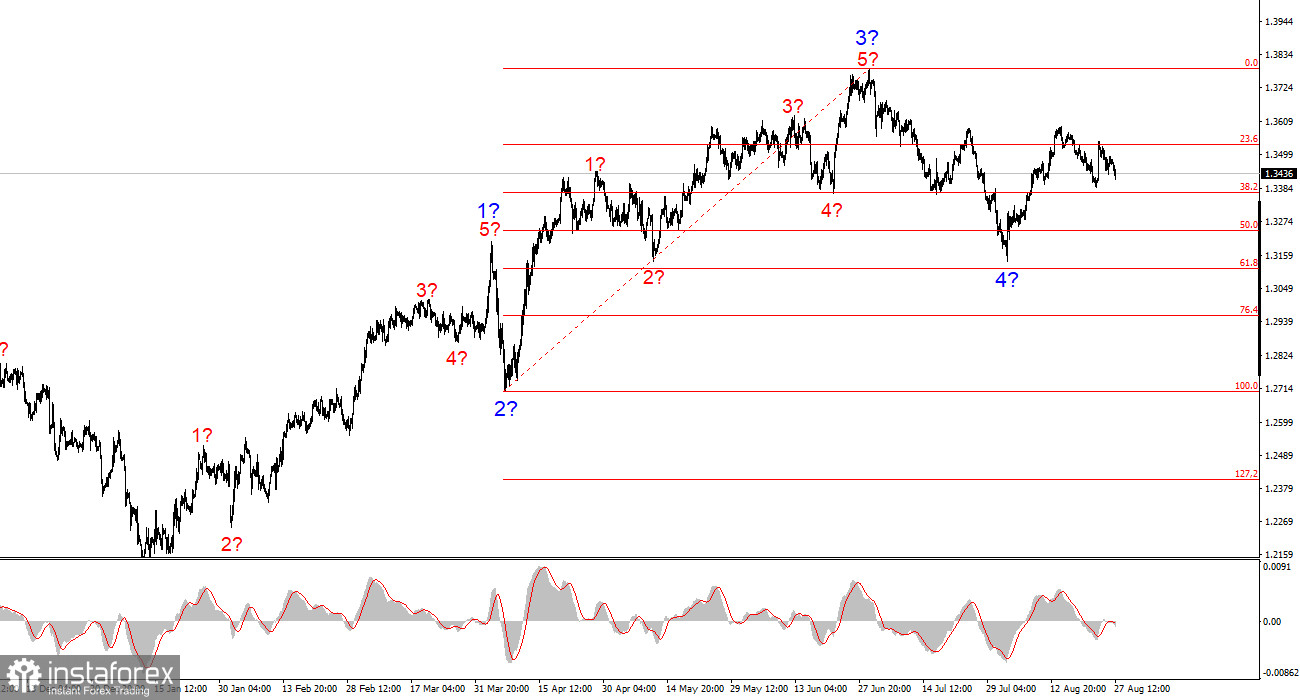

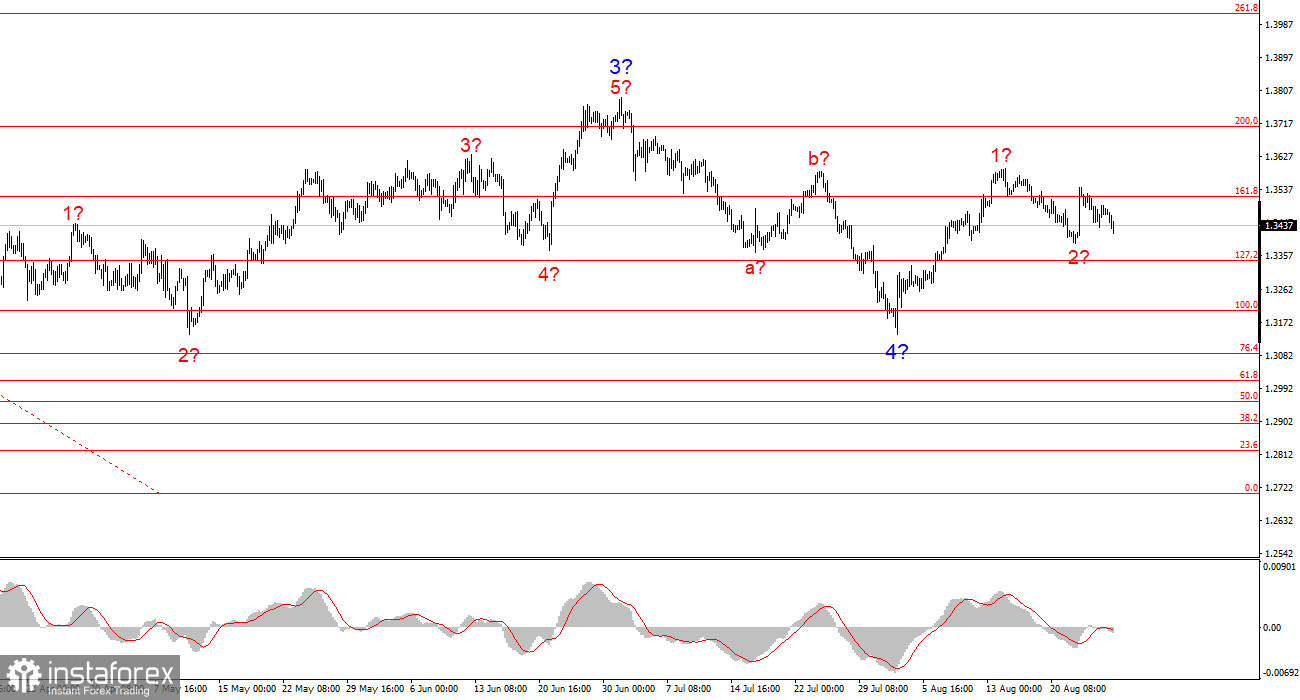

For GBP/USD, the wave structure continues to indicate the formation of a bullish impulsive sequence. The wave pattern is almost identical to EUR/USD, as the only "driving force" remains the U.S. dollar. Demand for the dollar is falling across the market (in the medium term), so many instruments are showing nearly identical dynamics. At this stage, wave 4 is assumed to be complete. If this is indeed the case, the instrument's upward movement will continue within impulsive wave 5. Wave 4 could take the form of a five-wave sequence, though this is not the most likely scenario.

It should be remembered that much in the currency market now depends on Donald Trump's policies—beyond trade alone. From time to time, positive news comes out of the U.S., but the market remains dominated by overall uncertainty, contradictory decisions and statements by Trump, and the White House's hostile and protectionist stance. Global tensions are increasing and, as I mentioned earlier, the dollar remains the central figure, which is why it takes all the "hits."

The GBP/USD pair declined by several dozen basis points on Wednesday, and the corrective wave is taking on a more complex form. To be precise, the assumed wave 2 maintains its "completed" status but may develop into a more complex structure. If so, the instrument's upward movement should resume today or tomorrow. However, I would also note that the corrective structure in the euro is becoming more complicated, and the same outcome may occur with the British pound.

The market is in no hurry to open positions at the moment. This week, two events could have easily triggered a decline in the U.S. dollar. First, Donald Trump dismissed Lisa Cook. Second, Trump raised tariffs on imports from India. Few would argue that these are important events that cannot be ignored. The dismissal of Lisa Cook—so far only within Trump's "universe"—carries far broader significance than the removal of an underperforming official. It shows that Trump will not back down from his intention to reshape the current FOMC lineup, replacing it with people loyal to him. These individuals would then make decisions aligned with Trump's agenda, effectively turning the Fed into a puppet of the U.S. president, something that should not happen under the Constitution.

The tariff increase on India represents a new escalation in the global trade war, designed to provide extra revenue to the perpetually deficit U.S. budget. Some market participants had grown complacent about tariffs, but clearly Trump is not standing still. New Delhi rejected Trump's generous proposal to stop purchasing oil and gas from Russia, so now all export-oriented Indian goods will face a 50% tariff. Naturally, such measures will sharply reduce Indian exports to the U.S., hitting India's economy. At the same time, rejecting relatively cheap Russian energy resources will also damage India's economy.

General conclusions

The wave pattern for GBP/USD remains unchanged. We are dealing with a bullish impulsive trend segment. Under Donald Trump, markets may face numerous shocks and reversals that could significantly affect the wave structure, but for now the working scenario remains intact. The targets of the bullish segment are now around 1.4017. At present, I assume that the construction of downward wave 4 is complete. Wave 2 of 5 may also be finished. Therefore, I recommend buying with a target of 1.4017.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often shift.

- If there is no confidence in the market situation, it is better not to enter.

- One can never have 100% certainty about market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română