Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two markets has been quite significant lately. Until the situation regarding trade tariffs becomes clearer, discussing the continuation of a bullish market in risk assets, including cryptocurrencies, will be challenging.

However, despite the current pullback, I remain optimistic about the long-term prospects for cryptocurrencies. Blockchain technology continues to evolve, finding more and more applications across various industries. The growing interest in decentralized finance signals the potential of cryptocurrencies. Many experts are increasingly stating that the digital asset market could receive a substantial boost under the support of the new U.S. administration, specifically Donald Trump.

As for the intraday strategy in the crypto market, I will continue to act based on any major dips in Bitcoin and Ethereum, anticipating the continuation of the medium-term bullish trend, which has not disappeared.

Below are the conditions and strategies for short-term trading.

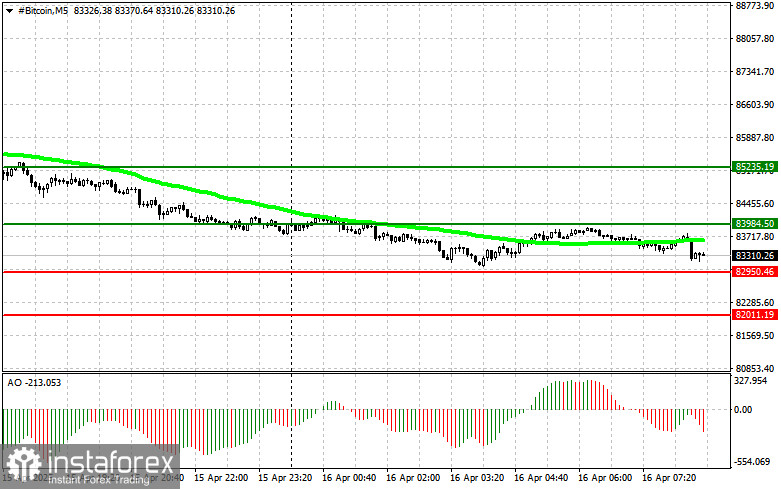

Buy Scenario

Scenario #1: I will buy Bitcoin today at the entry point around $84,000, targeting a rise to $85,200. At $85,200, I plan to exit the long and open a short position on a rebound.

Before a breakout buy, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario #2: Buying is also possible from the lower boundary at $82,900, provided there is no market reaction to a downside breakout, with a rebound toward $84,000 and $85,200.

Sell Scenario

Scenario #1: I will sell Bitcoin today at the entry point around $82,900, targeting a decline to $82,000. At $82,000, I plan to exit the short and open a long position on a rebound.

Before a breakout sell, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $84,000, provided there is no market reaction to an upside breakout, targeting $82,900 and $82,000.

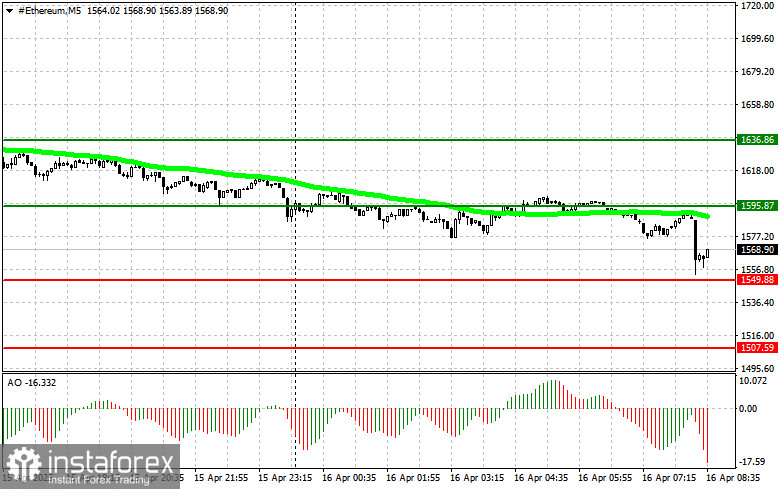

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today at the entry point around $1,595, targeting a rise to $1,636. At $1,636, I plan to exit the long and open a short position on a rebound.

Before a breakout buy, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory.

Scenario #2: Buying is also possible from the lower boundary at $1,549, provided there is no market reaction to a downside breakout, with a rebound toward $1,595 and $1,636.

Sell Scenario

Scenario #1: I will sell Ethereum today at the entry point around $1,549, targeting a decline to $1,507. At $1,507, I plan to exit the short and open a long position on a rebound.

Before a breakout sell, ensure that the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $1,595, provided there is no market reaction to an upside breakout, targeting $1,549 and $1,507.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română