Trouble never comes alone. Europe's political system is collapsing like a house of cards. After France, the fire has spread to the Netherlands, where a vote of no confidence in the government may also take place. As risks rise, so does uncertainty—and Donald Trump's tariff sword of Damocles continues to hang over the euro bloc and EUR/USD.

The White House occupant has declared that any country imposing digital taxes on American companies will have only itself to blame. They will face extra tariffs for access to the big and beautiful store called America.

Even though the European Union was not mentioned directly, everyone understands who is being discussed. It's Europe that imposes digital taxes. It's also supposed to lower tariffs on imports of US corporations, including agricultural firms. Otherwise, US auto tariffs will remain at 27.5% rather than dropping to 15%, as provided for in the agreement between Washington and Brussels.

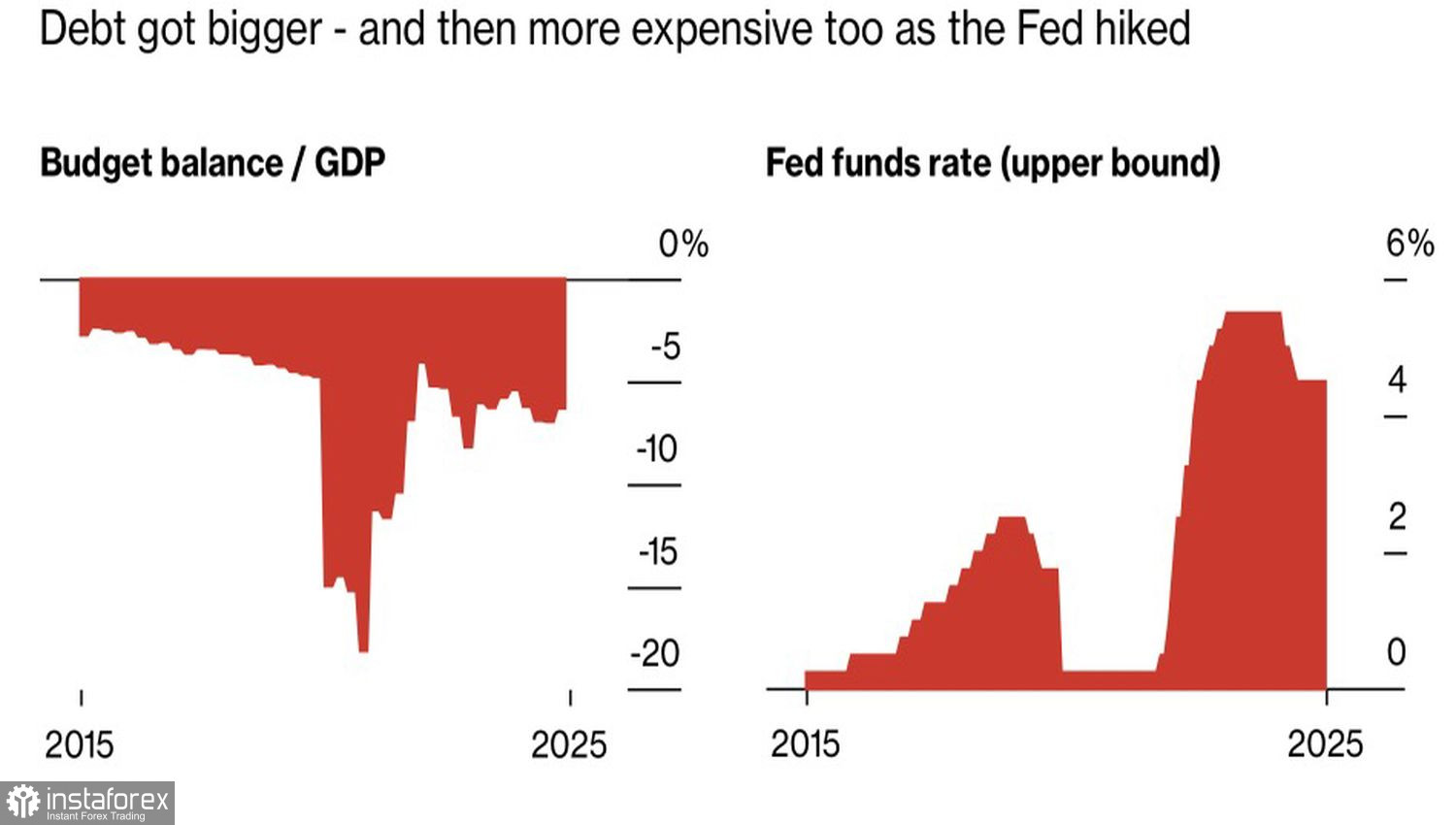

US National Debt Dynamics and Fed Rate

Despite political crises and tariffs suffocating the bulls in EUR/USD, the US dollar's problems are much more severe. France and the Netherlands will likely resolve their issues, but the United States is unlikely to do so. Trump's policies will drag them into the abyss.

In theory, this is known as fiscal dominance. Instead of cutting budget spending and raising taxes, the government demands rate cuts from the central bank. This reduces the cost of servicing debt but increases the risk of runaway inflation. Developed countries don't do this, but developing ones do it from time to time. If the US starts looking like a second-world country, why park money there? Capital flight will be just as much a reason to sell the dollar as expectations of Federal Reserve monetary expansion.

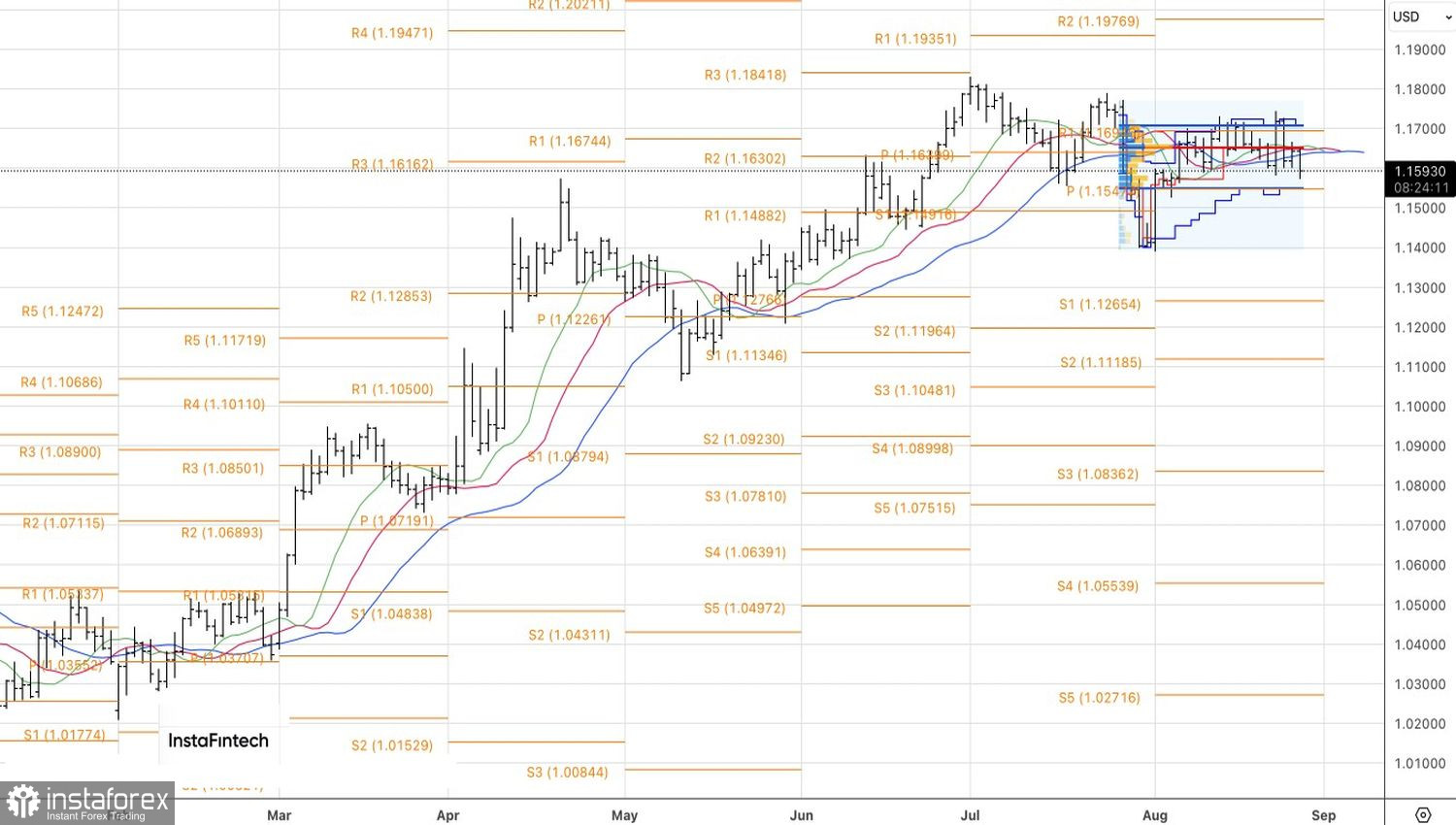

So, if politics stands in the euro's way, the White House blocks the US dollar. The US president believes the whole world revolves around him and continues to dictate his will to the financial markets. Political crises in France and the Netherlands may persist, but they are unlikely to disrupt the uptrend for EUR/USD. It's just a correction, offering a tactical opportunity to buy the main currency pair at a better price.

Trump and his team want a weaker dollar to boost the competitiveness of US companies—and they'll get it, one way or another. That's why it's best to be in the same boat as the EUR/USD buyers, not the sellers.

Technically, on the daily chart of the main currency pair, the bears managed to play out the inside bar and push the price below 1.160. Nevertheless, there's no reason to doubt the strength of the uptrend. A rebound in EUR/USD from the support at pivot levels 1.155 and 1.150 will be grounds to form long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română