On Thursday, the GBP/USD currency pair pulled back slightly, but this strengthening of the dollar has no real impact on the overall picture. The British pound has corrected in recent weeks to the Murray level "3/8" at 1.3367, which seems sufficient considering the broader fundamental background. To recap briefly, Donald Trump has recently signed one trade agreement but increased tariffs for 24 countries. Additionally, the U.S. president announced new duties on copper and pharmaceuticals imports and introduced "baseline tariffs" for 150 countries worldwide, ranging from 15% to 50%. In other words, Trump wants every country that exports goods or services to the U.S. to contribute to the American budget. Thus, while the White House leader has made one move toward so-called de-escalation, he's made about 170 moves toward further escalation.

We still believe that the U.S. dollar has no chance of strengthening in 2025. Of course, the dollar cannot fall forever—sooner or later, the market will fully price in the trade tariffs and stop selling off the dollar. However, for now, the tariff situation continues to worsen day by day. Trump and his allies continue to exert intense pressure on the Federal Reserve and its chairman, Jerome Powell, personally. The resignation of Powell and the appointment of a new Fed Chair would almost certainly mean the loss of independence for the U.S. central bank. The likely consequence would be uncontrolled rate cuts and the ignoring of inflation. The outlook, frankly, is not encouraging. That's why many investors (and not only investors) currently have no burning desire to deal with the U.S. dollar.

It's worth noting that the Bank of England's monetary policy is currently as irrelevant as the European Central Bank's. The UK's macroeconomic data may have only local, short-term effects on the pound's performance against the dollar. On the daily timeframe, it is visible that there have been no significant corrections in the past six months. On the weekly chart, the three-year upward trend remains intact. Add to this the fact that Trump has no interest in a "strong" dollar, and the conclusion is clear: everything points to further weakening of the American currency.

What could stop the dollar's decline?

In our opinion, nothing. Keep in mind that the dollar appreciated against many of its peers for 16 years. So now we're talking about a global trend reversal. If that's the case, then for at least the next 5–6 years, the dollar is likely to fall out of favor with traders. Secondly, a trade truce is now off the table—that much is clear. Third, if Trump forces the Fed into submission, he will essentially control all domestic economic processes single-handedly. Fourth, if Trump realizes his ambition for a third presidential term, the "dark days" for the dollar—and the entire world—may last a very long time.

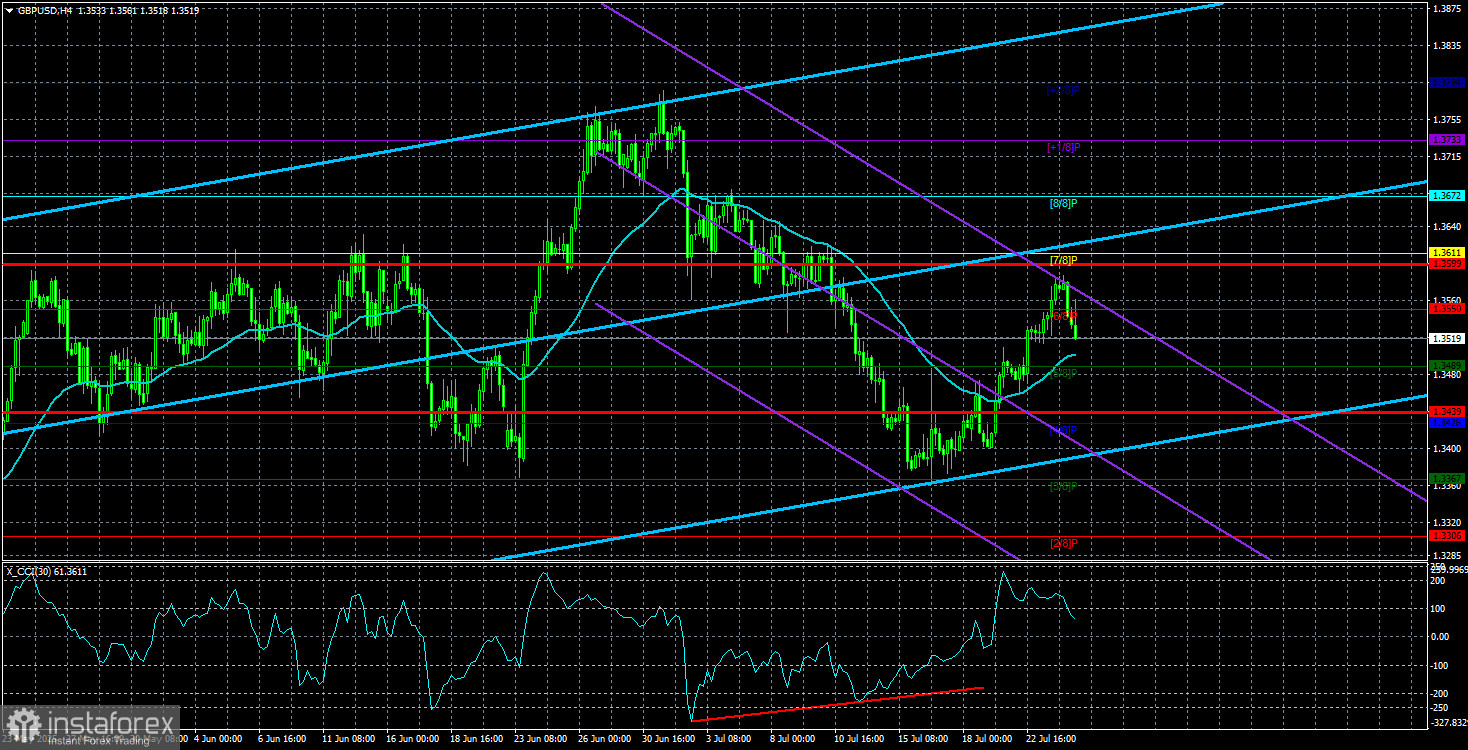

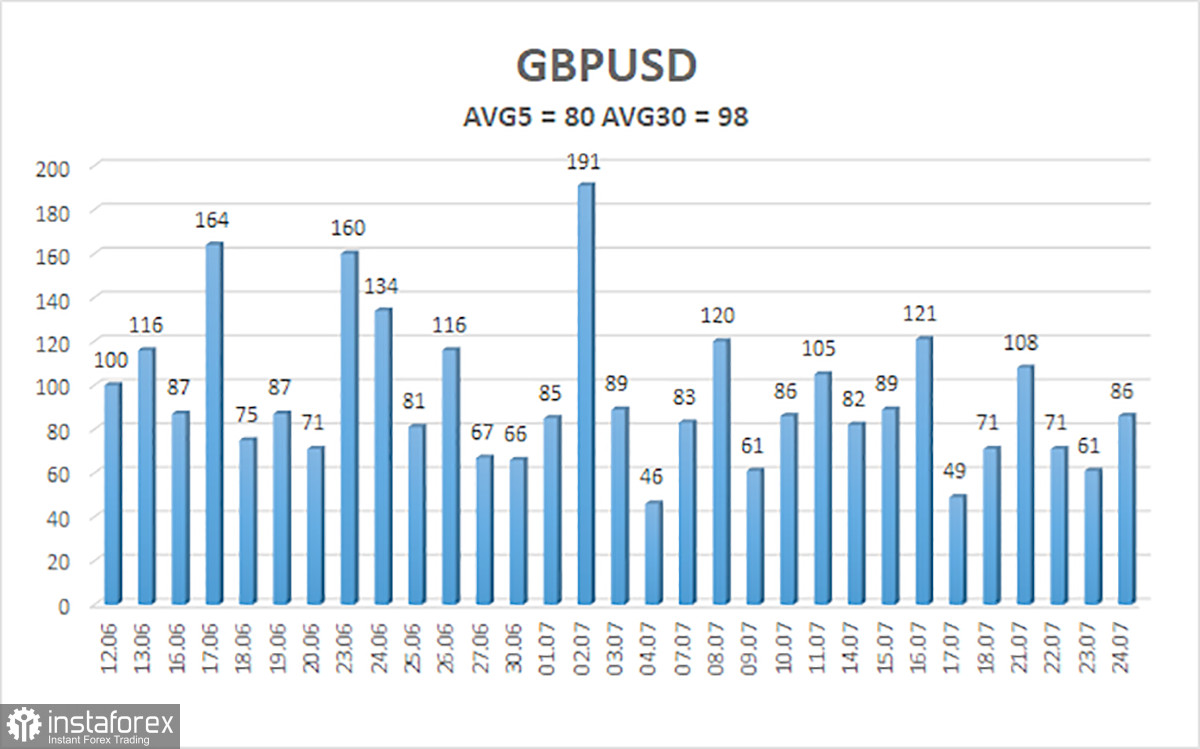

The average volatility for GBP/USD over the past five trading days is 80 pips, which is considered "moderate" for this pair. Therefore, on Friday, July 25, we expect the pair to move within the range of 1.3439 to 1.3599. The long-term linear regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has entered the oversold zone twice, signaling a resumption of the upward trend. Bullish divergences have also formed.

Nearest Support Levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading Recommendations:

The GBP/USD pair may resume its upward trend. The pair has corrected sufficiently, and in the medium term, Trump's policies are likely to continue putting pressure on the dollar. Therefore, long positions with targets at 1.3599 and 1.3611 remain relevant as long as the price is above the moving average. If the price moves below the moving average line, small short positions with a target at 1.3428 may be considered on purely technical grounds. From time to time, the U.S. dollar shows corrections, but for a sustained trend reversal, evident signs of an end to the global trade war are needed—something that now appears unlikely.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română