Monetary policy, economic growth, and capital flows are the three pillars that determine currency rates in Forex. Questions remain on all of them. Will the Federal Reserve aggressively cut rates? Will the eurozone economy outperform the U.S.? Where will hedging flows drive the U.S. dollar? The answers to these questions will decide the fate of EUR/USD.

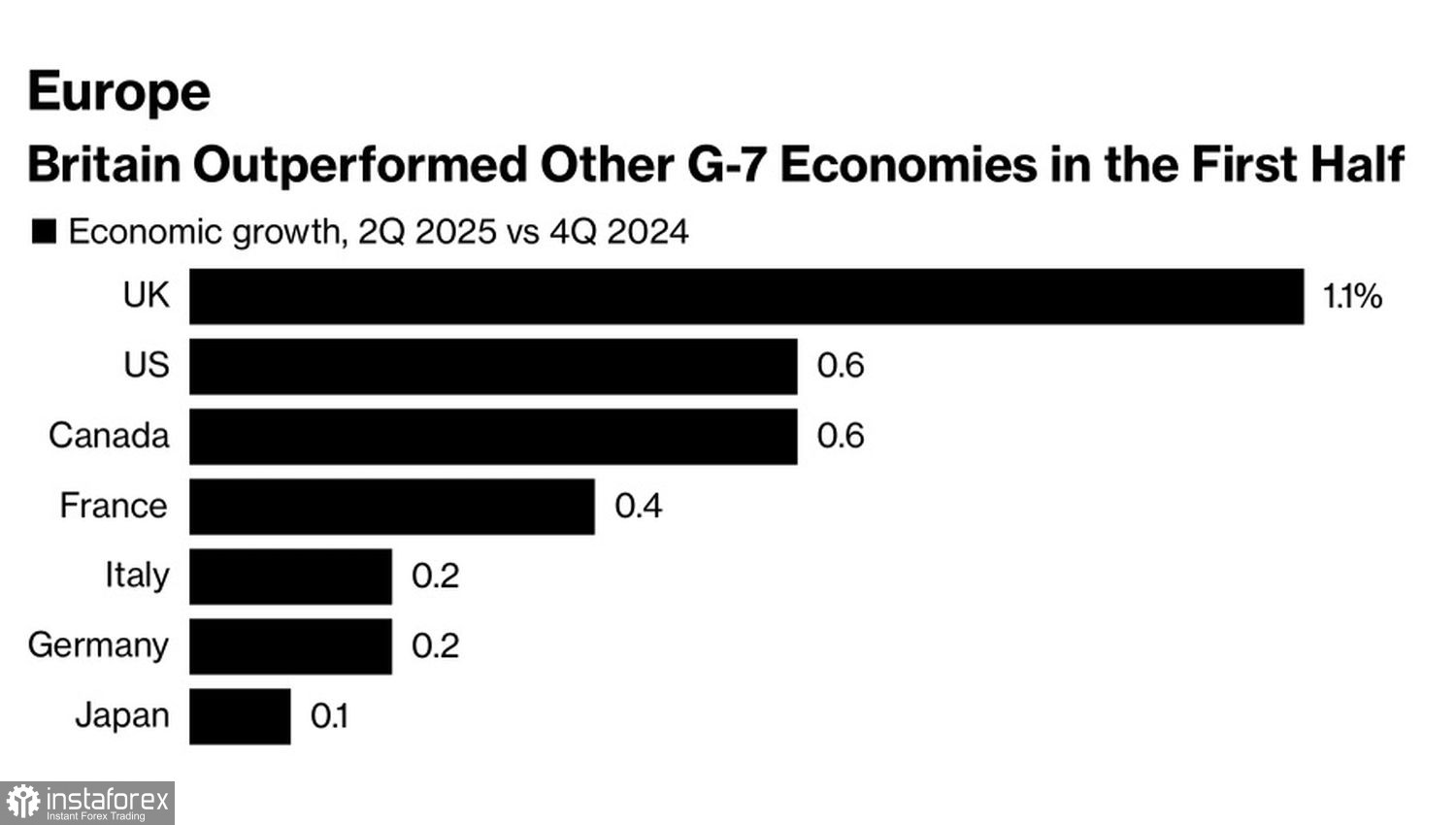

A strong economy means a strong currency. In the second quarter, U.S. GDP looked better than its European counterparts. However, the main reason was the smoothing of U.S. import flows after the spike seen in January–March.

Dynamics of leading G7 economies

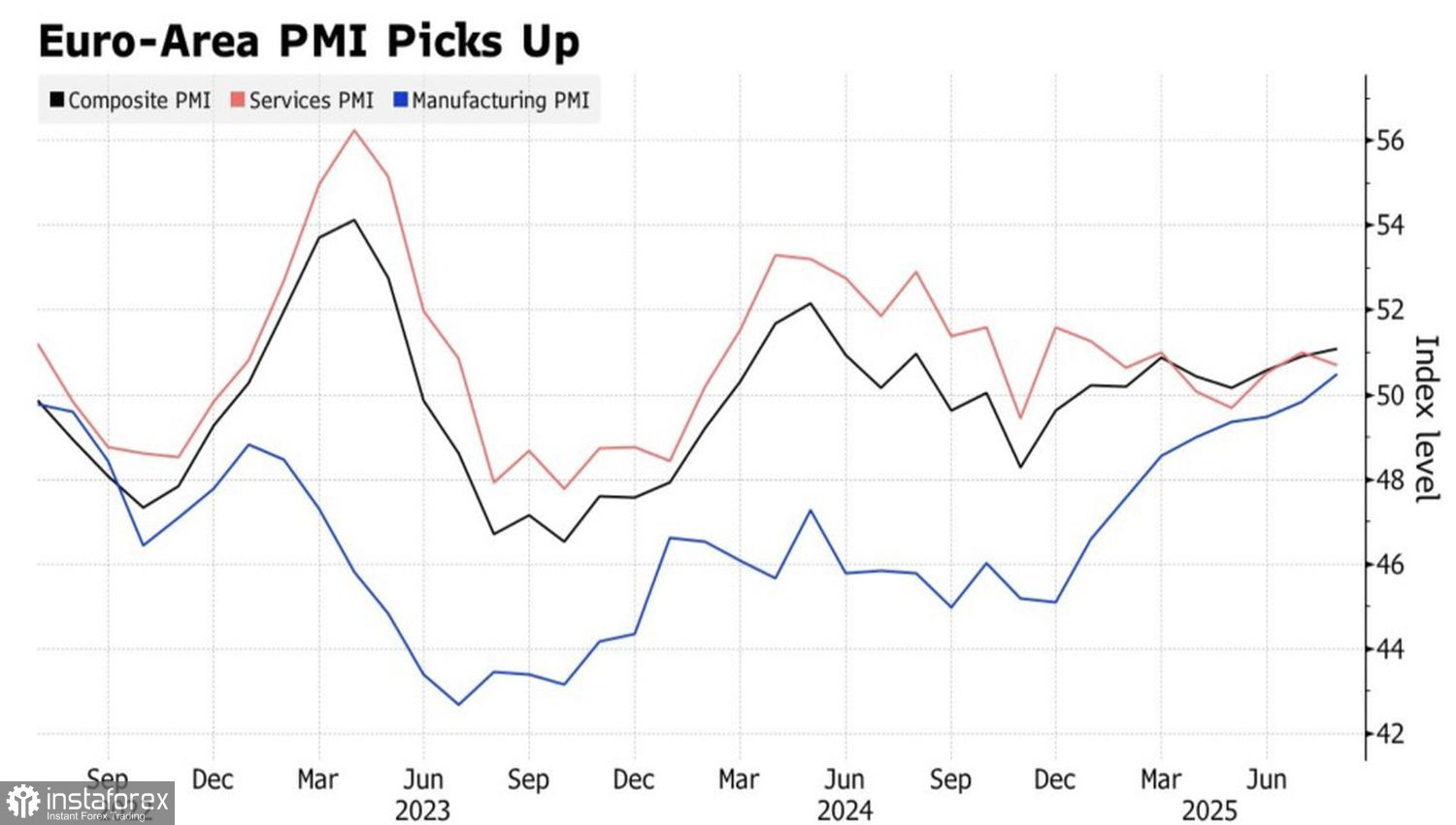

Aggressive European Central Bank monetary expansion, Germany's fiscal stimulus, and a decline in tariff-related uncertainty boosted business activity in the currency bloc to a 15-month high. Despite high import duties, purchasing managers remain optimistic. The manufacturing PMI entered expansion territory for the first time in three years.

There are many arguments suggesting that in 2026 the European economy will surpass that of the U.S., partly thanks to the potential end of the Russia–Ukraine conflict. Adding the nearing completion of the ECB's monetary expansion cycle and the Fed's readiness to cut rates, EUR/USD bears appear doomed.

Dynamics of European business activity

However, capital flows raise even more questions than economic growth and monetary policy. According to Credit Agricole research, in June non-residents bought U.S. equities worth 163 billion dollars on a net basis. Of this, the official sector invested 46 billion dollars, while the rest remained with the private sector. The overall figure is a record high, yet the USD index lost about 2% over the first month of summer. A paradox?

Credit Agricole believes the issue lies in active FX risk hedging by foreign investors. While buying U.S. assets, they simultaneously sold the U.S. dollar. The firm suggests the reason was a broadly negative backdrop for the greenback. However, if EUR/USD continues consolidating, demand for hedging will decrease. As a result, the dollar may strengthen — against the expectations of most Forex traders.

In the short term, EUR/USD dynamics will depend on Jerome Powell's remarks at Jackson Hole. The Fed Chair is unlikely to dissuade markets from expecting a September cut in the federal funds rate. However, he will not preemptively announce a second step toward monetary expansion in 2025. Such a speech could support the U.S. dollar.

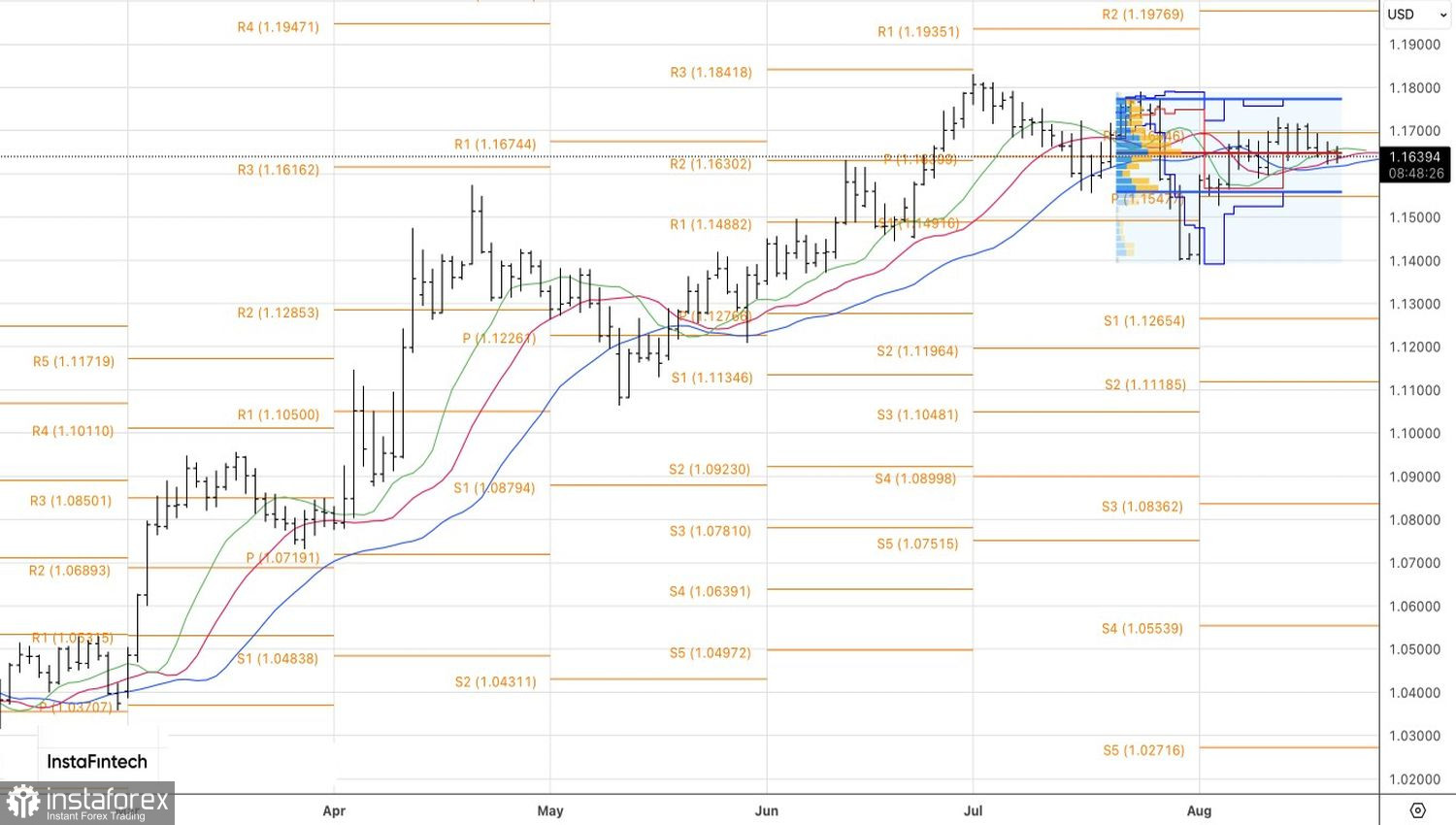

Technically, the daily EUR/USD chart shows ongoing consolidation and a battle for fair value at 1.165. A breakout below the 1.162–1.170 trading range may trigger selling. A firm close above 1.165 followed by a move toward 1.170 resistance would be a basis for buying.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română