Analysis of Macroeconomic Reports:

No macroeconomic reports are scheduled for Friday, except for the third estimate of Germany's Q2 GDP. This is a secondary report, as the market is already mentally prepared for another vague figure. Therefore, we believe that today the macroeconomic background is absent, just as it was during the first three days of the week. As a result, volatility may once again be low during the day.

Analysis of Fundamental Events:

The only fundamental event of Friday worth noting is Jerome Powell's speech. The market is once again expecting clarifications from the Federal Reserve Chair regarding future changes in monetary policy. Part of the market (as always) expects dovish decisions before the end of the year, while another part remains doubtful. The weakness of the labor market supports the case for multiple key rate cuts, while rising inflation supports a more hawkish stance. There is a high probability that Powell will not provide an answer to these questions and will instead take a cautious position, preferring to wait for the next inflation and labor market reports. Therefore, expectations may be in vain.

For traders, the trade war remains the number one priority. Since we do not see any signs of de-escalation, we also see no grounds for medium-term dollar purchases. As before, the US currency can only count on local growth based on technical factors or isolated events/reports, but nothing more.

Conclusions:

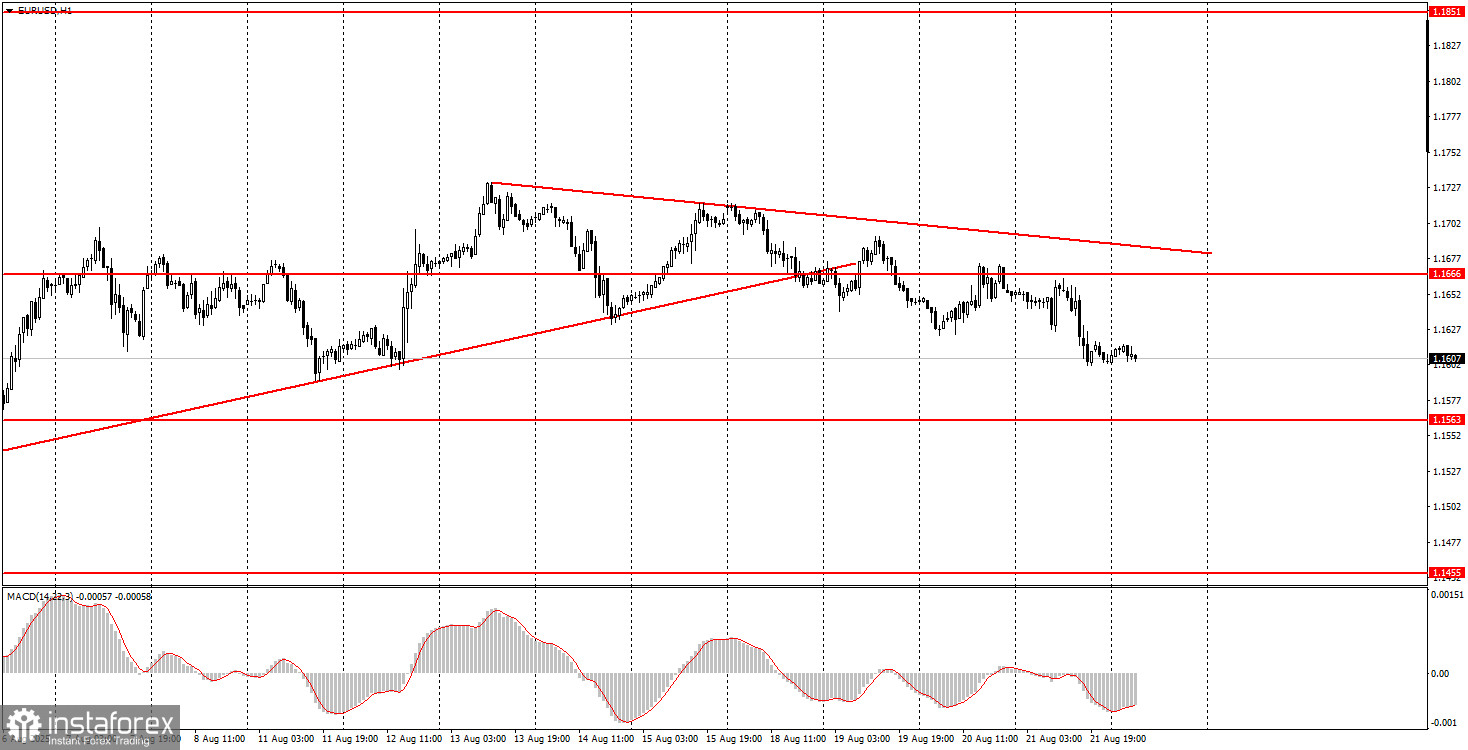

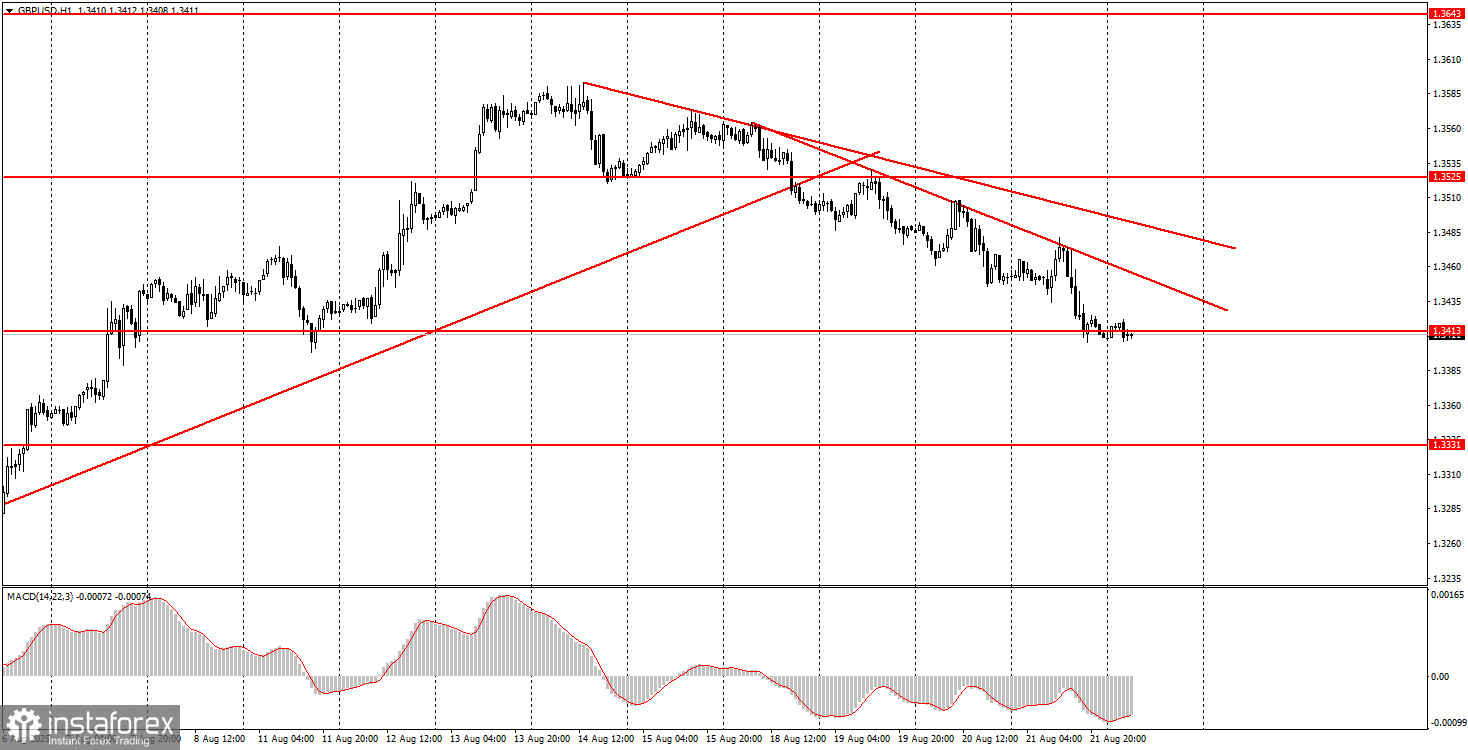

During the last trading day of the week, both currency pairs may again be traded on technical grounds—at least until Powell's speech. The euro rebounded yesterday from the 1.1655–1.1666 area and may therefore continue its decline toward 1.1552–1.1571. The British pound may "detach" today from the 1.3413–1.3421 area, which would allow opening short positions with a target at 1.3329–1.3331.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română