In my previous article, I asked: how is it possible that in a country which sees itself as a world leader in almost every area, the president can openly insult and criticize the head of the central bank — the very person he appointed eight years ago? Yet with each passing day, things in America become more heated and more intriguing.

On Tuesday, a REPUBLICAN senator (which is important) published a letter on his X (formerly Twitter) account allegedly from Jerome Powell announcing his resignation. Within hours, it became clear that Powell had written no such letter — it had been generated by artificial intelligence. A few hours later, the post was deleted, and the senator's staff refused to comment. Just a little story to brighten my readers' day.

Meanwhile, Donald Trump announced the signing of a trade agreement with Japan under which Japanese imports would be taxed at 15%, and Japan would commit to investing 550 billion dollars into the American economy. "I just signed the biggest trade deal in U.S. history; I think this might be the largest deal ever with Japan. We worked on it long and hard. And it's a great deal for everyone," said the White House leader.

According to the agreement, U.S. exports to Japan will also be subject to 15% tariffs, and the U.S. is to receive 90% of the profits from the Japanese investments. Japan has stated that the 550 billion dollars in investment will be provided to Japanese businesses by the government in the form of equity and loans to support the pharmaceutical and technology sectors. Tokyo is not thrilled about the deal with the U.S., but acknowledges there was no other option. Prime Minister Shigeru Ishiba said the government would carefully review the agreement — although what is there to review, if it's already signed?

It's worth noting that demand for the U.S. dollar did not increase after the agreement with Japan was signed. The market remains skeptical toward all White House trade deals, which, by the way, have been very few.

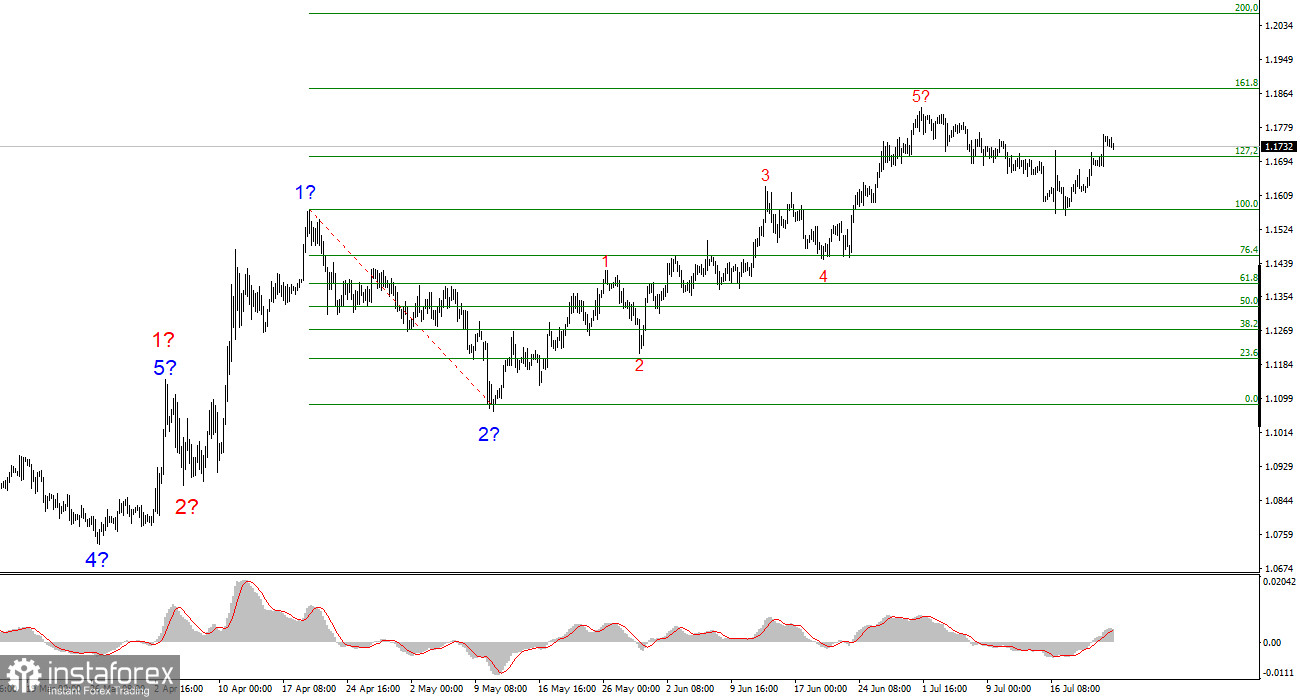

Wave outlook for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build a bullish trend segment. The wave pattern still largely depends on the news background related to Trump's decisions and U.S. foreign policy — and so far, there have been no positive changes. The trend's targets may extend to the 1.25 area. Therefore, I continue to view buying opportunities with targets around 1.1875 (which corresponds to the 161.8% Fibonacci level) and higher. The failed attempt to break below the 1.1572 level (100.0% Fibonacci) indicates the market's readiness for further EUR/USD purchases.

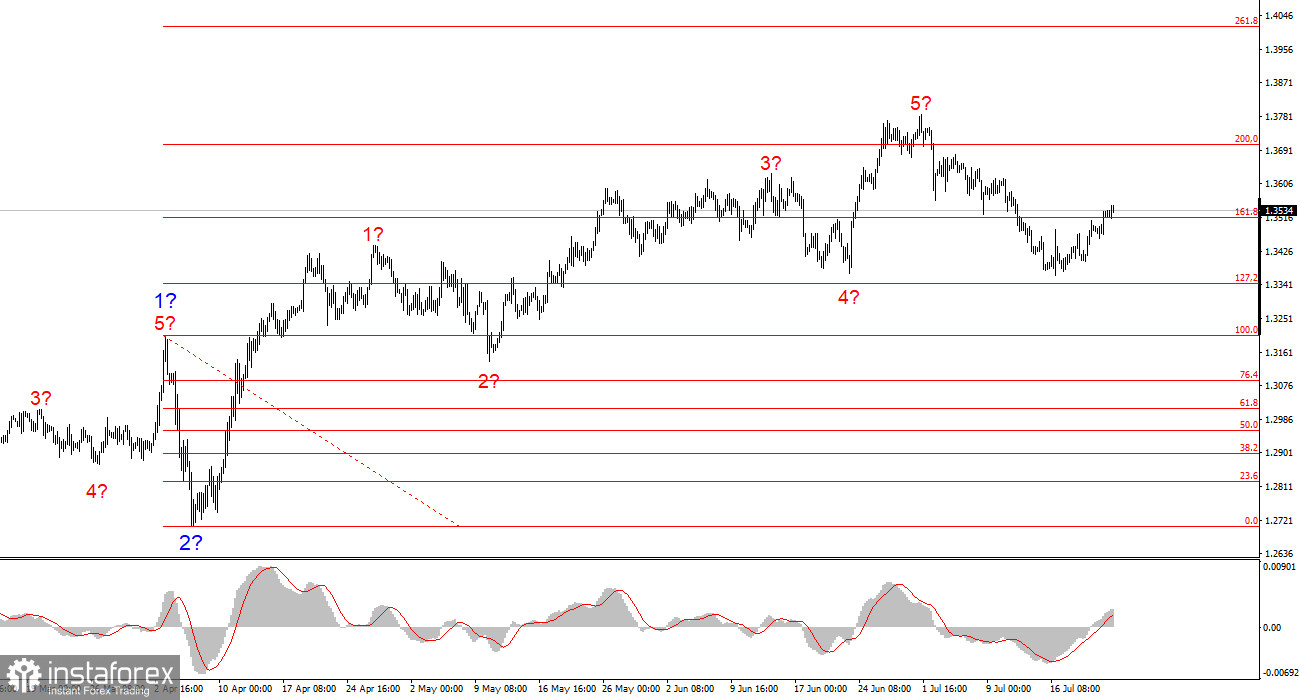

Wave outlook for GBP/USD:

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish, impulsive trend segment. Under Trump, markets may face many more shocks and reversals, which could significantly impact the wave pattern. However, at this point, the main scenario remains intact. The current bullish trend segment targets the 1.4017 level, which corresponds to 261.8% Fibonacci from the assumed global wave 2. A corrective wave structure is currently developing. According to classic theory, it should consist of three waves, though the market may settle for just one.

Core Principles of My Analysis:

- Wave structures should be simple and understandable. Complex patterns are difficult to interpret and often subject to revisions.

- If there is no confidence in the market situation, it's better to stay out.

- One can never have 100% certainty in the direction of market movement. Don't forget to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română