Bitcoin reached a new high of $112,000 before pulling back slightly. This level now appears to be the key point that will determine the asset's upward trend in the near term. A break below it could trigger a larger sell-off, with a return to the $100,000 mark, where big players are expected to step in again.

Meanwhile, yesterday, a noteworthy report suggested that by 2028, the stablecoin market could grow to $1.2 trillion. This forecast is certainly ambitious, given the current market capitalization of stablecoins. However, the growing popularity of digital assets and their integration into various sectors of the economy should be taken into account.

There are several key reasons for optimism. First, stablecoins offer stability that other cryptocurrencies often lack, making them attractive as a medium of exchange and store of value. Second, regulatory frameworks for stablecoins in the US have become much clearer than before, reducing uncertainty and fostering broader adoption. Earlier, US Treasury Secretary Bessent and US "Crypto Czar" David Sacks predicted that the expansion of the dollar-denominated stablecoin market would create significant demand for US Treasuries, since under the new legislation, new stablecoin issuances must be 100% backed. This scenario implies that stablecoin issuers will actively invest reserves in short-term government bonds, which in turn will support US debt and strengthen the American financial system.

If Bessent's and Sacks' assumptions prove correct, the growth of the stablecoin market will become an additional driver for the US economy. Increased demand for Treasuries could reduce borrowing costs for the government, allowing more funds to be directed toward infrastructure, education, and other key sectors. Moreover, the expansion of the stablecoin industry would create new jobs and attract investment into technology companies operating in the digital finance sector.

As for intraday strategy in the cryptocurrency market, I will continue to rely on major pullbacks in Bitcoin and Ethereum, with the expectation of a further development of the medium-term bullish market trend, which remains intact. The short-term trading strategy and conditions are outlined below.

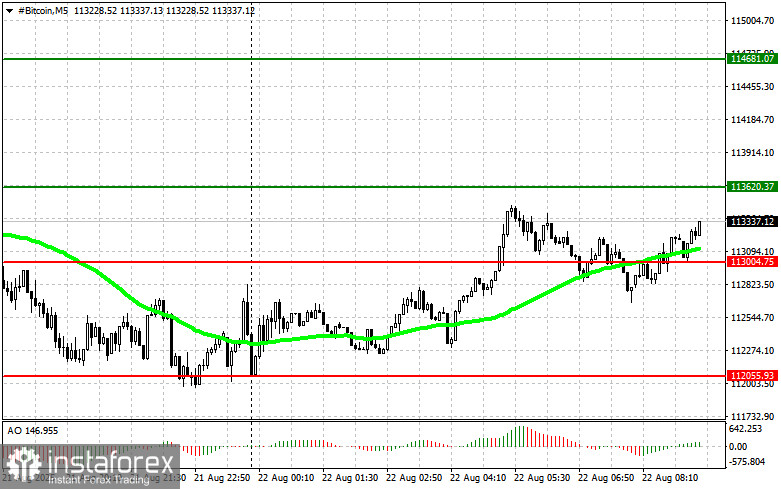

Bitcoin

Buy Scenario

Scenario No. 1: I plan to buy Bitcoin today upon reaching the entry point around $113,600, targeting growth to $114,600. Around $114,600, I will exit long positions and immediately sell on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario No. 2: Bitcoin can also be bought from the lower boundary at $113,000 if there is no market reaction to its breakout, with a reversal expected back toward $113,600 and $114,600.

Sell Scenario

Scenario No. 1: I plan to sell Bitcoin today upon reaching the entry point around $113,000, targeting a decline to $112,000. Once the price reaches around $112,000, I will exit my short positions and immediately buy on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario No. 2: Bitcoin can also be sold from the upper boundary at $113,600 if there is no market reaction to its breakout, with a reversal expected back toward $113,000 and $112,000.

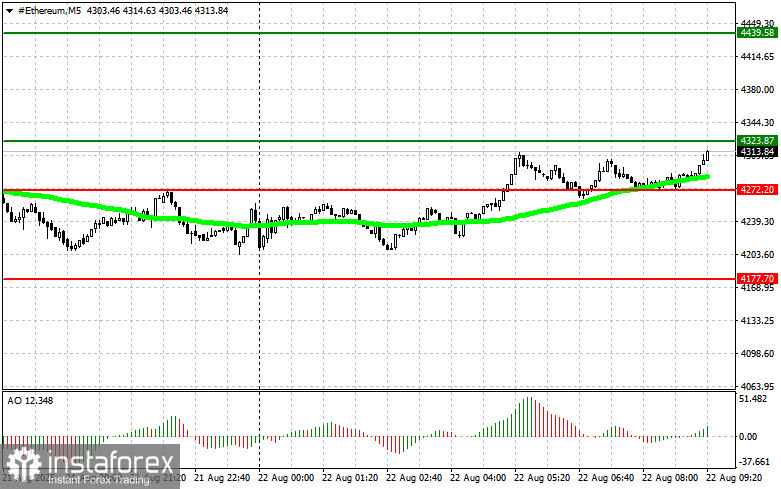

Ethereum

Buy Scenario

Scenario No. 1: I plan to buy Ethereum today upon reaching the entry point around $4,323, targeting growth to $4,439. Around $4,439, I will exit long positions and immediately sell on the rebound. Before buying on the breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario No. 2: Ethereum can also be bought from the lower boundary at $4,272 if there is no market reaction to its breakout, with a reversal expected back toward $4,323 and $4,439.

Sell Scenario

Scenario No. 1: I plan to sell Ethereum today upon reaching the entry point around $4,272, targeting a decline to $4,177. Around $4,177, I will exit short positions and immediately buy on the rebound. Before selling on the breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario No. 2: Ethereum can also be sold from the upper boundary at $4,323 if there is no market reaction to its breakout, with a reversal expected back toward $4,272 and $4,177.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română