The strong likelihood that the Federal Reserve will not be able to resume cutting interest rates this year is providing significant support for the U.S. dollar. The dollar index may break above the 99.00 mark by the end of this week and continue rising into the next. Another contributing factor is the renewed uncertainty introduced by Trump regarding how the tariff saga will ultimately conclude.

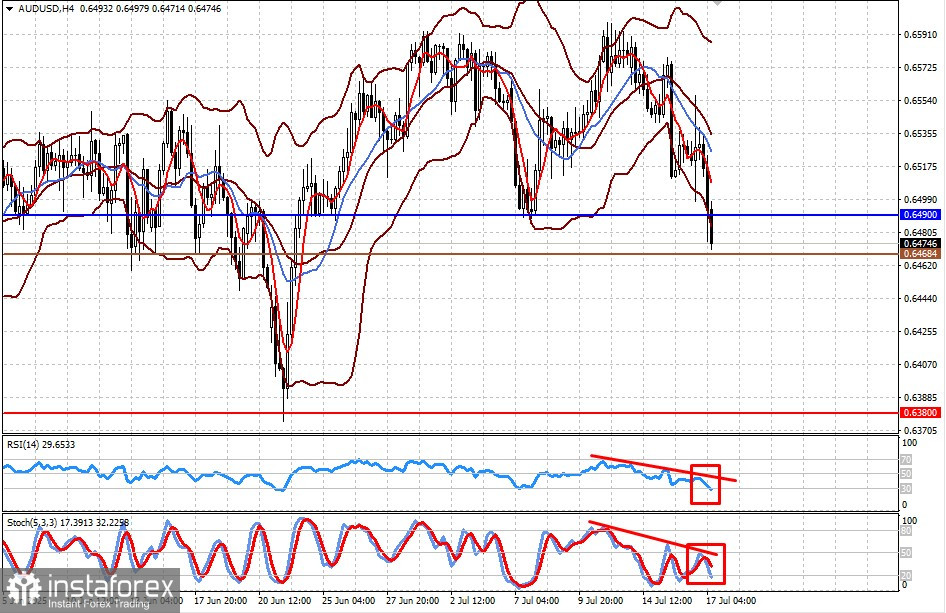

From a technical standpoint, the AUD/USD pair remains in a short-term sideways trend, but continued dollar strength could lead to a notable decline. On both the daily and 4-hour charts, the pair is forming a trend reversal pattern — a "double top" — with a neckline at the 0.6490 level.

Technical Outlook and Trade Idea:

The price is trading below the lower Bollinger Band, as well as below the 5- and 14-period SMAs, which have recently crossed and now indicate increasing downside momentum. The RSI is falling and entering oversold territory, while the Stochastic oscillator is turning downward and approaching the oversold zone.

The pair is well-positioned to fall toward 0.6380, completing the double top pattern. A potential entry point for short positions is at 0.6468.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română