Trade Analysis and Tips for Trading the Japanese Yen

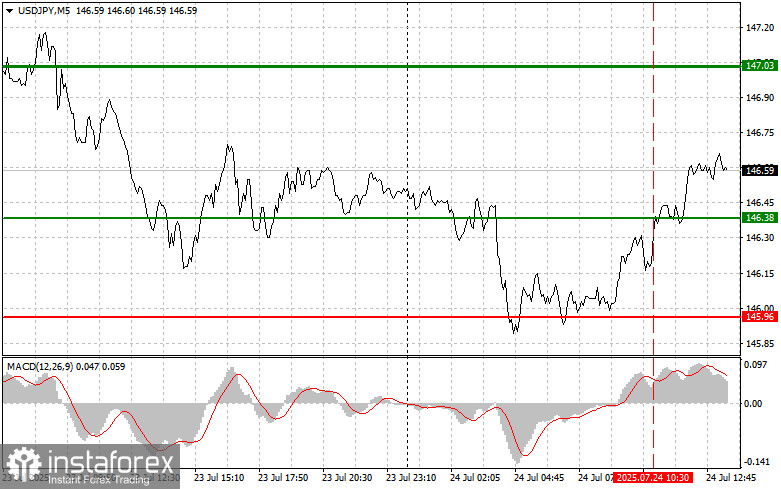

The test of the 146.38 level occurred at a time when the MACD indicator had already moved far above the zero line, which limited the pair's upward potential.

Today, U.S. data will be released on manufacturing and services PMIs, initial jobless claims, and new home sales. These economic indicators could significantly influence the direction of USD/JPY, as they play a key role in assessing the current state and future prospects of the U.S. economy. The manufacturing PMI provides insight into the health of the industrial sector, a key component of economic growth. The services PMI reflects the condition of the services industry, which constitutes a large share of U.S. GDP. Initial jobless claims serve as an indicator of labor market conditions. A decline in claims signals improving employment and a falling unemployment rate. New home sales reflect the state of the construction sector and consumer confidence. An increase in sales indicates rising housing demand, which positively affects related sectors like building materials and furniture production. However, only strong data—exceeding economists' forecasts—can drive USD/JPY higher.

As for the intraday strategy, I will mainly rely on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 146.75 (green line on the chart), aiming for a rise to 147.31 (thicker green line). Around 147.31, I will exit long positions and open short positions in the opposite direction, targeting a 30–35 point pullback from that level. A strong rally in the pair will be possible only if the data is very strong. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 146.44 level while the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a reversal to the upside. A move toward the opposite levels of 146.75 and 147.31 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after the 146.44 level is broken (red line on the chart), which will likely lead to a sharp drop. The key target for sellers will be 145.95, where I plan to exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 point rebound from that level. Downward pressure on the pair could return at any moment. Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the 146.75 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels of 146.44 and 145.95 can then be expected.

Chart Key:

- Thin green line – entry price to buy the trading instrument

- Thick green line – projected level for setting Take Profit orders or manually securing profit, as further growth beyond this level is unlikely

- Thin red line – entry price to sell the trading instrument

- Thick red line – projected level for setting Take Profit orders or manually securing profit, as further decline beyond this level is unlikely

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones

Important:

Beginner Forex traders must be extremely cautious when deciding to enter the market. Before the release of key fundamental reports, it's best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news events, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use proper money management and trade with large volumes.

And remember, successful trading requires a clear trading plan like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română