Analysis of Macroeconomic Reports:

There are very few macroeconomic events scheduled for Tuesday, with the only notable one being the eurozone unemployment rate. However, this report does not typically have as strong an impact on traders as the U.S. unemployment rate, so it is likely that the market will largely overlook it. Additionally, the macroeconomic and fundamental calendars for Germany, the U.S., and the UK are empty for today.

Analysis of Fundamental Events:

While there are no significant fundamental events to note for Tuesday, a new speech from U.S. President Donald Trump is expected. On Monday, he announced that he would be making very important statements, which could trigger market volatility in the evening. Yesterday, we observed a sharp decline in the dollar following a scandal at the White House. Later, Trump announced that the U.S. would stop providing aid to Ukraine and impose new tariffs on China. Given this context, we wouldn't be surprised if the U.S. dollar starts to rise today. However, Trump's unpredictable policies may cause traders to think twice before purchasing the dollar.

General Conclusions:

On the second trading day of the week, both currency pairs could move in any direction, as the market is currently driven by emotions, with Donald Trump being the primary catalyst. For the euro, the pound, and the dollar, it's not just about the decisions made by the U.S. president, but also how the market interprets those decisions. For example, Friday's dispute at the White House was unlikely to be the direct reason for selling the dollar.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

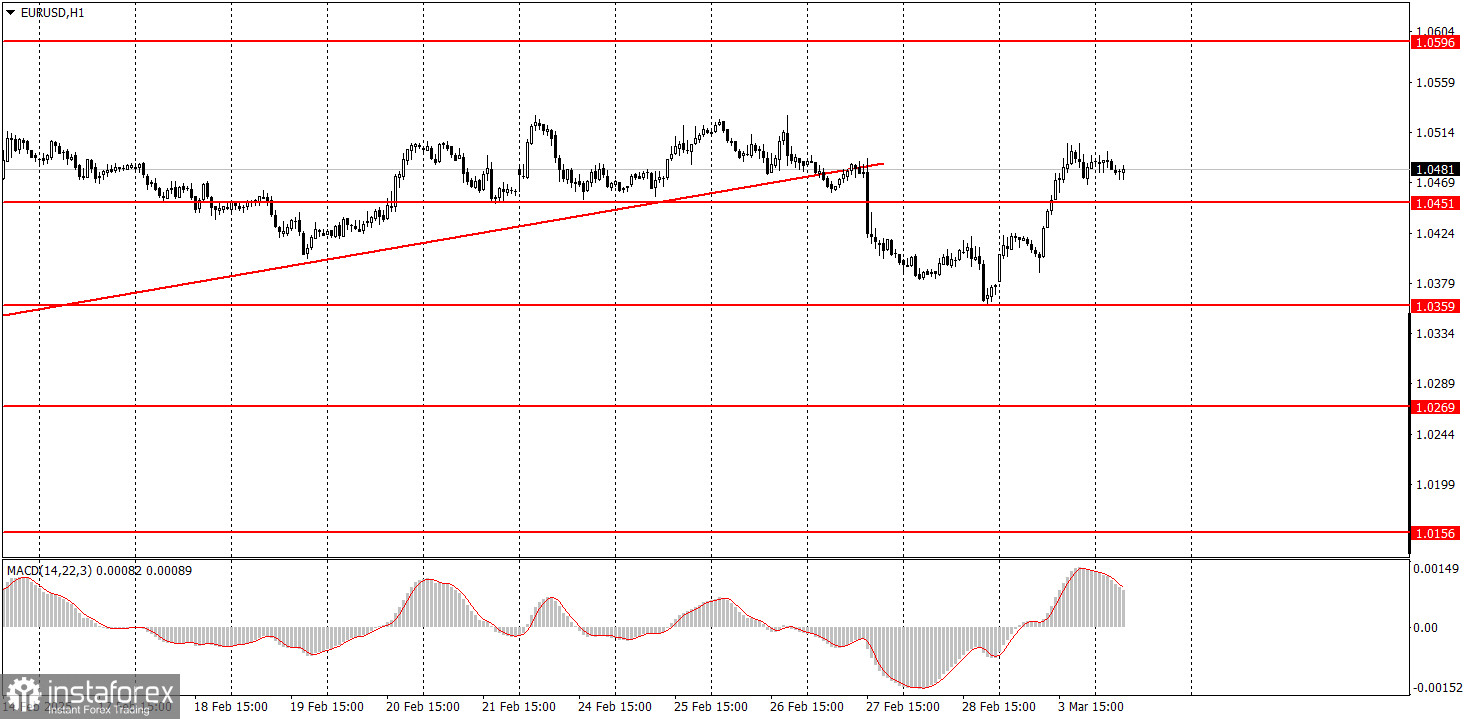

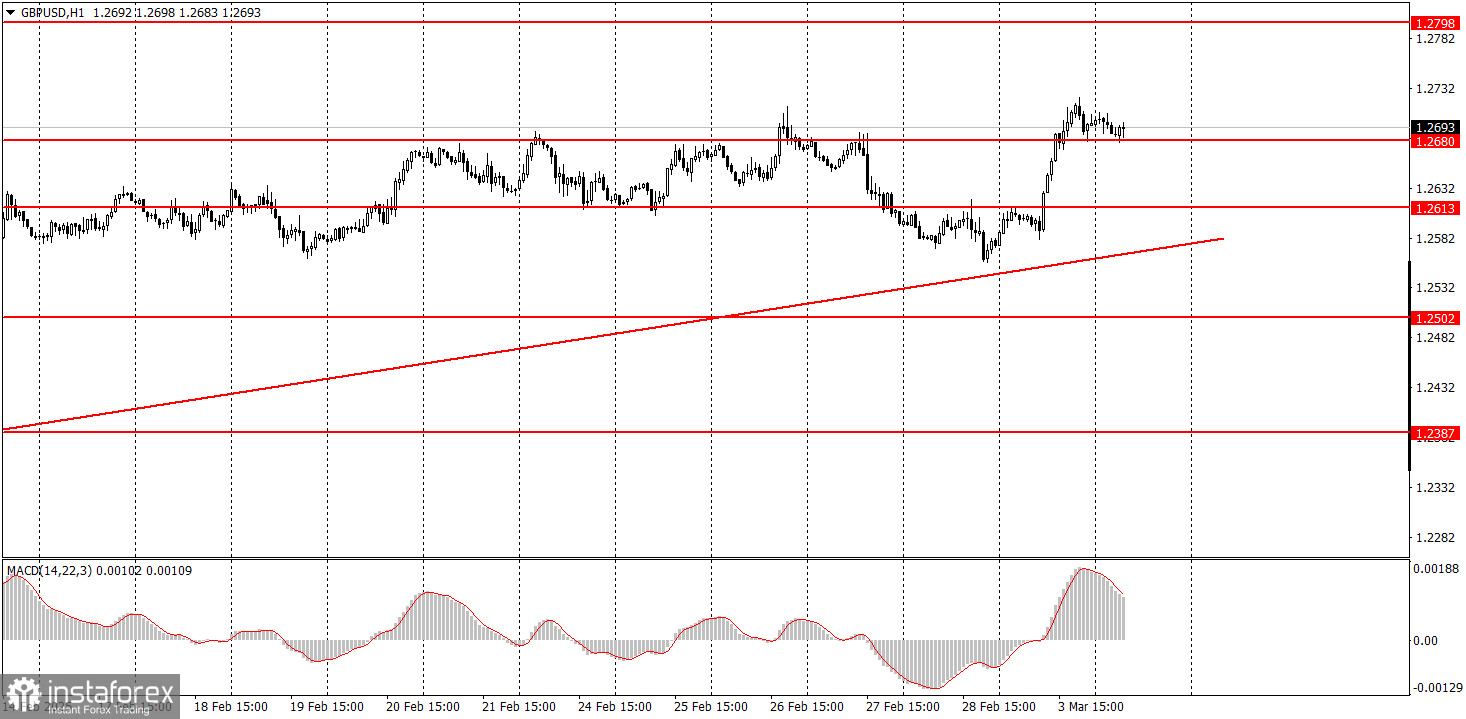

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română