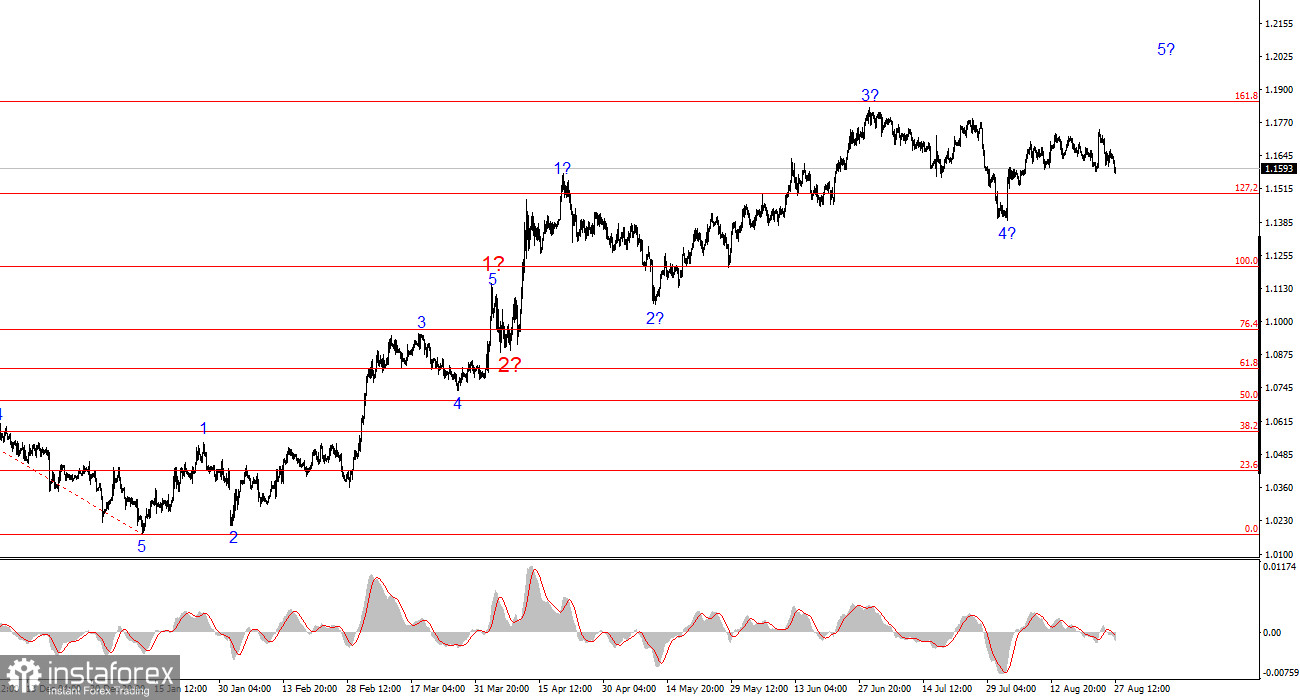

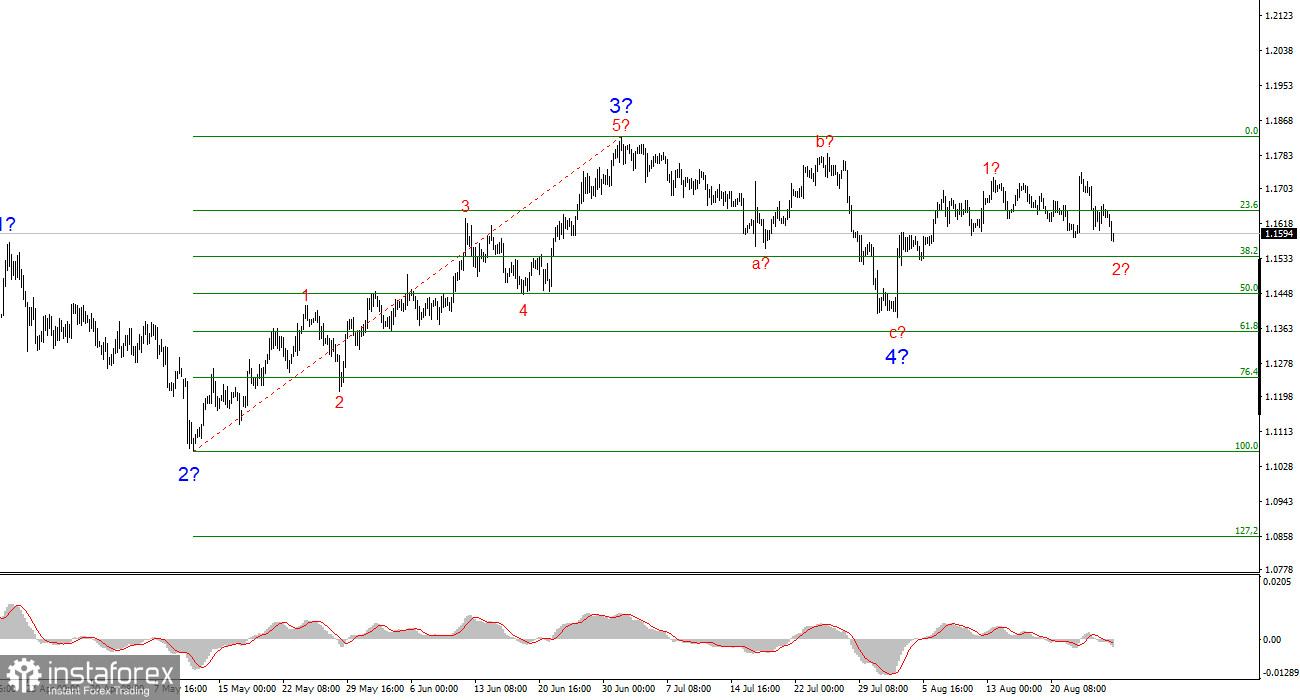

The wave pattern on the 4-hour chart for EUR/USD has remained unchanged for several months now, which is encouraging. Even when corrective waves are forming, the integrity of the structure is preserved. This allows for accurate forecasts. It is worth noting that the wave structure does not always look exactly as it does in textbooks. At present, however, it looks very clear.

The upward trend segment continues, and the news background largely works against the dollar. The trade war initiated by Donald Trump is ongoing. The confrontation with the Fed continues. Dovish expectations are growing. Trump's "One Big Law" will increase U.S. government debt by 3 trillion dollars, while the president keeps raising tariffs and introducing new ones. The market does not rate the results of Trump's first six months highly, even though Q2 economic growth was 3%.

At this stage, it can be assumed that wave 4 is complete. If so, then the construction of impulsive wave 5 has begun, with targets potentially extending up to the 1.25 level. Of course, corrective wave 4 could still develop into a longer five-wave structure, but I proceed from the most likely scenario.

The EUR/USD pair declined slightly again on Wednesday. Today's economic calendars for both the Eurozone and the U.S. are completely empty, and the dollar is rising more out of inertia than on any positive news. This conclusion is simple: there is no positive news for the U.S. currency. Although demand for the dollar has increased in recent days, in my view this means very little. The current news backdrop does not provide any grounds to believe in a justified and sustainable strengthening of the dollar.

Under these circumstances, I want to remind readers that the market is a complex mechanism. If a conclusion was made yesterday or the day before that the U.S. dollar is bound to weaken in the medium term, that does not mean the decline must start immediately. Wave analysis is complex, and many traders know about complicated corrective structures. What do they imply? That the market is in a pause, shaped by current conditions. During such pauses, the instrument cannot literally stand still. Price fluctuations will occur daily. Therefore, I would not revise objective conclusions just because "the price is moving the wrong way."

Demand for the U.S. dollar is slowly growing, but what explains it now? Personally, I do not see any reason for the dollar to rise. And if its strengthening cannot be explained, then such movement should not be played. It is possible that a complex corrective structure will develop in the near term, and the market may prefer to wait for inflation and labor market reports. In that case, the pause could last at least another week.

General conclusions

Based on my analysis of EUR/USD, I conclude that the instrument continues building an upward trend segment. The wave pattern remains entirely dependent on the news background tied to Trump's decisions and U.S. foreign policy. The targets of this segment may extend up to the 1.25 level. Therefore, I continue to consider long positions with targets near 1.1875, which corresponds to the 161.8% Fibonacci level, and above. I assume wave 4 is complete. Accordingly, now remains a good time for buying.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often change.

- If there is no confidence in the market situation, it is better not to enter.

- One can never have 100% certainty about market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română