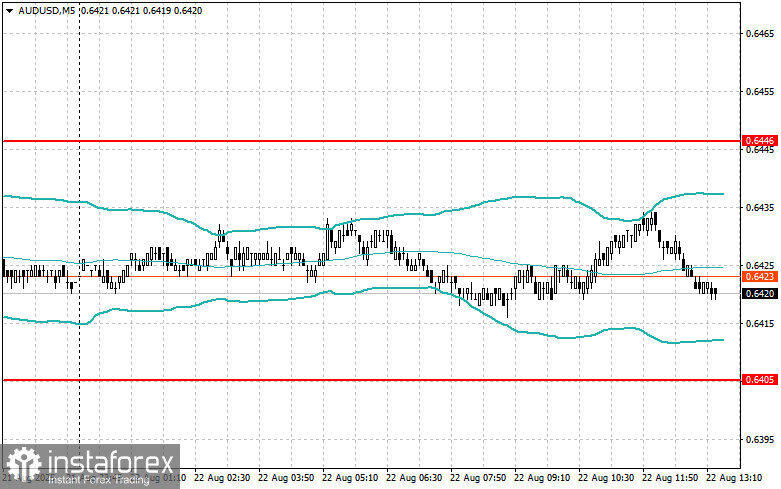

Only the Australian dollar could be traded today using the Mean Reversion strategy, but a major reversal move never materialized. I did not trade through Momentum, as no strong movements were expected in the first half of the day.

Germany's GDP data disappointed, but the euro completely ignored it. Weak economic indicators from the eurozone's largest economy raise doubts about the region's overall resilience. If the slowdown trend continues, the European Central Bank will find it more difficult to maintain a wait-and-see policy aimed at combating inflation.

It is clear that today everyone is awaiting the speech of Fed Chair Jerome Powell and his signals on the future path of monetary policy. Traders will closely watch every word, trying to decipher the regulator's intentions regarding inflation, interest rates, and economic growth. Even a slight change in rhetoric could spark market volatility.

In the current economic environment, marked by high inflation and a slowdown in labor market growth, the Fed's task becomes especially challenging. On the one hand, it needs to contain inflation, which may lead to a recession. On the other hand, excessive monetary easing could trigger another sharp inflationary spike. Therefore, the signals Powell sends to the market must be clear and balanced. Only concrete guidance from the policymaker will result in steady, directional moves; otherwise, we are headed for complete uncertainty.

Momentum Strategy (breakout) for the second half of the day:

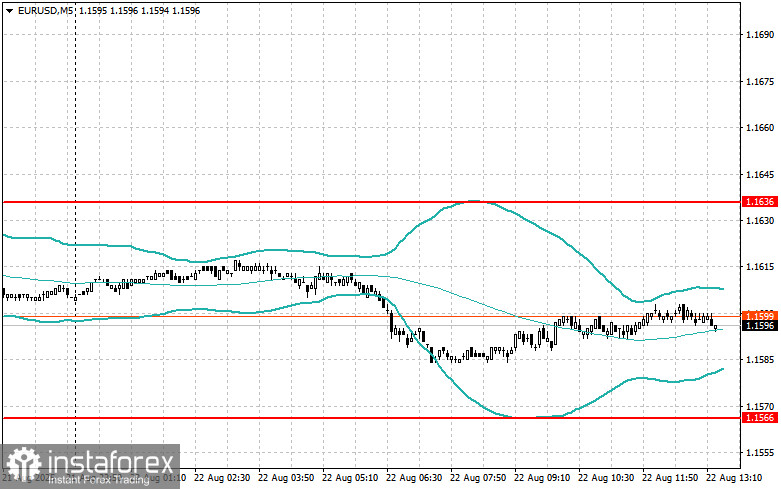

For EUR/USD

- Buying on a breakout above 1.1605 may lead to growth toward 1.1630 and 1.1690;

- Selling on a breakout below 1.1575 may lead to a decline toward 1.1540 and 1.1500.

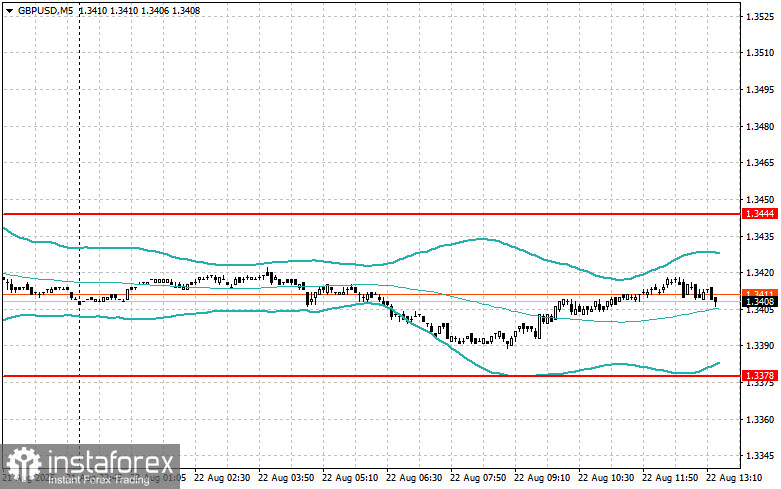

For GBP/USD

- Buying on a breakout above 1.3420 may lead to growth toward 1.3450 and 1.3480;

- Selling on a breakout below 1.3400 may lead to a decline toward 1.3370 and 1.3340.

For USD/JPY

- Buying on a breakout above 148.80 may lead to growth toward 149.20 and 149.50;

- Selling on a breakout below 148.55 may lead to a decline toward 148.15 and 147.80.

Mean Reversion Strategy (return) for the second half of the day:

For EUR/USD

- I will look for selling opportunities after a failed breakout above 1.1636 followed by a return below this level;

- I will look for buying opportunities after a failed breakout below 1.1566 followed by a return above this level.

For GBP/USD

- I will look for selling opportunities after a failed breakout above 1.3444 followed by a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3378 followed by a return above this level.

For AUD/USD

- I will look for selling opportunities after a failed breakout above 0.6446 followed by a return below this level;

- I will look for buying opportunities after a failed breakout below 0.6405 followed by a return above this level.

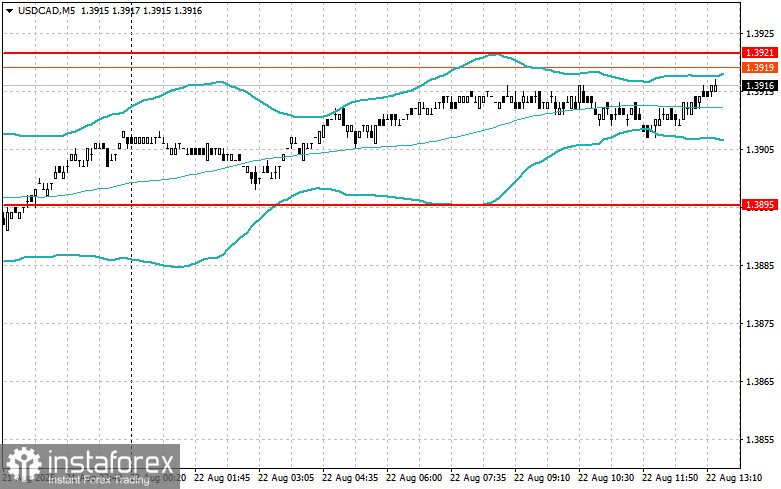

For USD/CAD

- I will look for selling opportunities after a failed breakout above 1.3921 followed by a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3895 followed by a return above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română