The euro, pound, and other risk assets experienced a slight recovery against the US dollar yesterday, but pressure has already returned during this morning's trading, leading to rather active sell-offs.

The rise in the US Consumer Confidence Index brought renewed demand for the US dollar, limiting the upside potential of risk assets in the second half of the day yesterday. This recovery in consumer sentiment affected traders' attitudes, as they again focused on the resilience of the American economy.

Today, the only notable data expected is Germany's GfK Leading Consumer Climate index. In the event of weak figures, the euro's decline may continue with renewed strength. Traders will closely watch this indicator, as it provides insight into German consumer sentiment and their willingness to spend in the future. A decline in consumer confidence can signal a slowdown in Germany's economic growth, which would, in turn, put pressure on the euro. Considering the current global economic challenges—including inflation and geopolitical instability—data from Germany is particularly significant. As the largest economy in Europe, Germany remains in a tough spot due to trade tariffs, so any negative signal is likely to be interpreted against the euro.

Data on retail sales from the Confederation of British Industry is also due in the first half of the day. With inflation still elevated and overall consumer confidence down, the market is expecting more negative than positive results. This could exert additional pressure on the British currency, which is already under strain due to the uncertain outlook for the UK economy. Retail sales data is an important indicator because it reflects the sentiment of retailers and their expectations regarding consumer demand.

Therefore, even if the above figures turn out not to be as bad as expected, they are unlikely to provide substantial support for the euro or the pound.

If the data matches economists' expectations, it's better to rely on a Mean Reversion strategy. If the data is significantly above or below expectations, the best approach is to use a Momentum strategy.

Momentum Strategy (Breakout):

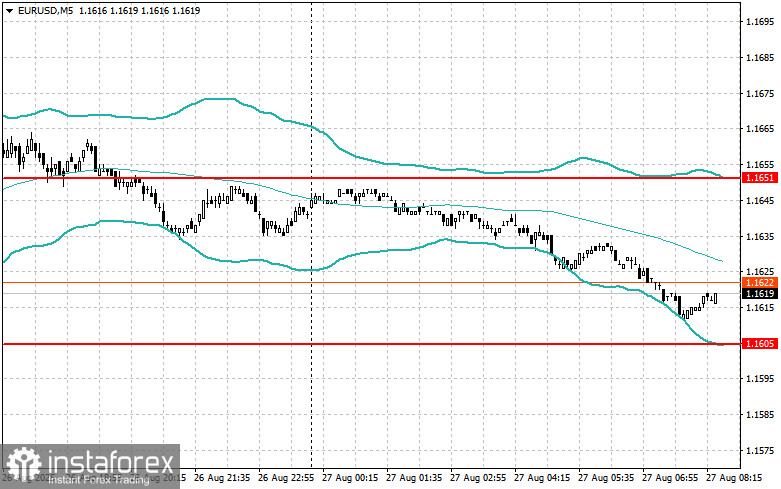

EUR/USD

Buying a breakout above 1.1630 could lead to euro gains toward 1.1660 and 1.1690.

Selling a breakout below 1.1605 could lead to a fall in the euro toward 1.1560 and 1.1530.

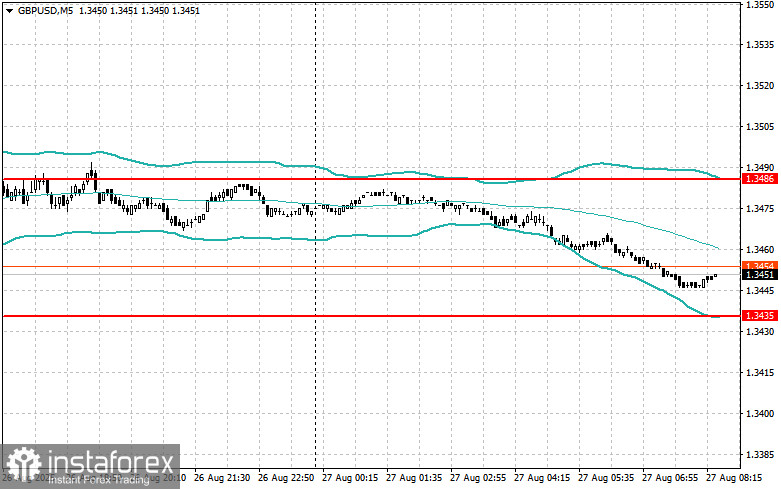

GBP/USD

Buying a breakout above 1.3470 could lead to gains toward 1.3490 and 1.3520.

Selling a breakout below 1.3445 could lead to a decline toward 1.3420 and 1.3390.

USD/JPY

Buying a breakout above 148.00 could lead to dollar strength toward 148.30 and 148.60.

Selling a breakout below 147.75 could lead to dollar selling toward 147.50 and 146.99.

Mean Reversion Strategy (Pullbacks):

EUR/USD

Sell after a failed breakout above 1.1651, once the price returns below that level;

Buy after a failed breakout below 1.1605, once the price returns above it.

GBP/USD

Sell after a failed breakout above 1.3486, once the price returns below that level;

Buy after a failed breakout below 1.3435, once the price returns above it.

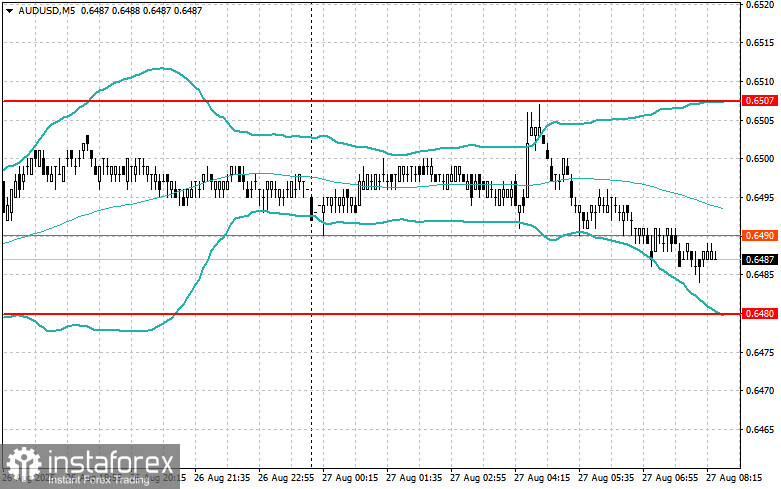

AUD/USD

Sell after a failed breakout above 0.6507, once the price returns below that level;

Buy after a failed breakout below 0.6480, once the price returns above it.

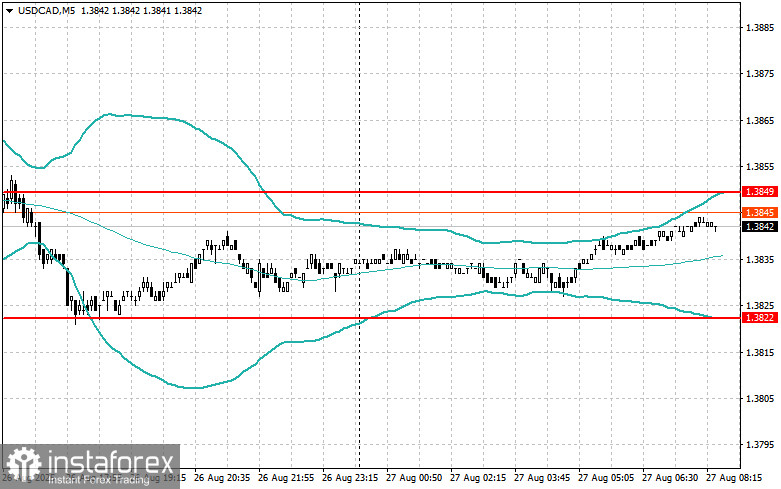

USD/CAD

Sell after a failed breakout above 1.3849, once the price returns below that level;

Buy after a failed breakout below 1.3822, once the price returns above it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română