Trade Analysis and Tips for Trading the British Pound

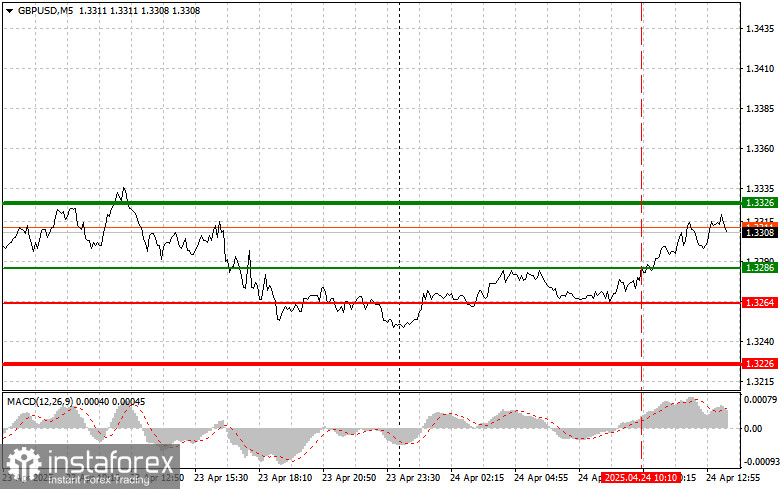

The test of the 1.3286 level occurred when the MACD indicator had already moved significantly above the zero mark, which I believed limited the pound's upward potential. For this reason, I didn't buy and missed the trade.

Positive data on the industrial orders balance supported the pound in the first half of the day. The index, which reflects the difference between companies reporting increases and decreases in orders, showed a reduced negative value, indicating improving sentiment in the industrial sector. This may be directly linked to easing inflationary pressures and the anticipated interest rate cuts by the Bank of England in the coming months. Lower borrowing costs typically stimulate investment and consumer demand, which positively impacts manufacturing activity. Overall, the improvement in industrial order balance is an encouraging signal for the UK economy, though the sustainability of this trend will depend on various internal and external economic factors. The pound, supported by the positive data, may continue to strengthen if the favorable momentum in the manufacturing sector persists and no negative surprises emerge from the global economy.

In the second half of the day, we expect reports on initial jobless claims and durable goods orders in the U.S., along with existing home sales figures. These macroeconomic indicators traditionally influence market sentiment and overall conditions. Jobless claims reflect the state of employment and indicate how many people have newly applied for government assistance due to job loss. A rise in this figure could weaken the dollar. Conversely, an increase in durable goods orders signals optimism among businesses and consumers, potentially spurring capital investment and production activity—positive for the dollar.

As for the intraday strategy, I will rely primarily on scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today upon reaching the 1.3322 entry point (green line on the chart), with the goal of rising toward 1.3362 (thicker green line on the chart). At the 1.3362 level, I'll exit long positions and open shorts in the opposite direction, targeting a 30–35 point reversal. Today's bullish continuation for the pound depends on weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.3295 level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and prompt a reversal upward. Growth toward 1.3322 and 1.3362 may be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after breaking below the 1.3295 level (red line on the chart), which would lead to a quick drop. The primary target will be 1.3261, where I will exit short positions and immediately enter long trades in the opposite direction (expecting a 20–25 point rebound). Sellers will likely emerge if strong U.S. data is released. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3322 level while the MACD indicator is in the overbought zone. This would cap the pair's upward potential and trigger a downward reversal. A drop toward 1.3295 and 1.3261 may follow.

Chart Key:

- Thin green line – entry price for long trades

- Thick green line – estimated Take Profit level or area to manually lock in profit (further growth beyond this point is unlikely)

- Thin red line – entry price for short trades

- Thick red line – estimated Take Profit level or area to manually lock in profit (further decline beyond this point is unlikely)

- MACD Indicator – use overbought and oversold zones as confirmation signals for trade entry

Important: Beginner Forex traders should be very cautious when entering the market. It's best to stay out before major economic reports are released to avoid being caught in sharp price swings. If you decide to trade during news events, always use stop-loss orders to limit potential losses. Without stops, you can quickly lose your entire deposit—especially if you don't apply proper money management or trade with large volume.

And remember: to trade successfully, you must have a clear trading plan, like the one provided above. Spontaneous trading decisions based on the current market situation are a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română