Analysis of Trades and Trading Advice for the Japanese Yen

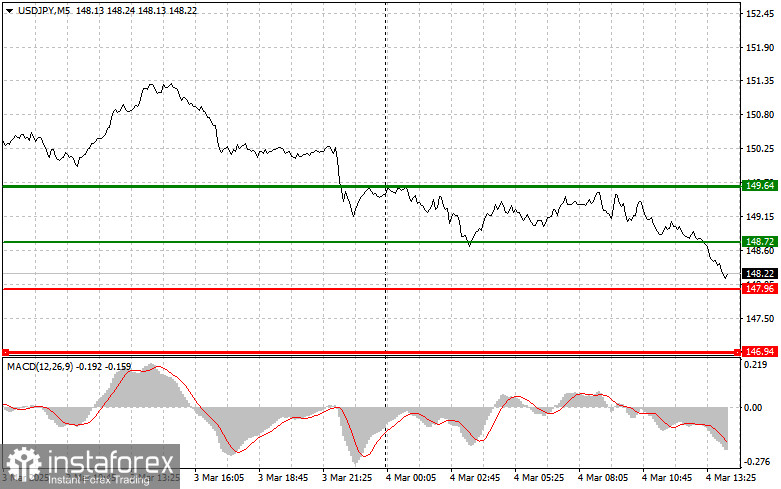

The test of the 149.12 price level coincided with the moment when the MACD indicator had just started moving downward from the zero mark, confirming a correct sell entry for the U.S. dollar. As a result, the pair declined to the target level of 148.17, yielding nearly 100 points.

At the moment, only hawkish rhetoric from a Federal Reserve representative can revive demand for USD/JPY. Investors are concerned that an acceleration in the pace of rate cuts will continue to weigh on the dollar. However, if the Fed demonstrates a firm commitment to fighting inflation, even at the cost of a recession, this will strengthen the U.S. dollar's position. Otherwise, the yen may gain additional upward momentum, especially as the Bank of Japan continues its policy shift toward tightening ultra-loose monetary policy, which its governor is expected to address today.

A statement indicating readiness for further rate adjustments could trigger a new wave of yen buying. Investors are closely watching for clear signs of when the BoJ will officially abandon its long-standing economic stimulus measures.

Regarding intraday strategy, I will primarily focus on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Buying USD/JPY today is possible if the price reaches 148.72 (green line on the chart), with a target at 149.64. At 149.64, I plan to exit the trade and open short positions in the opposite direction, aiming for a 30-35 point correction from the entry point. The pair's growth is expected as part of an upward correction. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I will also consider buying USD/JPY today if the price undergoes two consecutive tests of 147.96, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a bullish reversal. Growth can be expected toward the 148.72 and 149.64 levels.

Sell Signal

Scenario #1: Selling USD/JPY today is planned after the price drops below 147.96 (red line on the chart), leading to a quick decline. The key target for sellers will be 146.94, where I will exit the trade and buy immediately in the opposite direction, aiming for a 20-25 point correction. Bearish pressure may emerge at any time today. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I will also consider selling USD/JPY today if the price undergoes two consecutive tests of 148.72, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a bearish reversal. A decline toward the 147.96 and 146.94 levels can be expected.

Chart Breakdown

- The thin green line represents the entry price for buying the trading instrument.

- The thick green line represents the estimated take profit level or a level where traders can manually lock in profits, as further upside beyond this level is unlikely.

- The thin red line represents the entry price for selling the trading instrument.

- The thick red line represents the estimated take profit level or a level where traders can manually lock in profits, as further downside beyond this level is unlikely.

- MACD Indicator: When entering the market, it is essential to consider overbought and oversold zones.

Important Notes

Beginner Forex traders must exercise extreme caution when entering the market. It is best to stay out of trading before major fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss protection, traders can quickly lose their entire deposit, especially if they are trading large positions without proper risk management.

A clear trading plan is essential for success—similar to the one outlined above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română