The Euro Holds Its Ground, While the Pound Resumes Decline Following Weak UK Data

Yesterday, European Central Bank President Christine Lagarde stated that the ECB had taken a wait-and-see approach, leaving interest rates unchanged following its meeting. The market had expected more decisive signals from the ECB regarding future policy, especially in light of declining inflation in the eurozone. Although Lagarde acknowledged that inflation had returned to target, she emphasized that the situation remains uncertain and that more data is needed before making any significant decisions—this cautious stance disappointed traders who had hoped for a more aggressive approach to monetary easing.

This morning, strong data from Germany may trigger the buying of EUR/USD. Figures are expected for the IFO Business Climate Index, the Current Assessment Index, and the Expectations Index. A report on eurozone private sector lending will also be released. An increase in the IFO index — especially if accompanied by improvements in the current assessment and expectations — could become a strong driver for the euro. Traders interpret such data as a sign of a strong and stable German economy, which in turn supports the euro. Positive lending figures would also boost optimism, signaling rising investment and consumer activity. Conversely, weaker-than-expected data could lead to euro sell-offs.

If the data aligns with economists' forecasts, it's best to rely on the Mean Reversion strategy. If the data comes in significantly above or below expectations, the Momentum strategy will likely be more effective.

Momentum Strategy (Breakout):

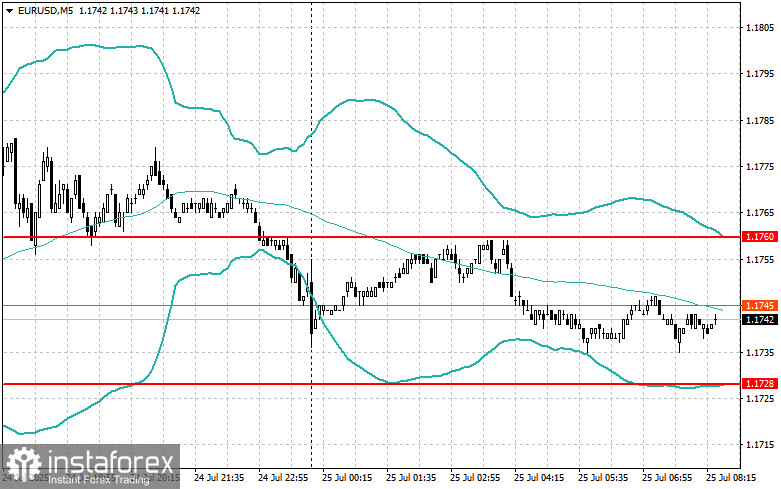

EUR/USD

Buying on a breakout above 1.1760 could lead to a rise toward 1.1790 and 1.1825

Selling on a breakout below 1.1735 could lead to a decline toward 1.1714 and 1.1680

GBP/USD

Buying on a breakout above 1.3505 could lead to a rise toward 1.3530 and 1.3550

Selling on a breakout below 1.3480 could lead to a decline toward 1.3455 and 1.3420

USD/JPY

Buying on a breakout above 147.00 could lead to a rise toward 147.35 and 147.78

Selling on a breakout below 146.80 could lead to a decline toward 146.30 and 145.92

Mean Reversion Strategy (Pullbacks):

EUR/USD

I will look for selling opportunities after a failed breakout above 1.1760 followed by a return below this level

I will look for buying opportunities after a failed breakout below 1.1728 followed by a return above this level

GBP/USD

I will look for selling opportunities after a failed breakout above 1.3513 followed by a return below this level

I will look for buying opportunities after a failed breakout below 1.3479 followed by a return above this level

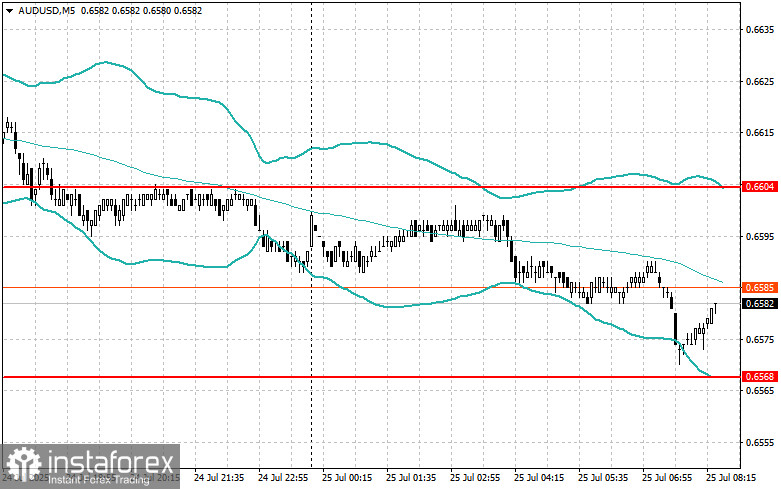

AUD/USD

I will look for selling opportunities after a failed breakout above 0.6604 followed by a return below this level

I will look for buying opportunities after a failed breakout below 0.6568 followed by a return above this level

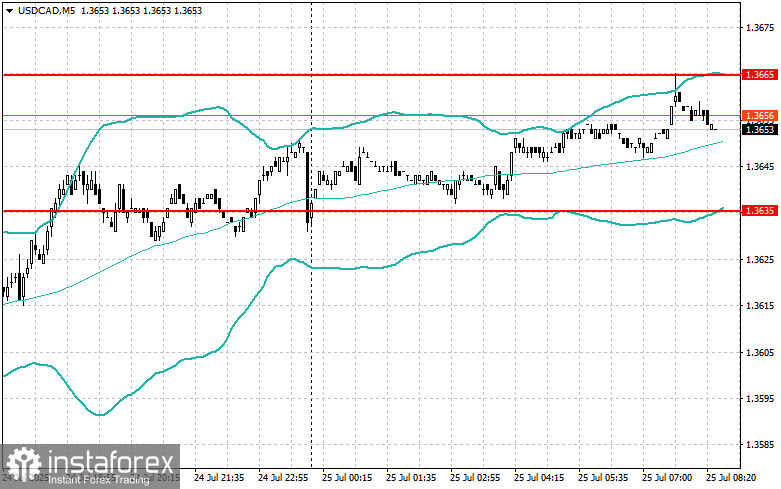

USD/CAD

I will look for selling opportunities after a failed breakout above 1.3665 followed by a return below this level

I will look for buying opportunities after a failed breakout below 1.3635 followed by a return above this level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română