Massive liquidations of long positions and mounting market fear

The latest developments in the cryptocurrency market triggered a record drop in prices and massive long position liquidations. According to the latest data, the total amount of liquidated positions exceeded $1.34 billion. This phenomenon, known as forced liquidation, occurs when sharp price fluctuations lead exchanges to automatically close leveraged positions due to insufficient margin collateral.

Massive liquidations of long positions and mounting market fear

The latest developments in the cryptocurrency market triggered a record drop in prices and massive long-position liquidations. According to the latest data, the total amount of liquidated positions exceeded $1.34 billion. This phenomenon, known as forced liquidation, occurs when sharp price fluctuations lead exchanges to automatically close leveraged positions due to insufficient margin collateral.

The Greed&Fear index sank to 21 out of 100, signaling a sharp burst in investor anxiety. In a panic-driven market, asset holders rush to sell their crypto assets, further accelerating declines in market quotes.

The leading exchanges with the highest liquidation volumes were:

Bybit – $500 million in liquidations

Binance – $246 million in liquidations

Most traders were betting on a rally in crypto assets, but the sudden market downturn led to heavy losses among market participants.

Trump's tariffs and their impact on the crypto market

The sharp drop in digital assets came in response to Trump's newly introduced tariffs on Canada and Mexico, causing an immediate market crash:

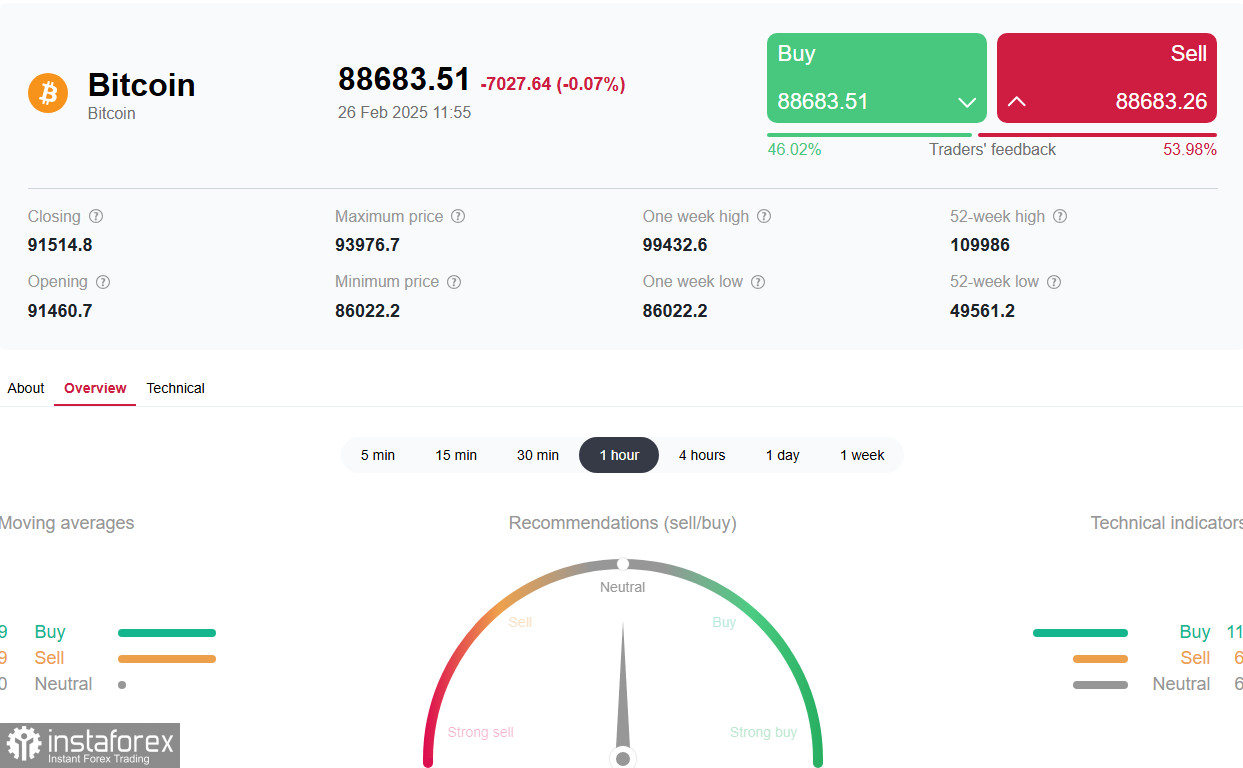

Bitcoin (BTC) fell below $90,000. The total market lost over $230 billion

Experts note that cryptocurrencies remain high-risk assets, often mirroring stock market behavior, unlike traditional safe-haven assets such as gold.

Bybit hack: the largest cyberattack on a crypto exchange

Another major factor pressuring the market was the recent hack of Bybit, one of the largest digital asset trading platforms. On February 21, 2025, hackers gained access to Bybit's cold wallet, which stored Ethereum holdings, and grabbed $1.4 billion worth of crypto.

At the time of the attack, Bybit handled over 6% of the global trading volume, making this the largest cyberattack in crypto industry history. The incident badly impacted Ethereum's price, fueling panic selling across the market.

Crypto market outlook: panic or opportunity?

Despite the heavy losses, some investors view the current decline as a long-term buying opportunity.

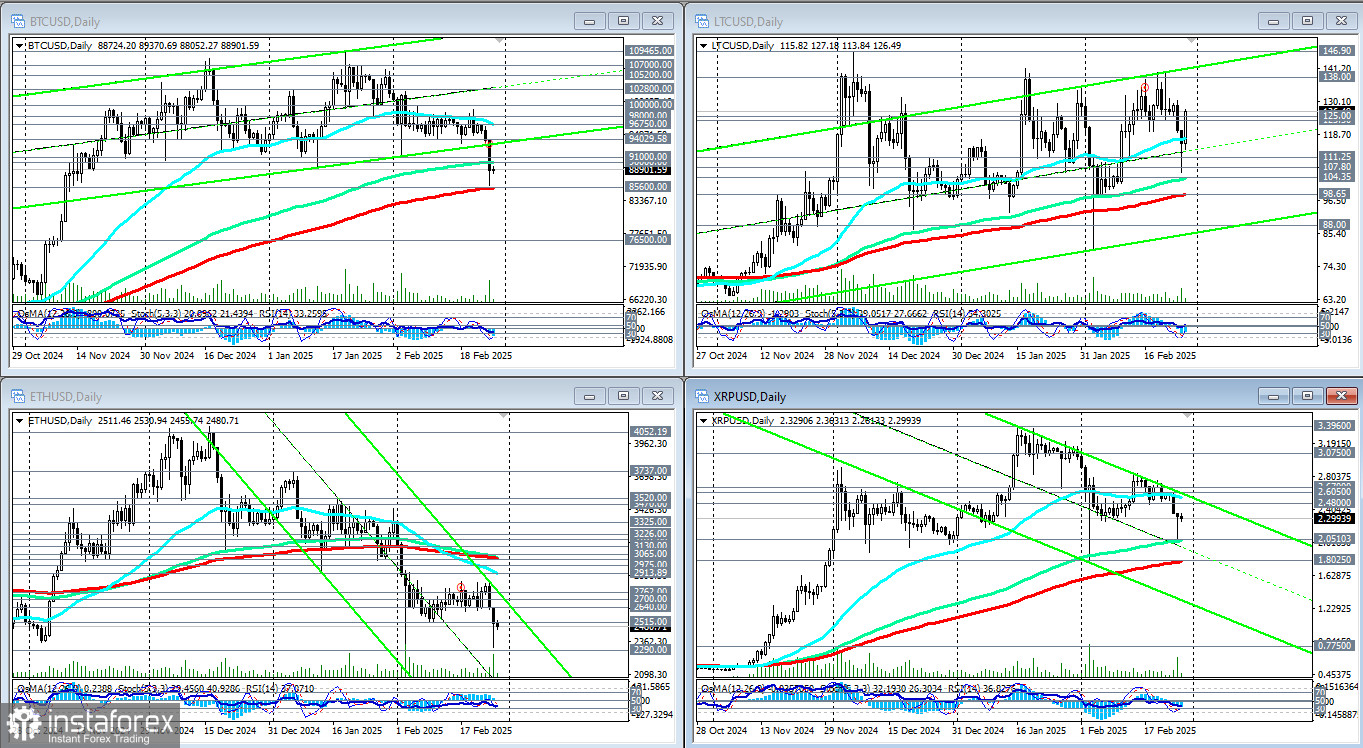

Bitcoin and other major cryptocurrencies remain above key support levels, although Ethereum (ETH/USD) remains under pressure, currently trading in a mid-term bearish zone but still holding within a long-term bullish trend above $2,290.

Key support levels for major crypto pairs:

BTC/USD: above $85,600 (EMA 200 on the daily chart)

LTC/USD: above $98.65 (EMA 200 on the daily chart)

XRP/USD: above $1.8025 (EMA 200 on the daily chart)

Ethereum remains "deeply depressed" as ETH/USD continues to trade within a mid-term bearish trend, but it still holds a long-term bullish position above $2,290 (EMA 200 on the weekly chart). The recent Bybit hack and the theft of Ethereum played a significant role in this persistent selling pressure on ETH.

Conclusion

The crypto market has once again been overwhelmed by extreme volatility, driven by geopolitical and economic factors. Trump's new tariffs and the massive Bybit hack have shaken investor confidence and triggered large-scale liquidations. However, long-term investors still see cryptocurrencies as promising assets, despite short-term turmoil.

The big question: crisis or buying opportunity?

Will the current events lead to a prolonged market downturn, or will they serve as an entry point for new investors? The coming weeks will determine how resilient digital assets remain in the face of global challenges. For long-term Bitcoin fans, price dips represent a strategic opportunity to accumulate assets, as they remain confident in BTC's long-term potential outweighing short-term volatility.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română