The euro and the pound rose throughout the day despite Donald Trump's threats to impose trade tariffs on several countries, including China. Surprisingly, there was no specific mention of the EU, further fueling demand for risk assets.

Yesterday's weak U.S. manufacturing activity data was the latest in a series of disappointing economic reports, highlighting a worsening economic situation in the U.S. This added pressure on the U.S. dollar and strengthened the euro and the pound. These reports intensify debates about a potential slowdown in U.S. GDP growth this year. Traders closely monitor each economic indicator to assess how resilient the economy is in the face of ongoing inflationary pressures and the Federal Reserve's restrictive monetary policy.

Weak manufacturing data is particularly concerning, as this sector has traditionally been one of the key drivers of economic growth. A decline in manufacturing activity could signal a slowdown in overall economic growth and weaker consumer and business demand.

In the first half of the day, eurozone unemployment data and Spain's unemployment change figures are expected today. The overall unemployment rate is projected to remain at 6.3%, which could support demand for the euro. However, it is important to remember that the European labor market is not uniform. Differences in national economies, education systems, and social support structures can offset the positive impact of a stable eurozone-wide figure. Traders should carefully analyze data from individual countries to get a more accurate picture of the situation.

If the data aligns with economists' expectations, following a Mean Reversion strategy is best. A Momentum strategy is recommended if the data is significantly higher or lower than expected.

Momentum Strategy (on breakout):

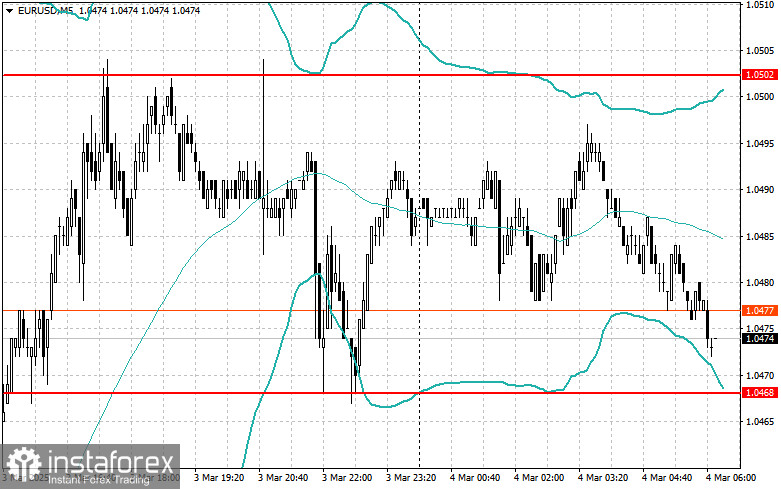

EUR/USD

Buying on a breakout above 1.0485 could push the euro towards 1.0520 and 1.0550.

Selling on a breakout below 1.0460 could drive the euro down to 1.0440 and 1.0420.

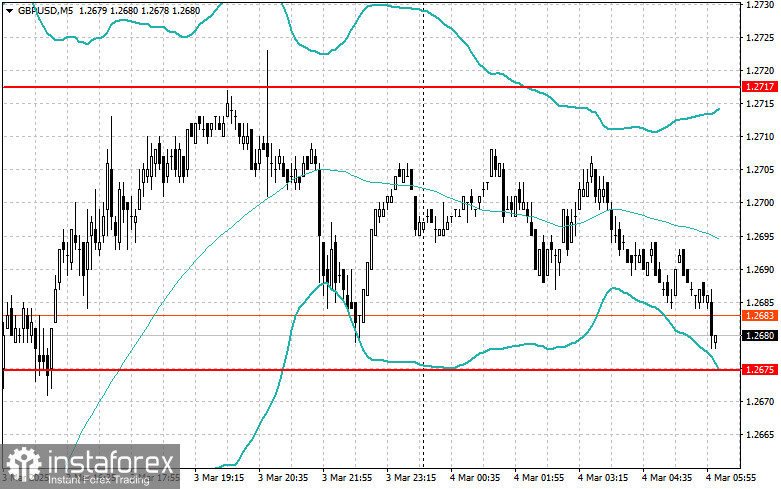

GBP/USD

Buying on a breakout above 1.2700 could lift the pound to 1.2730 and 1.2760.

Selling on a breakout below 1.2680 could push the pound down to 1.2645 and 1.2610.

USD/JPY

Buying on a breakout above 149.25 could strengthen the dollar toward 149.60 and 149.90.

Selling on a breakout below 148.95 could lead to a dollar decline toward 148.60 and 148.20.

Mean Reversion Strategy (on pullbacks):

EUR/USD

Looking for sell opportunities after an unsuccessful breakout above 1.0502, once the price returns below this level.

Looking for buy opportunities after an unsuccessful breakout below 1.0468, once the price moves back above this level.

GBP/USD

Looking for sell opportunities after an unsuccessful breakout above 1.2717, once the price returns below this level.

Looking for buy opportunities after an unsuccessful breakout below 1.2675, once the price moves back above this level.

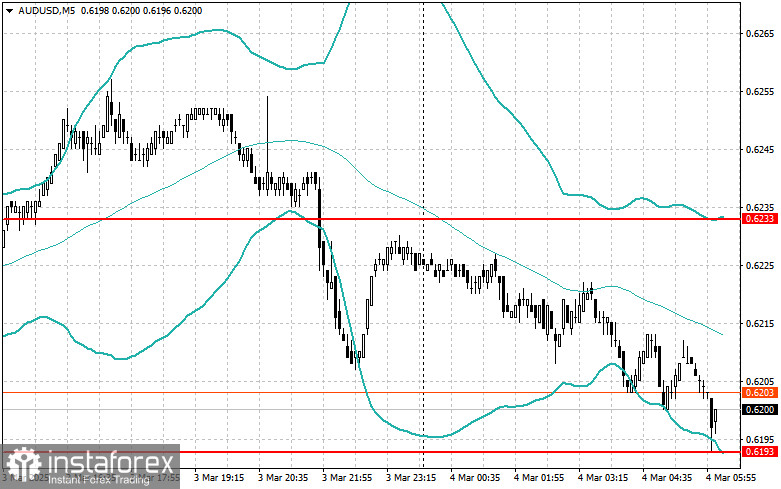

AUD/USD

Looking for sell opportunities after an unsuccessful breakout above 0.6233, once the price returns below this level.

Looking for buy opportunities after an unsuccessful breakout below 0.6193, once the price moves back above this level.

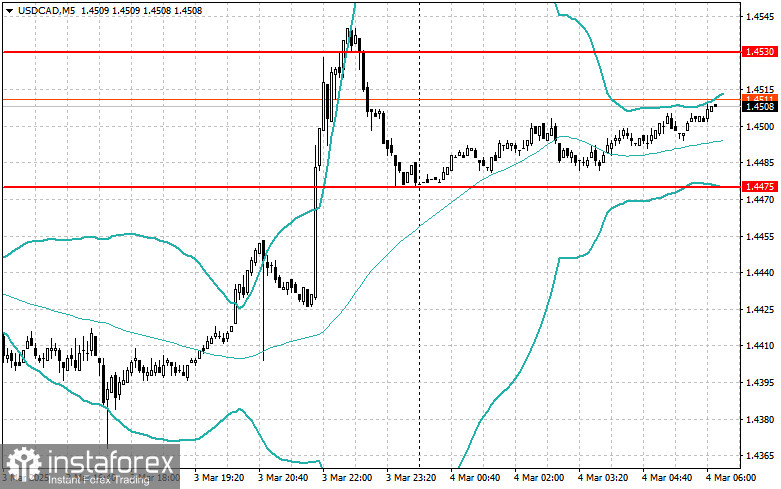

USD/CAD

Looking for sell opportunities after an unsuccessful breakout above 1.4530, once the price returns below this level.

Looking for buy opportunities after an unsuccessful breakout below 1.4475, once the price moves back above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română