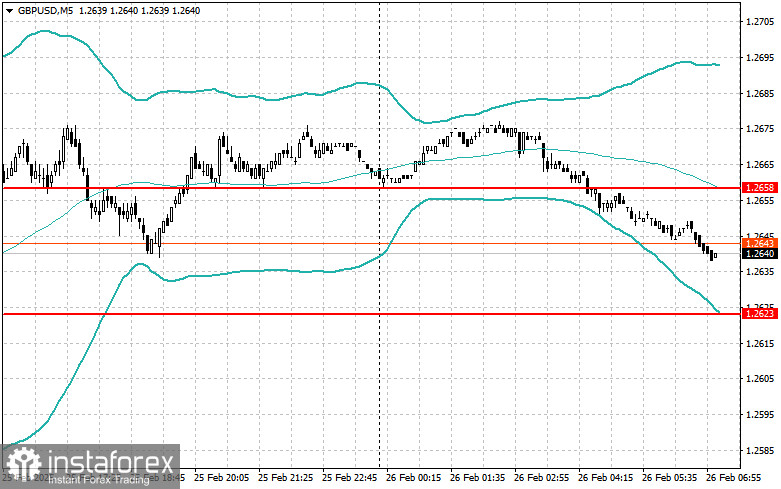

GBP/USD

Buying on a breakout above 1.2648 could push the pound toward 1.2665 and 1.2720.

Selling on a breakout below 1.2620 could lead to a drop toward 1.2600 and 1.2560.

USD/JPY

Buying on a breakout above 149.65 could lead to a rise toward 149.92 and 150.17.

Selling on a breakout below 149.35 could trigger a sell-off toward 148.90 and 148.58.

Mean Reversion Strategy (on pullbacks):

EUR/USD

I will look for sell opportunities after an unsuccessful breakout above 1.0538, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.0486, upon a return above this level.

GBP/USD

I will look for sell opportunities after an unsuccessful breakout above 1.2658, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.2623, upon a return above this level.

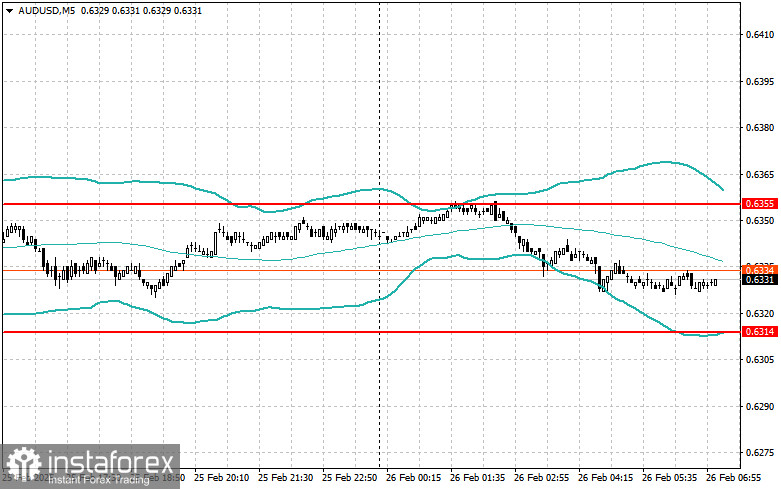

AUD/USD

I will look for sell opportunities after an unsuccessful breakout above 0.6355, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 0.6314, upon a return above this level.

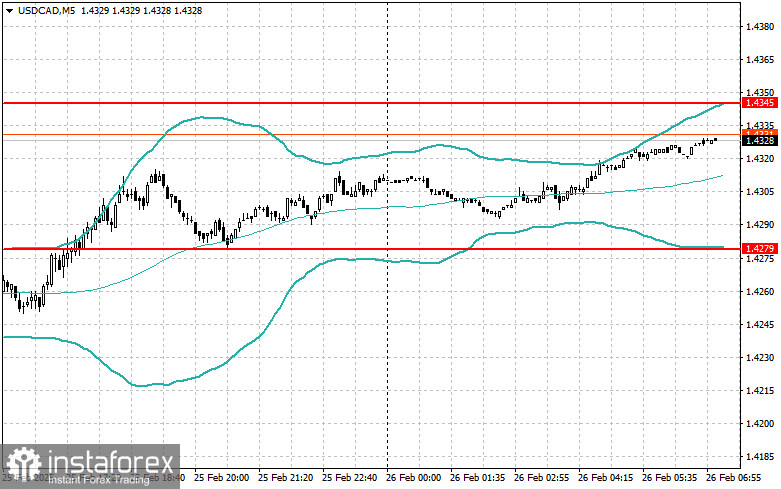

USD/CAD

I will look for sell opportunities after an unsuccessful breakout above 1.4345, upon a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.4279, upon a return above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română