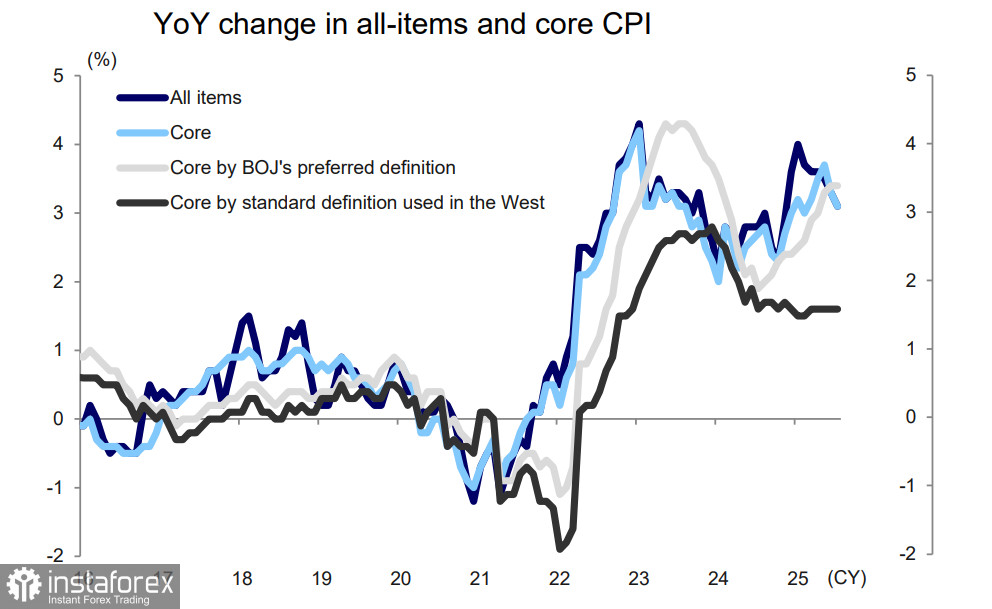

The nationwide CPI data published on August 22 showed a slowdown in overall inflation in July, from 3.3% year-over-year (y/y) to 3.1%; core inflation also declined from 3.3% to 3.1%. At the same time, the Bank of Japan's preferred measure of core inflation (all items excluding fresh food and energy) remained unchanged from June at +3.4%.

The trade agreement between the US and Japan has yet to have any impact on inflation. Uncertainty has decreased, but the Bank of Japan remains committed to acting cautiously before proceeding with any further rate hikes. According to the BOJ's view, it will remain "within the norm" at least until the end of 2025, while inflation will remain above the +2% target, supporting arguments for a resumption of policy rate normalization.

Service price inflation has hardly changed; inflation in goods appears to be near a peak, as the positive base effect for rice and other food products will wane. Meanwhile, service inflation is expected to remain stable against the backdrop of continued significant wage increases. According to Mizuho Bank, core CPI inflation is expected to remain around the BOJ's "price stability target" of 2% until at least the end of 2025, and is expected to begin declining from Q2 2026 as goods inflation decreases.

A Bank of Japan rate hike has been overdue for a while—nobody denies this—but the BOJ is maintaining its pause, fearing unpredictable consequences. The yield on 20-year Japanese government bonds (JGB) jumped to 2.655%, the highest since 1999. Given the gigantic level of government debt, every percentage point increase in yields means trillions of additional yen must be spent on servicing the debt. According to Reuters, Japan's Ministry of Finance plans to request a record $220 billion for debt servicing in the next fiscal year—an all-time high—and a rate hike will inevitably require further expenditures.

Market forecasts still favor a rate hike in October. Based on current realities, Japan's economy is expected to withstand such a move without difficulty. GDP for the second quarter performed notably better than forecasts. To assess the impact of the new tariffs, a couple of more months are needed, and all the statistics will be available by October.

Additional uncertainty, as usual, may be tied to news out of the US. The market is generally convinced that Powell's Jackson Hole speech was dovish, but seems to overlook the fact that abandoning average inflation targeting gives the Fed more flexibility, which could actually lead to rate hikes—not cuts—if Trump's tariff policy triggers an inflation spike. Powell, by the way, already shifted responsibility for such a scenario, should it unfold, onto Trump in his speech. We need to wait for the US August inflation data and the results of the September 17 FOMC meeting, as they could bring considerable surprises for the markets.

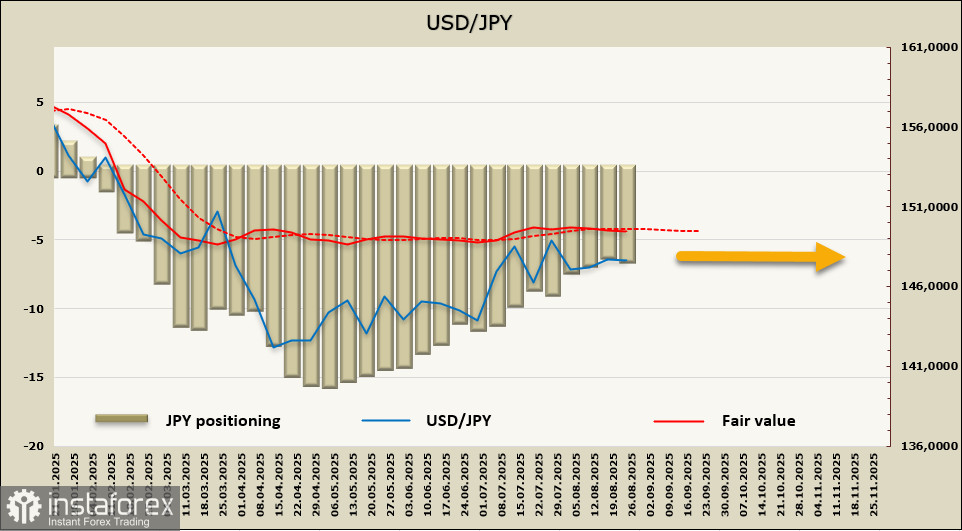

The net long position on the yen increased by $291 million during the reporting week, reaching $6.567 billion. Speculative positioning remains bullish, but the tendency for the long position to contract remains. The calculated price still lacks a clear direction.

The yen continues to trade in a relatively narrow range, and there is no reason for it to break out. The range boundaries are 145.80/146.20... 148.80/149.20—the pair is in a precarious balance, and movement in either direction could trigger a whole storm of consequences with unpredictable results.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română