The euro, the pound, and other risk assets fell against the US dollar as yesterday's exceptionally strong data on US economic activity heightened concerns that the Federal Reserve will continue to pursue a restrictive interest rate policy.

The outstanding US PMI data, which turned out much better than economists' forecasts, supported the dollar yesterday. The Manufacturing PMI surged to 53.3, beating expectations of 50.0, while the Services PMI reached 55.4, also exceeding projections. These figures indicate that the US economy remains resilient and continues to grow despite recession fears caused by high inflation and elevated interest rates. Rising PMI signals an increase in business activity, which typically boosts demand for the dollar. Traders view strong economic data as a sign that the Fed may continue with its tight monetary policy to combat inflation, despite certain labor market challenges.

As for today's data, in the first half of the day, figures on Germany's Q2 GDP are expected. Economists are closely watching these numbers as they may shed light on the overall state of the European economy. After a relatively sluggish start to the year, driven by geopolitical uncertainty and the trade crisis, any signs of recovery in the German economy will be welcomed by the market. In particular, investors will focus on GDP components such as consumer spending, capital investment, and exports. If Germany's GDP data comes out better than expected, it may strengthen the euro. Conversely, weak figures could intensify recession fears and trigger market sell-offs.

There is no scheduled data for the UK.

If the figures match economists' expectations, it is better to act based on a Mean Reversion strategy. If the data turns out significantly higher or lower than expected, the best approach would be to use a Momentum strategy.

Momentum Strategy (Breakout):

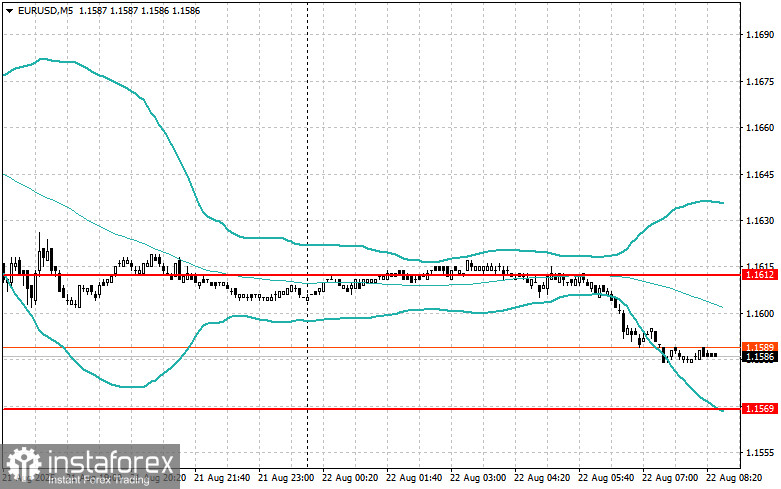

EUR/USD

Buying on a breakout above 1.1600 may lead to growth toward 1.1626 and 1.1658.

Selling on a breakout below 1.1570 may lead to a decline toward 1.1530 and 1.1480.

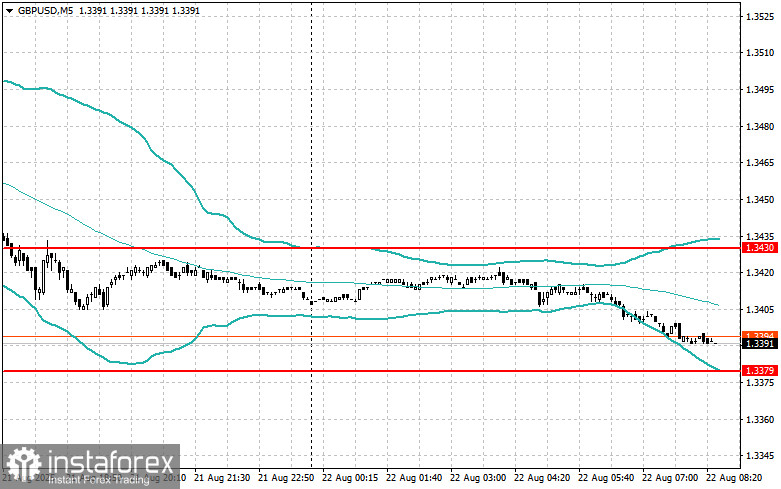

GBP/USD

Buying on a breakout above 1.3405 may lead to growth toward 1.3425 and 1.3450.

Selling on a breakout below 1.3380 may lead to a decline toward 1.3345 and 1.3315.

USD/JPY

Buying on a breakout above 148.75 may lead to growth toward 149.05 and 149.30.

Selling on a breakout below 148.50 may lead to a decline toward 148.15 and 147.80.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Look for selling opportunities after a failed breakout above 1.1612, with a return below this level.

Look for buying opportunities after a failed breakout below 1.1569, with a return above this level.

GBP/USD

Look for selling opportunities after a failed breakout above 1.3430, with a return below this level.

Look for buying opportunities after a failed breakout below 1.3379, with a return above this level.

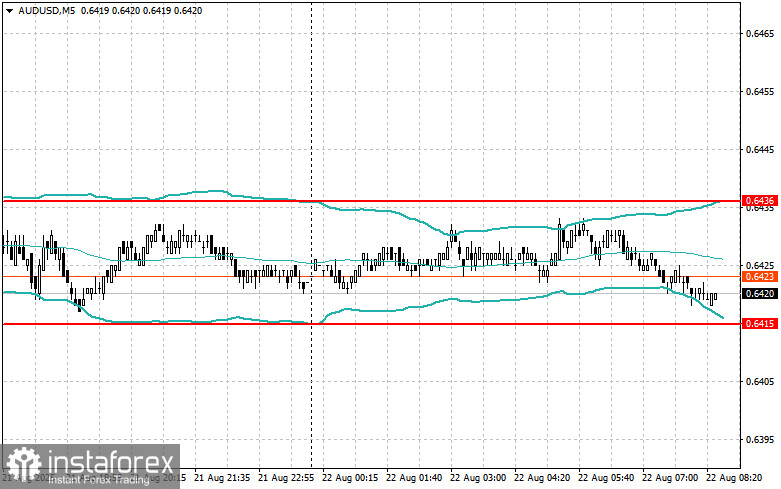

AUD/USD

Look for selling opportunities after a failed breakout above 0.6436, with a return below this level.

Look for buying opportunities after a failed breakout below 0.6415, with a return above this level.

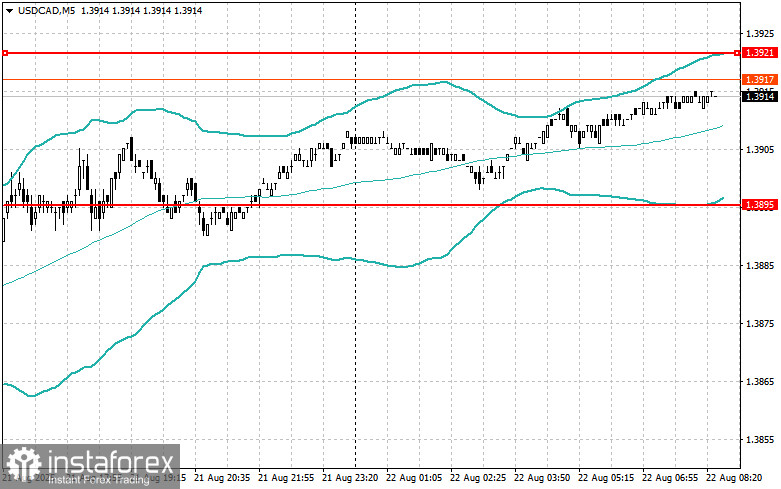

USD/CAD

Look for selling opportunities after a failed breakout above 1.3921, with a return below this level.

Look for buying opportunities after a failed breakout below 1.3895, with a return above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română