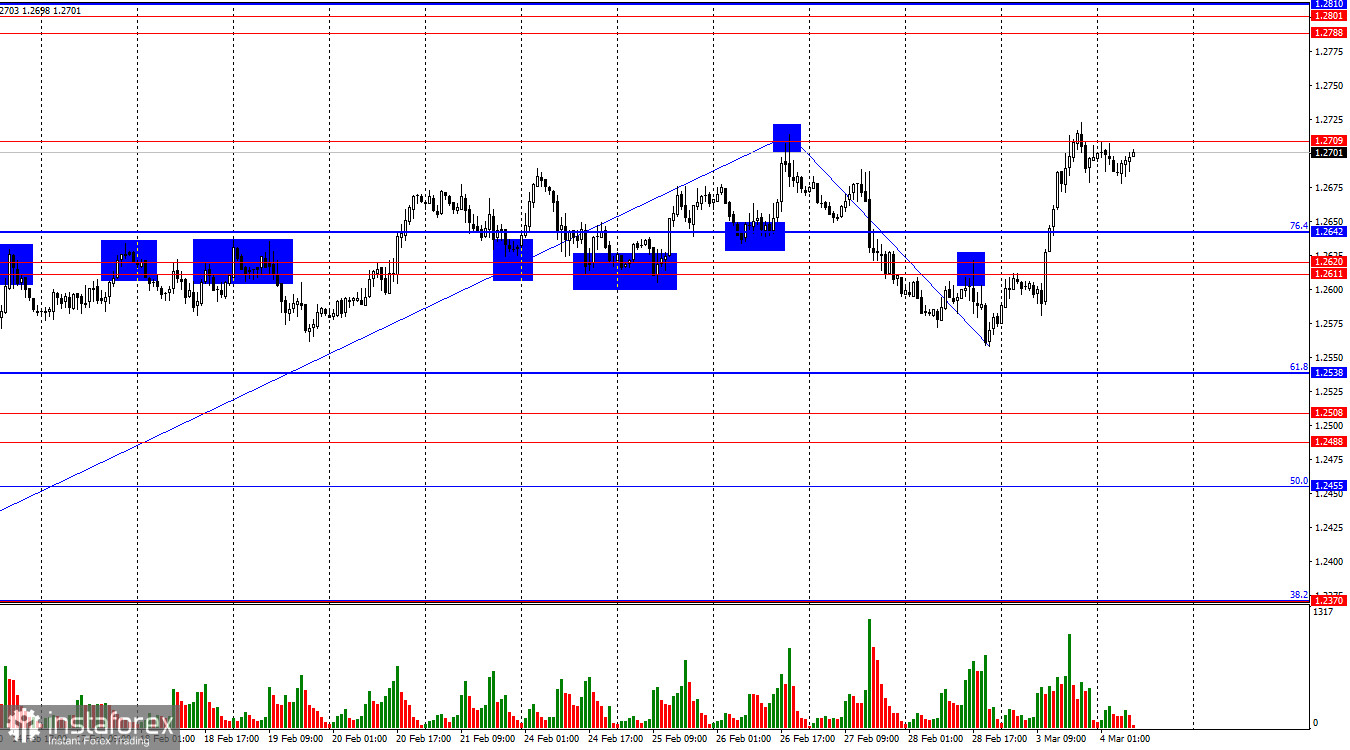

On the hourly chart, the GBP/USD pair reversed in favor of the British pound on Monday and posted new growth up to the level of 1.2709. Another rebound from this level will work in favor of the U.S. dollar and give bearish traders a second chance. If this scenario unfolds, the pair could decline toward the Fibonacci 61.8% level at 1.2538. Yesterday's rally left me puzzled. While the rise in the euro can be somewhat justified, the pound's surge was not entirely logical based on the news backdrop. The fundamental background was not particularly favorable for the dollar, yet the pound soared as if the Federal Reserve had cut rates by 0.50%.

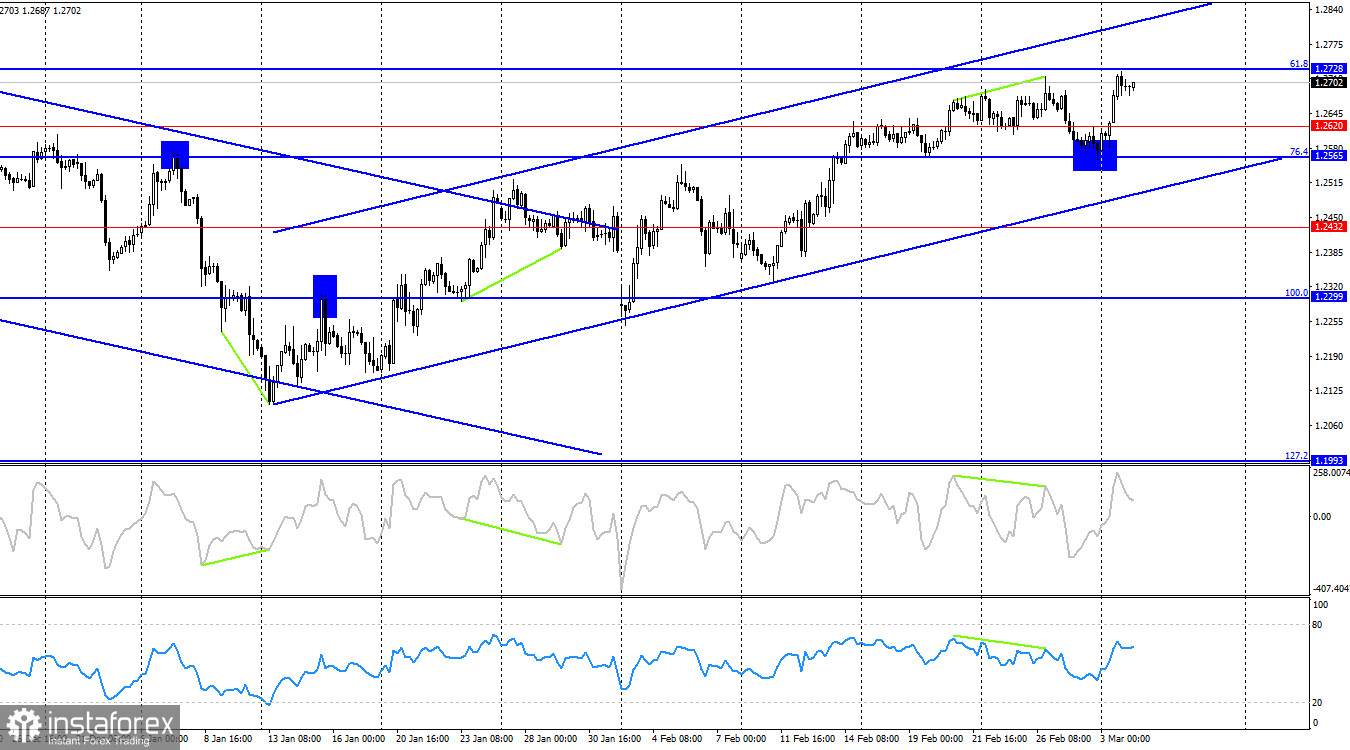

The wave situation is absolutely clear. The last completed downward wave did not break below the previous low, while the latest upward wave has already surpassed the last peak. This indicates that a "bullish" trend is still forming. However, graphical analysis suggests that at least one more downward wave is likely. The pound has shown strong growth recently, but the trend may shift to a "bearish" one.

Monday's fundamental background was overwhelmingly strong, leaving traders somewhat confused and prompting a panic sell-off of the troubled dollar. I have already mentioned Donald Trump's political decisions, which likely caused the dollar's collapse. In addition to new tariffs and a revised funding plan for Ukraine, Trump is preparing a new statement regarding a natural resources agreement with Kyiv. It should be noted that Ukraine will struggle to continue its military conflict with Russia without American support. Trump wants to end this conflict and no longer intends to spend U.S. taxpayers' money on assisting Kyiv.

Additionally, yesterday saw the release of the S&P manufacturing activity index for the U.S. and the ISM index. While the S&P index showed a fairly high reading, the ISM index fell below expectations. However, the main focus is currently on geopolitics rather than the economy.

On the four-hour chart, the pair reversed in favor of the U.S. dollar after forming a "bearish" divergence in both indicators, but the decline was short-lived. A rebound from the Fibonacci 61.8% level at 1.2728 would support the dollar and signal another drop toward the lower boundary of the ascending trend channel. However, I do not expect a significant decline in the pound until the price closes below this channel. There are no developing divergences in any indicators today.

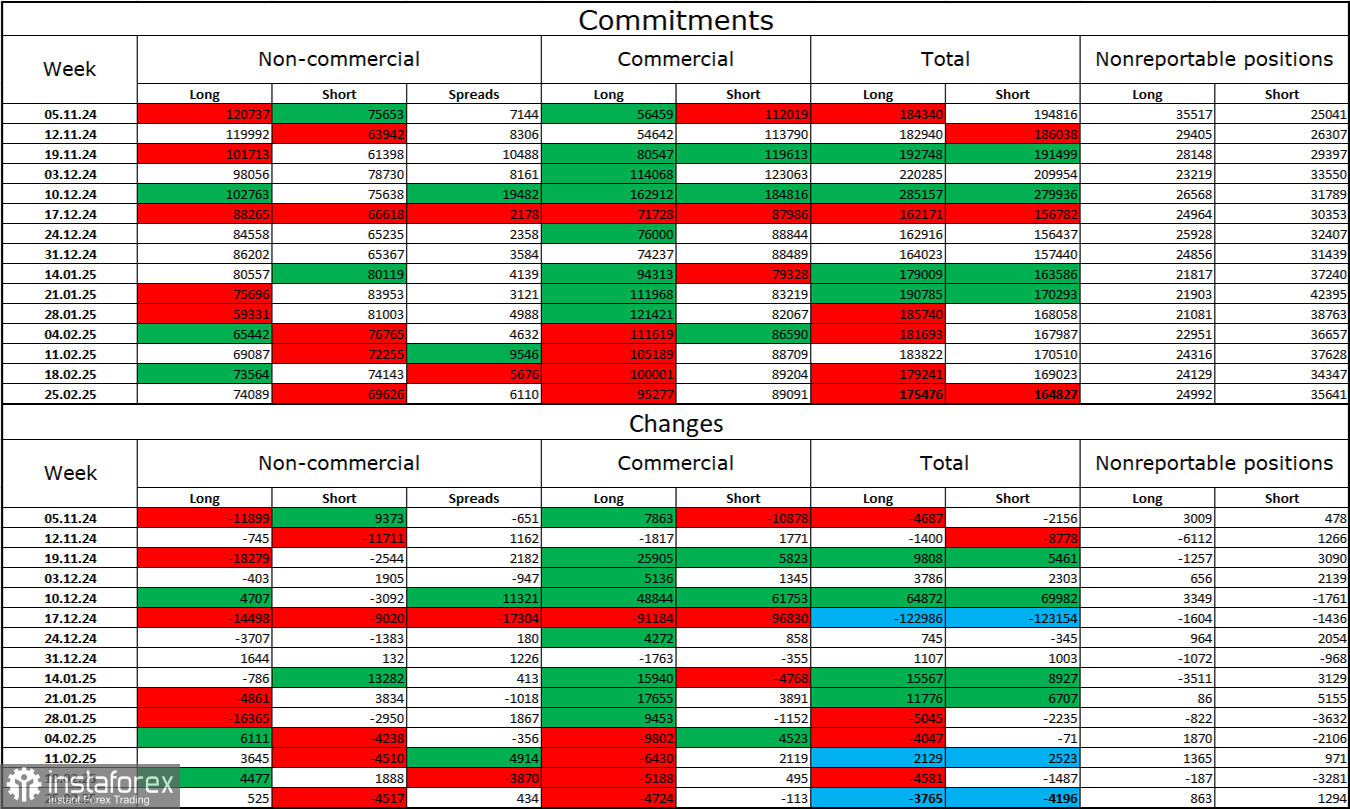

Commitments of Traders (COT) Report

The sentiment of the "Non-commercial" trader category became less "bearish" over the last reporting week. The number of long positions held by speculators increased by 525, while the number of short positions decreased by 4,517. Bulls have lost their market advantage, but bears have not yet managed to increase selling pressure significantly. The gap between long and short positions is minimal, standing at 74,000 versus 69,000.

In my view, the pound still faces downward risks, and the COT reports indicate a slow and gradual strengthening of bearish positions. Over the past three months, the number of long positions has decreased from 120,000 to 74,000, while the number of short contracts has dropped from 75,000 to 69,000. I believe that professional traders will continue reducing long positions or increasing short positions over time, as all potential supporting factors for the British pound have already been priced in. The pound received temporary support from decent UK economic data. However, graphical analysis currently signals further growth.

Economic Calendar for the U.S. and the UK

On Tuesday, the economic calendar contains no significant releases. Therefore, the fundamental background will not influence traders' sentiment throughout the day.

GBP/USD Forecast and Trading Advice

Selling the pair is possible today if it rebounds from the 1.2709–1.2728 zone, with targets at 1.2611–1.2620 and 1.2565. I would not consider buying at this time, as bulls have been in control for a long time, and the pound's recent rally already appears questionable.

Fibonacci retracement levels are built from 1.2809 to 1.2100 on the hourly chart and from 1.2299 to 1.3432 on the four-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română