Euro and Pound Retain All Prerequisites for Further Growth

The single European currency showed virtually no reaction to yesterday's meeting of European Central Bank officials, during which another interest rate cut was announced. In her speech, ECB President Christine Lagarde emphasized that the economic outlook for the eurozone remains uncertain due to the unpredictability of U.S. actions, which threatens slowing GDP growth. For this reason, the meeting participants unanimously supported the decision to cut the rate. Lagarde also noted that while most indicators suggest inflation is nearing the desired 2% target, the impact of the newly introduced tariffs is still difficult to assess.

Today, consolidation is expected, with minor fluctuations within yesterday's range. Traders will likely adopt a wait-and-see approach, anticipating more substantial market drivers. Attention will probably shift toward news from overseas, where trade policy continues to influence global markets.

Overall, the broader market outlook still favors further euro appreciation. On one hand, the ECB's rate cut should have put pressure on the euro, but this did not materialize. On the other hand, concerns over slowing global economic growth limit investor optimism, but this benefits the euro, as increasing attention is now focused on the weakening U.S. dollar, driven by Trump's actions.

Today's trade balance figures from Italy are unlikely to have any meaningful impact.

The Mean Reversion strategy is preferred if the data matches economists' expectations. If the data significantly exceeds or falls short of expectations, the Momentum strategy is the most effective approach.

Momentum Strategy (Breakout):

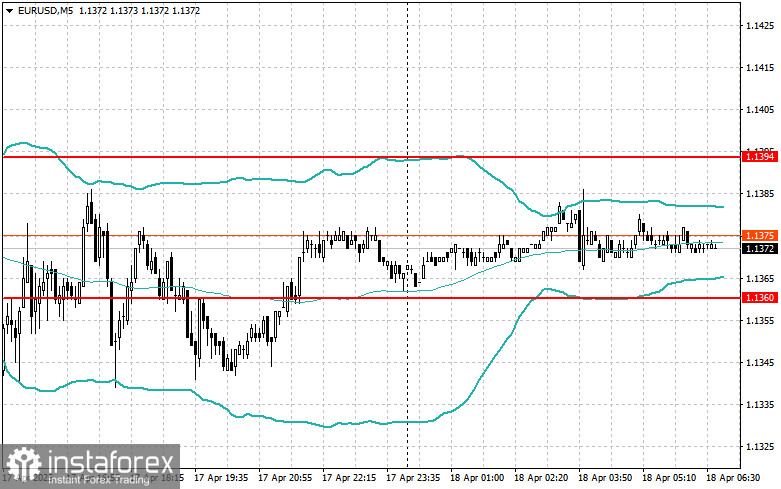

EUR/USD

Longs on a breakout above 1.1405 may lead to growth toward 1.1467 and 1.1525.

Shorts on a breakout below 1.1340 may lead to a decline toward 1.1265 and 1.1200.

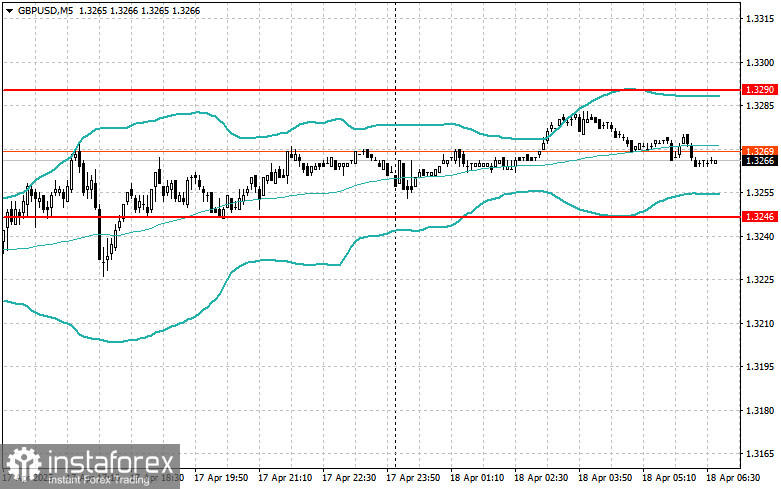

GBP/USD

Longs on a breakout above 1.3285 may push the pound toward 1.3335 and 1.3380.

Shorts on a breakout below 1.3245 may push it down toward 1.3205 and 1.3165.

USD/JPY

Longs on a breakout above 142.50 may target 143.00 and 143.40.

Shorts on a breakout below 142.20 may lead to a selloff toward 141.80 and 141.35.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look to sell after a failed breakout above 1.1394 with a return below this level.

Look to buy after a failed breakout below 1.1360 with a return back above this level.

GBP/USD

Look to sell after a failed breakout above 1.3290 with a return below this level.

Look to buy after a failed breakout below 1.3246 with a return back above this level.

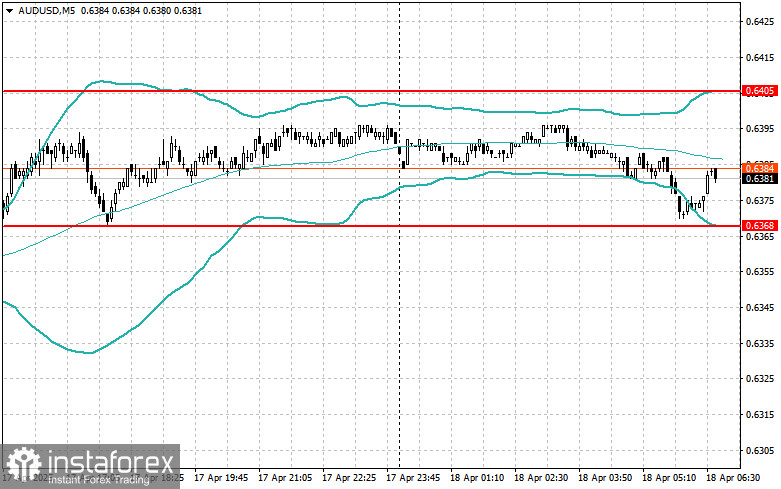

AUD/USD

Look to sell after a failed breakout above 0.6405 with a return below this level.

Look to buy after a failed breakout below 0.6368 with a return back above this level.

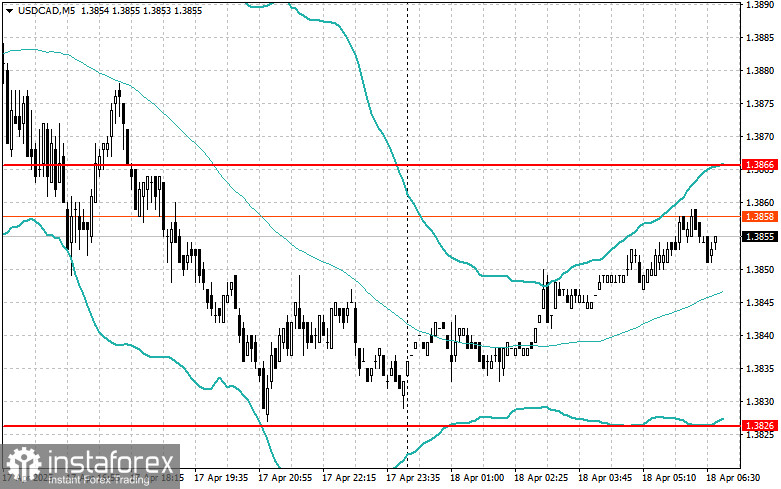

USD/CAD

Look to sell after a failed breakout above 1.3866 with a return below this level.

Look to buy after a failed breakout below 1.3826 with a return back above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română