Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However, any new wave of selling would require strong justification, which is currently absent from the market.

Meanwhile, in a recent speech, Federal Reserve Chair Jerome Powell hinted that U.S. banking regulators may soften cryptocurrency restrictions. This is undoubtedly good news for the digital asset industry. Powell acknowledged the wave of failures and frauds over the years but also recognized the sector's growing popularity. Given the Fed's previously conservative stance, this kind of statement—regarding new recommendations and rules that banks will be expected to follow—could lay the groundwork for developing cryptocurrency legislation and attracting new investors and major players. However, Powell emphasized that any policy changes to encourage innovation must not compromise consumer protection and must support the banking system's stability.

It's worth noting that during Trump's presidency, federal agencies such as the FDIC and OCC had already started reversing previously imposed restrictions on crypto-related operations for banks. Powell also voiced support for the ongoing congressional efforts to regulate stablecoins.

I will continue to base my actions on any significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of the intact medium-term bullish trend.

For short-term trading, the strategy and conditions are outlined below.

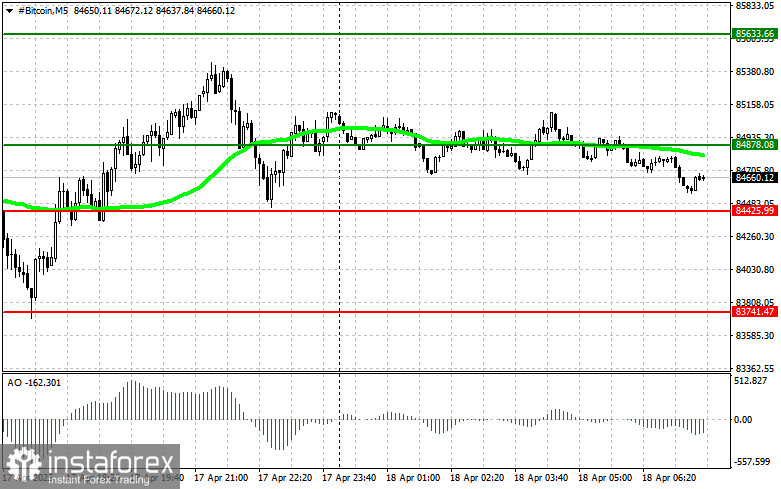

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today at the entry point near $84,900 with a target at $85,600. I will exit long positions at $85,600 and immediately sell on the pullback. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: If the market does not react to a breakout, buying is also possible from the lower boundary at $84,400, aiming for $84,900 and $85,600.

Sell Scenario

Scenario #1: I will sell Bitcoin today at the entry point near $84,400 with a target at $83,700. I will exit short positions at $83,700 and immediately buy on the pullback. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $84,800 if there is no market reaction to a breakout. Aim for $84,400 and $83,700.

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today at the entry point near $1,588, with a target at $1,625. I will exit long positions at $1,625 and immediately sell on the pullback. Before entering a breakout trade, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buying is also possible from the lower boundary at $1,575, if there is no market reaction to a breakout, aiming for $1,588 and $1,625.

Sell Scenario

Scenario #1: I will sell Ethereum today at the entry point near $1,575 with a target of $1,546. I will exit short positions at $1,546 and immediately buy on the pullback. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $1,588, if there is no market reaction to a breakout, aiming for $1,575 and $1,546.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română