Trade analysis and tips for trading the euro

The price test of 1.1611 occurred when the MACD indicator had just started moving down from the zero mark, which confirmed the correct entry point for selling the euro. As a result, the pair fell by 30 points.

Disappointing German consumer sentiment data released by GfK added extra pressure on the euro, deepening the downward trend. The index, which reflects Germans' willingness to spend, fell to -23.6, missing forecasts of -21.3. This reflects rising concerns among households about the economy and their personal financial situation. The spread of pessimism among German consumers serves as a warning for the ECB, which seeks to contain inflation while avoiding a recession. In the near term, the euro will likely remain under pressure due to the combination of weak German data and expectations of a more dovish ECB policy.

In the second half of the day, the key event will be the speech by FOMC member Thomas Barkin. Market participants will listen closely for hints about the Fed's future interest rate policy. Should Barkin take a dovish stance, the dollar could weaken, giving the euro a chance for modest strengthening. However, his comments should not be overestimated if other factors continue to support the dollar.

As for intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Signal

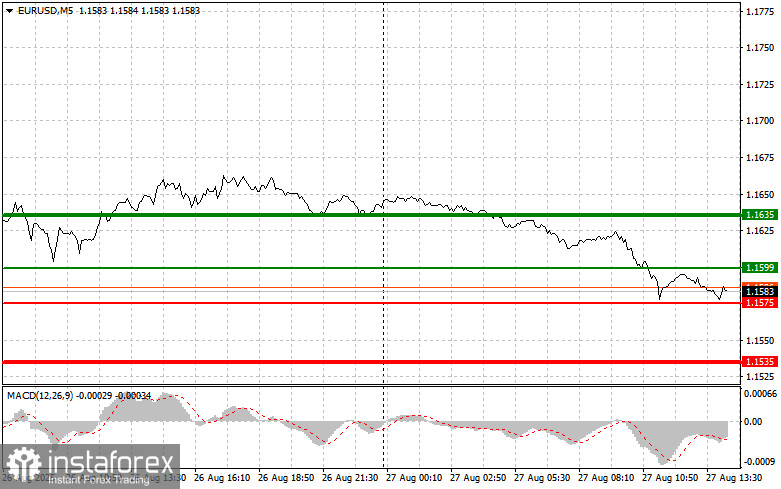

Scenario #1: Today, buying the euro is possible around 1.1599 (green line on the chart) with a target at 1.1635. At 1.1635, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry. A strong rise in the euro is more likely after weak statistics. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1575 level at a time when the MACD is in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. A rise toward 1.1599 and 1.1635 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1575 level (red line on the chart). The target will be 1.1535, where I intend to exit and immediately buy in the opposite direction, aiming for a 20–25 point bounce. Pressure on the pair will return in the case of strong statistics. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1599 level while the MACD is in overbought territory. This will limit the pair's upward potential and trigger a reversal downward. A decline toward 1.1575 and 1.1535 can then be expected.

What's on the chart:

- Thin green line – entry price where the instrument can be bought;

- Thick green line – projected level to place Take Profit or manually fix profit, as further growth above this point is unlikely;

- Thin red line – entry price where the instrument can be sold;

- Thick red line – projected level to place Take Profit or manually fix profit, as further decline below this point is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very cautious when making entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can lose your deposit very quickly, especially if you neglect money management and trade large volumes.

And remember, for successful trading you need to have a clear trading plan, like the one I outlined above. Spontaneous decisions based only on the current market situation are an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română