Tuesday Trade Review:

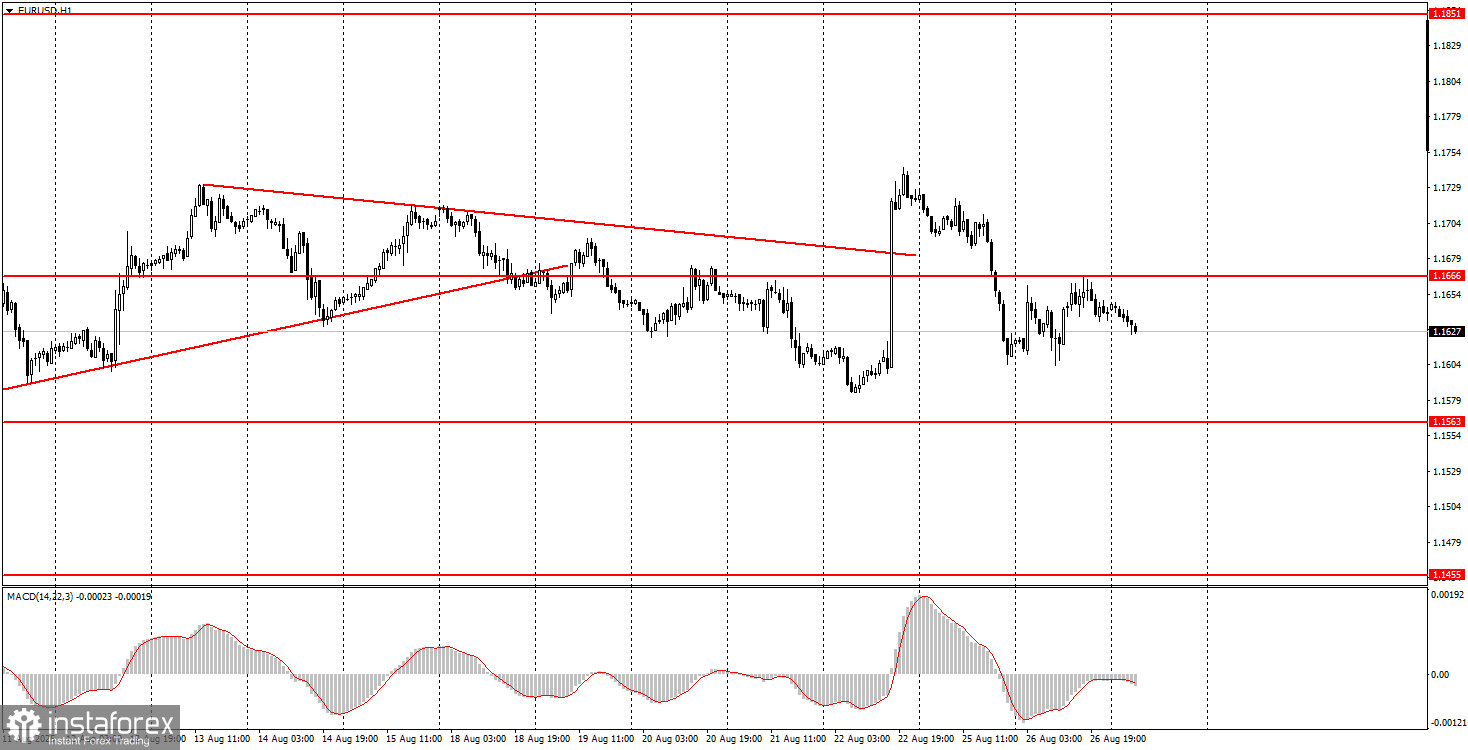

1H Chart of EUR/USD

On Tuesday, the EUR/USD currency pair traded exclusively sideways amid a near-total lack of fundamental and macroeconomic information. In the previous article, we noted that the only more or less significant report of the day—the US Durable Goods Orders—could provoke a market reaction only if the data differed significantly from forecasts. In reality, US orders in July fell by 2.8%, with projections ranging from -2.5% to -4.0%. Thus, the actual reading landed within the forecast range, so there was no reaction. Overall, the pair is at the early stage of a new uptrend, but the market is not rushing into active buying. This may again be due to the lack of news and the market's anticipation of events that will determine the dollar's future. However, in our view, the dollar's fate is already sealed. One way or another, traders still cannot break through the 1.1655–1.1666 area, meaning potential euro growth is temporarily on hold.

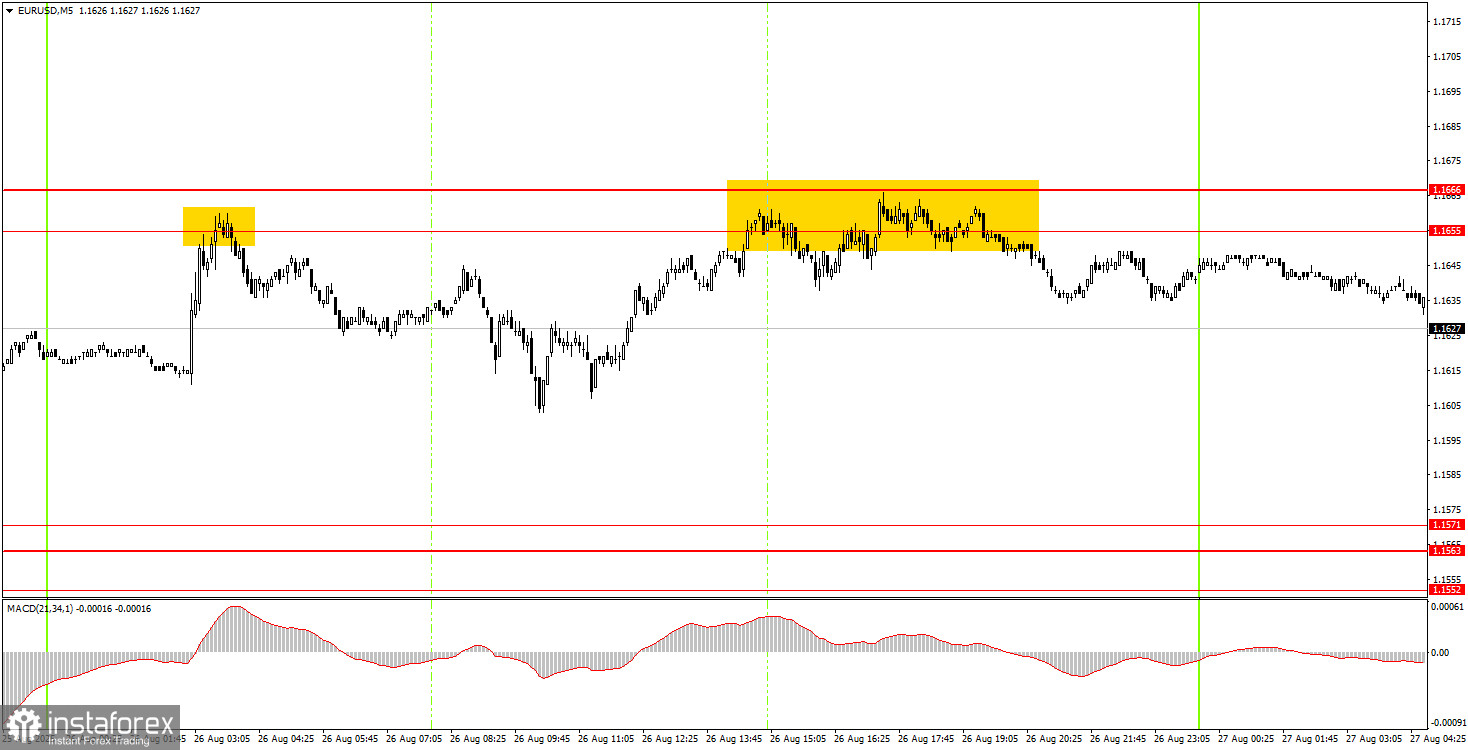

5M Chart of EUR/USD

On the 5-minute timeframe, two decent sell signals formed on Tuesday, but volatility throughout the day was quite low. Thus, at best, you could make a couple of dozen pips. The price bounced twice from the 1.1655–1.1666 area, allowing for short positions to be taken. The last signal was formed in the evening, and the trade could be carried over to today by moving the Stop Loss to breakeven.

How to Trade on Wednesday:

On the hourly timeframe, EUR/USD still has every chance to resume the uptrend that has been forming since the start of the year. The flat has ended, and a new bullish trend is forming, while the fundamental and macroeconomic background for the US dollar remains disastrous. Thus, as before, the US currency can only count on technical corrections.

On Wednesday, the EUR/USD pair may trade with low volatility again, as several important events are still scheduled for today. After breaking below and rebounding from the 1.1655–1.1666 area, a local decline toward 1.1571 can be expected.

On the 5-minute timeframe, watch the levels: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1552–1.1563–1.1571, 1.1655–1.1666, 1.1740–1.1745, 1.1808, 1.1851, 1.1908. On Wednesday, there are again no significant events or reports scheduled in either the US or the Eurozone, so volatility is likely to remain weak. This means that even high-quality trading signals may yield only modest profits.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română