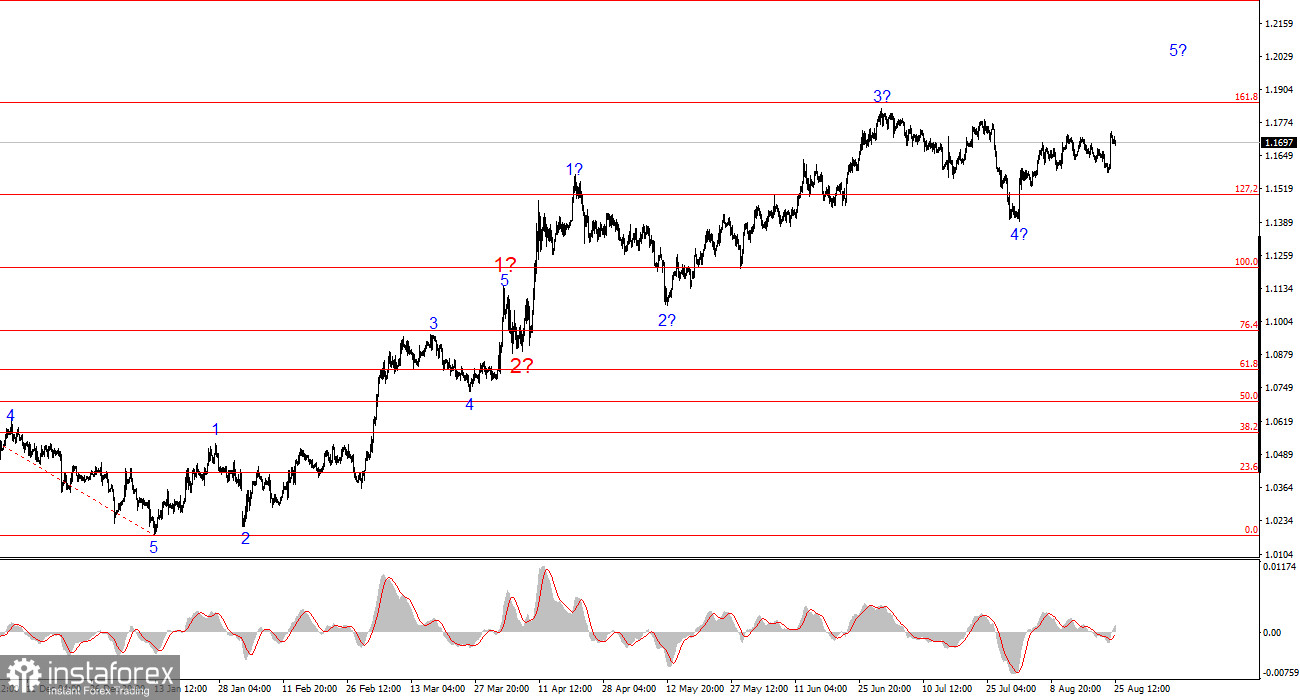

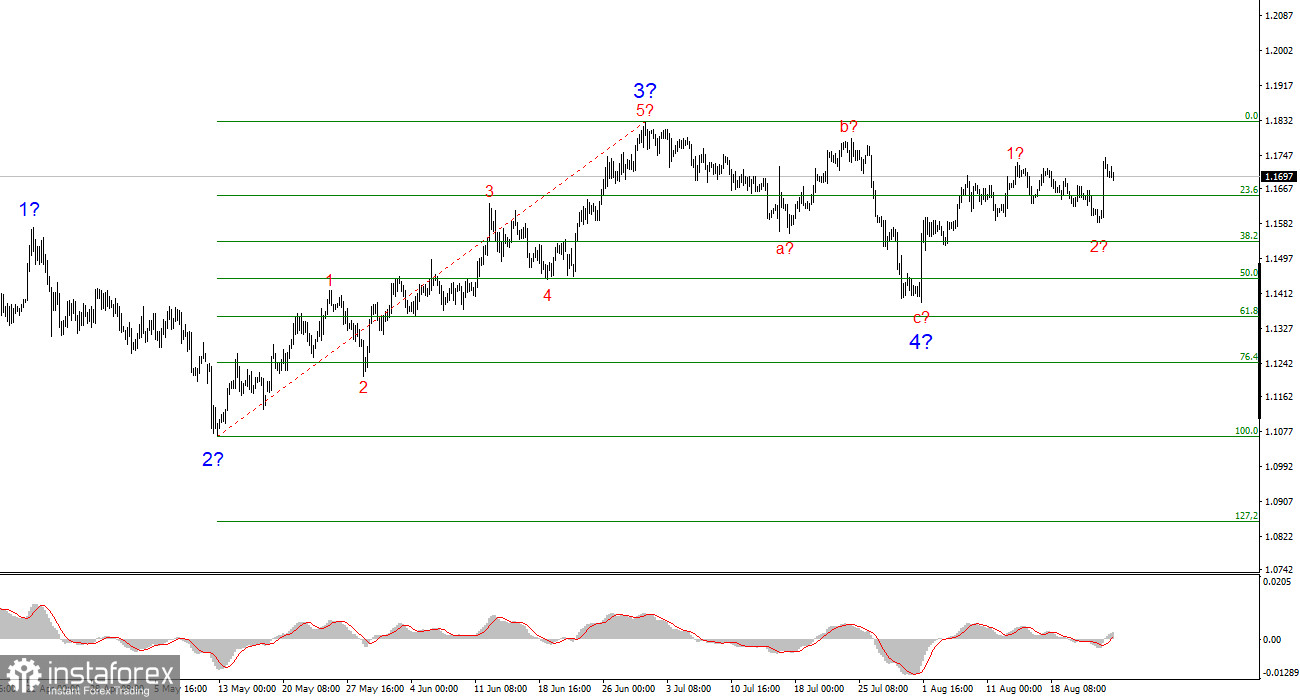

The wave pattern on the 4-hour chart of EUR/USD has not changed for several months, which is encouraging. Even during the formation of corrective waves, the integrity of the structure remains intact. This allows for accurate forecasts. It is worth noting that wave structures do not always look like textbook examples. At present, however, the structure looks very clear.

The construction of the upward trend segment continues, while the news background mostly does not support the dollar. The trade war launched by Donald Trump continues. The confrontation with the Fed continues. "Dovish" expectations are growing. Trump's "one big law" will add 3 trillion dollars to U.S. national debt, while the U.S. president keeps raising and introducing new tariffs. The market has rated the results of Trump's first six months very poorly, even though economic growth in Q2 came in at 3%.

At this point, it can be assumed that the formation of wave 4 is complete. If so, the construction of impulse wave 5 has begun, with targets extending up to the 1.25 level. Of course, the corrective structure of wave 4 could take a longer five-wave form, but I am working from the most likely scenario.

The EUR/USD rate fell by 30 basis points on Monday by the start of the U.S. session, but trading amplitude has been low today. Jerome Powell's Friday speech triggered a sharp drop in demand for the U.S. currency, and on Monday the market showed no intention of revising its conclusion. The mistake lies in the fact that Powell did not give any "dovish" signals. His admission that a rate cut in September is possible does not mean the next NonFarm Payrolls report will not come out strong or that inflation is bound to rise again. Therefore, the Fed's decision will depend on the next data releases and on inflation and labor market trends over the past four months, not three.

The "cooling" of the U.S. labor market may have been a "shock reaction" to Trump's global trade war. If the economy grew in Q2, unemployment should not be rising. Powell openly noted the low unemployment rate on Friday. Based on this, Powell himself doubts the labor market will continue to slow. However, virtually no one now doubts that inflation will rise. If the labor market shows signs of recovery in August, the Fed may reject easing monetary policy in September. In this case, I do not expect strong demand for the dollar, since a lack of changes in Fed policy is not a positive factor for the currency. It merely reflects the absence of new negatives. Nevertheless, the market drew illogical conclusions from Powell's Friday speech and, as Monday shows, is comfortable with those conclusions.

General Conclusions

Based on the EUR/USD analysis, I conclude that the instrument continues to build an upward trend segment. The wave pattern still depends entirely on the news background tied to Trump's decisions and U.S. foreign policy. Trend targets can extend up to the 1.25 level. Therefore, I continue to consider buying with targets near 1.1875, which corresponds to the 161.8% Fibonacci level, and higher. I assume wave 4 is complete, which means it remains a good time to buy.

Main Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often change.

- If there is no confidence in the market situation, it is better to stay out.

- Absolute certainty in market direction never exists. Always remember protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română