While markets remain focused on trade wars, particularly between the U.S. and China, incoming economic data indicate persistent structural problems in the advanced economies of Europe and the United States.

Markets enthusiastically reacted with a two-day rally following comments by U.S. Treasury Secretary Scott Bessent, who expressed hope for easing trade tensions between Washington and Beijing and assurances from Donald Trump that he had no plans to remove Jerome Powell from his post as Federal Reserve Chair. Now, all attention is shifting to key economic reports, which are pointing to a further plunge of the European economy into a state of depression and local challenges in the U.S.

Starting with Europe, the PMI reports for manufacturing and services in leading eurozone countries—France and Germany—as well as the composite reading for the eurozone all signal a continued slowdown. This confirms the entrenched negative trend for continental Europe, which can no longer be described merely as a "recession" but as a full-fledged depression. European elites are attempting to counter this through a strategy of military-industrial mobilization.

Even though the United Kingdom is outside the EU, it is also experiencing serious economic difficulties, as recent PMI data confirm.

What about the U.S.?

The situation there has improved somewhat. The Services PMI for April declined to 51.4 from 54.4 (the forecast was 52.8). While this is a slowdown, it's not yet catastrophic—the indicator remains above the 50-point mark that separates expansion from contraction. In manufacturing, the PMI rose slightly to 50.7 from 50.2, avoiding the expected drop to 49.0.

The U.S. housing market also remains relatively stable. New home sales in March increased to 724,000 compared to 674,000 previously, beating the forecast of 684,000.

Overall, the data from Europe and the U.S. show a relatively stronger position for the American economy. However, it's worth noting that the reports still don't fully reflect the impact of Trump's tariff wars, especially against China.

While investors try to focus on macroeconomic indicators, trade tensions remain the central narrative and will continue to dominate investor decision-making.

Looking at the broader picture of U.S.-China rivalry, it seems likely that the world's two largest economies will eventually have to compromise. Unless something extreme happens—like another unexpected move by Trump to pressure China with new sanctions—markets may already have passed their bottom and could begin to recover.

Forecast of the Day:

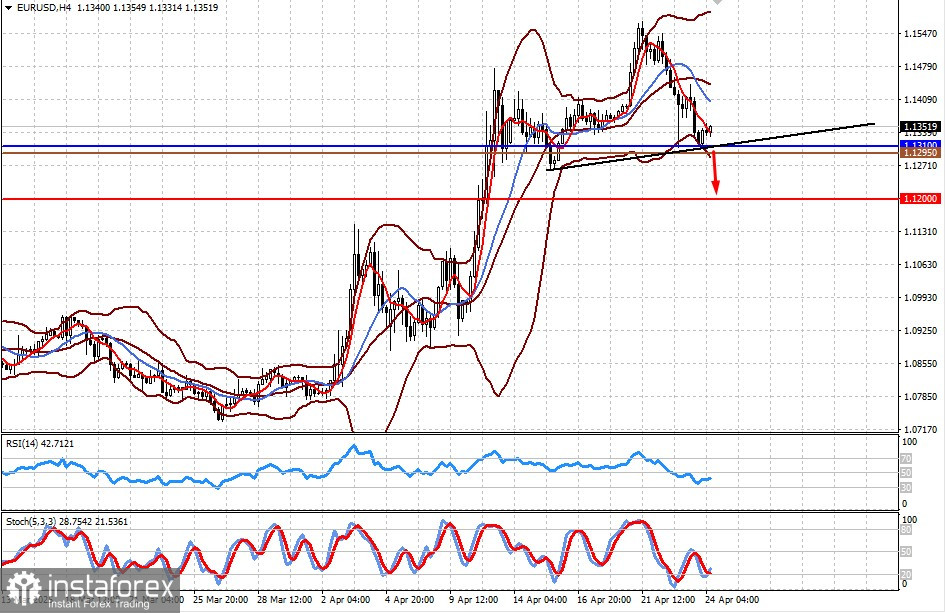

EUR/USD

The pair has recently surged on the back of dollar weakness, fueled by recession fears and speculation about Powell's potential removal. However, if the dollar stabilizes and the interest rate spread between the ECB and the Fed shifts against the euro, a renewed decline in EUR/USD is possible. A drop below 1.1310 would open the way toward 1.1200. A suitable sell level could be around 1.1295.

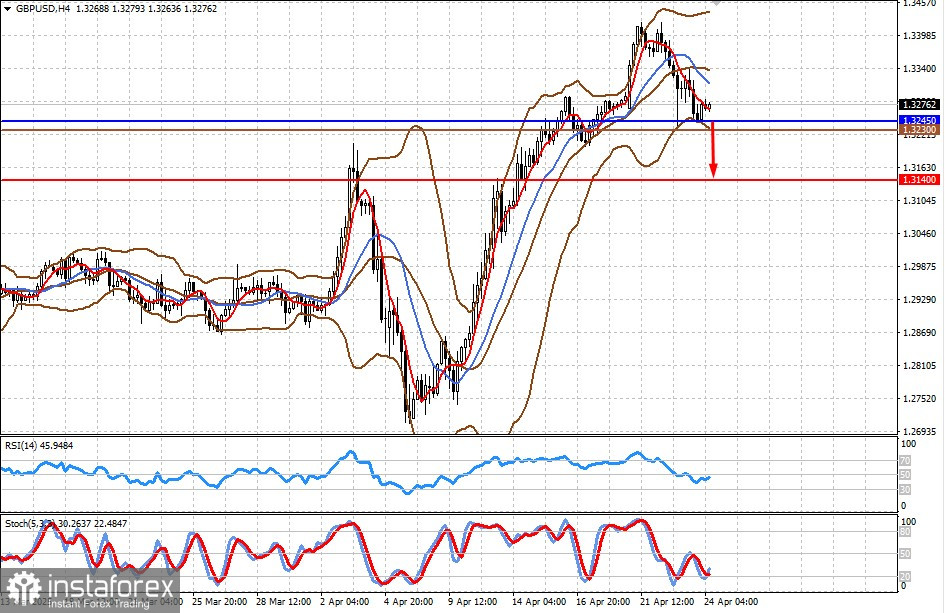

GBP/USD

The situation is similar to EUR/USD. The pound has mirrored the euro's movement. A decline below 1.3245 could push the pair toward 1.3140. A suitable sell level could be around 1.3230.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română