Analysis of Trades and Trading Advice for the Euro

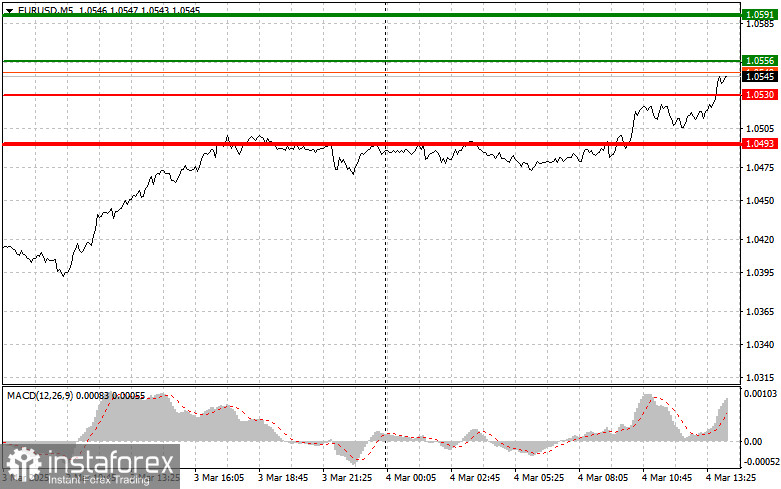

The test of the 1.0492 price level coincided with the moment when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro. A second test of 1.0492 shortly afterward, with the MACD in the overbought area, triggered Scenario #2 for selling, but the pair failed to decline, leading to a stop-out on the position.

The unemployment rate in the eurozone fell to 6.2%, which was better than economists' forecasts, causing the euro to strengthen against the U.S. dollar. A decline in unemployment indicates a stronger eurozone economy, supported by job growth in key sectors. An improving labor market contributes to higher consumer spending, which, in turn, stimulates economic growth. The rise in the euro against the dollar reflects increased investor interest in European assets. However, expectations that the European Central Bank (ECB) may continue cutting rates this Thursday suggest that further euro growth will be limited.

In the second half of the day, key events include the RCM/TIPP Economic Optimism Index from the U.S. and a speech by FOMC member John Williams. Investors will be closely monitoring both events, trying to assess the current state of the U.S. economy and the potential trajectory of Federal Reserve monetary policy. The RCM/TIPP Economic Optimism Index serves as a barometer of consumer and investor confidence in the country's economic outlook. An increase in the index may signal rising economic activity, while a decline could point to recession risks.

John Williams' speech, as a key FOMC member, could provide insights into the Fed's stance on inflation, employment, and the likelihood of further rate hikes.

Regarding intraday strategy, I will primarily focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buying the euro today is possible if the price reaches 1.0556 (green line on the chart), with a target of 1.0591. At 1.0591, I plan to exit the trade and open short positions in the opposite direction, aiming for a 30-35 point correction from the entry point. Euro growth today can only be expected if U.S. data turns out weak. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I will also consider buying the euro today if the price undergoes two consecutive tests of 1.0530, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a bullish reversal. Growth can be expected toward the 1.0556 and 1.0591 levels.

Sell Signal

Scenario #1: Selling the euro is planned after the price reaches 1.0530 (red line on the chart), targeting 1.0493, where I will exit the trade and buy immediately in the opposite direction, aiming for a 20-25 point correction. Bearish pressure on the pair may return following strong U.S. economic data. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I will also consider selling the euro today if the price undergoes two consecutive tests of 1.0556, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a bearish reversal. A decline toward the 1.0530 and 1.0493 levels can be expected.

Chart Breakdown

- The thin green line represents the entry price for buying the trading instrument.

- The thick green line represents the estimated take profit level or a level where traders can manually lock in profits, as further upside beyond this level is unlikely.

- The thin red line represents the entry price for selling the trading instrument.

- The thick red line represents the estimated take profit level or a level where traders can manually lock in profits, as further downside beyond this level is unlikely.

- MACD Indicator: When entering the market, it is essential to consider overbought and oversold zones.

Important Notes

Beginner Forex traders must exercise extreme caution when entering the market. It is best to stay out of trading before major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss protection, traders can quickly lose their entire deposit, especially if they are trading large positions without proper risk management.

A clear trading plan is essential for success—similar to the one outlined above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română