Review of Trades and Trading Advice for the Euro

No tests of the levels I outlined occurred in the first half of the day. A decline in volatility ahead of the ECB's key meeting is evident.

The three-day rally in the euro stalled due to a lack of strong interest in buying before the ECB's rate decision. Investors have likely already priced in the expected rate cut and are now waiting for clearer guidance on future monetary policy. The anticipated rate cut and ongoing geopolitical uncertainty have temporarily halted the euro's rise, shifting the market into a wait-and-see mode. Further movement will depend on ECB officials' statements and global economic developments.

In the second half of the day, weekly U.S. jobless claims data will be released. This indicator reflects the number of individuals filing for unemployment benefits for the first time. A rise in claims suggests worsening employment conditions and a potential economic slowdown. If the data is weak, particularly after yesterday's ADP report, pressure on the dollar may increase.

Additionally, the non-manufacturing labor productivity report will be released. Productivity growth is a key factor influencing corporate profitability and overall economic competitiveness. Higher productivity allows for more output with lower costs, boosting earnings and improving living standards. Also, labor unit cost data will be published, reflecting the cost of labor per unit of output. Rising labor costs can pressure corporate profits and drive up consumer prices, whereas a decline may enhance competitiveness and support economic growth.

For intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

Buy Signal

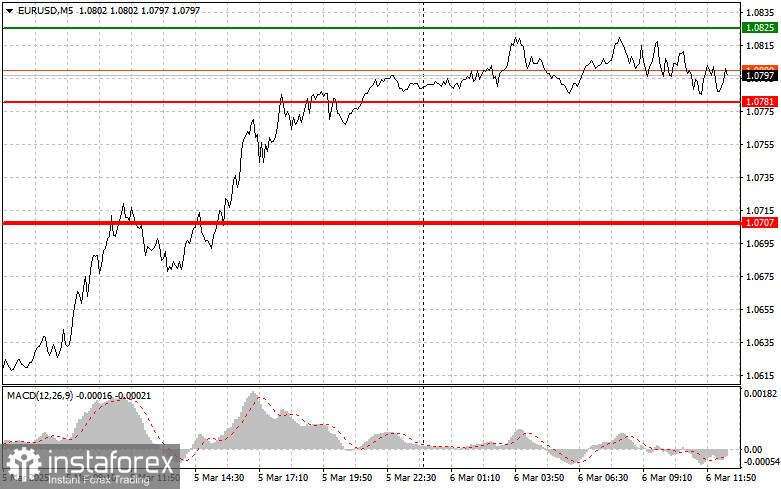

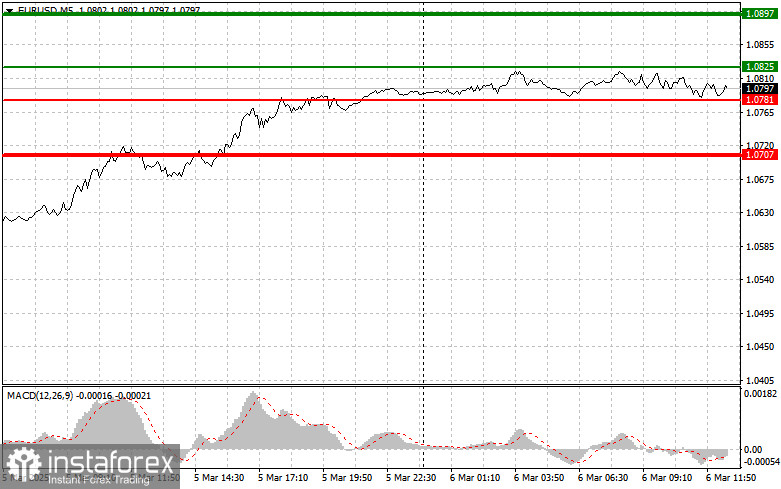

Scenario #1: I plan to buy the euro at 1.0825 (green line on the chart) with an upward target of 1.0897. At 1.0897, I will exit long positions and initiate shorts in the opposite direction, expecting a 30-35 point pullback. A bullish move today is likely only if U.S. data disappoints. Important: Before buying, ensure the MACD indicator is above the zero level and just starting to rise.

Scenario #2: Another buying opportunity arises if the euro tests 1.0781 twice, with MACD in oversold territory. This would limit the pair's downward potential and trigger a reversal. In this case, an upward move toward 1.0825 and 1.0897 is expected.

Sell Signal

Scenario #1: I plan to sell the euro once the price reaches 1.0781 (red line on the chart). The target will be 1.0707, where I will exit short positions and enter long positions, aiming for a 20-25 point rebound. Selling pressure may return if U.S. data is strong. Important: Before selling, ensure MACD is below zero and just beginning to decline.

Scenario #2: Another short opportunity arises if the euro tests 1.0825 twice, with MACD in overbought territory. This would limit the pair's upward potential and trigger a reversal downward. A decline toward 1.0781 and 1.0707 is expected.

Chart Key

- Thin green line: Entry price for long positions.

- Thick green line: Expected Take Profit level or manual profit-taking zone, as further upside beyond this point is unlikely.

- Thin red line: Entry price for short positions.

- Thick red line: Expected Take Profit level or manual profit-taking zone, as further downside beyond this point is unlikely.

- MACD Indicator: Important for identifying overbought and oversold zones before entering trades.

Important Notes for Beginner Traders

Forex trading requires caution when making entry decisions. It is advisable to stay out of the market before key fundamental reports to avoid sharp price fluctuations. If you choose to trade during high-impact news releases, always set stop-loss orders to minimize losses. Without stop-loss protection, you risk wiping out your account quickly, especially when trading large volumes without risk management.

For successful trading, always have a clear trading plan, similar to the one outlined above. Spontaneous trading based on short-term market fluctuations is a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română