The euro, pound, and other risk assets jumped sharply yesterday after several statements by US Federal Reserve officials.

Williams, in particular, made it clear that the September meeting will be a heated one and that the committee may decide to cut interest rates in less than three weeks.

Uncertainty over the Fed's future policy persists, putting pressure on the US dollar. Against this backdrop, traders are closely monitoring incoming economic data and statements from Fed officials to gauge the likelihood of rate cuts. Today's weak economic growth figures could prompt the Fed to act more aggressively.

In contrast, Europe is experiencing relative stability. The European Central Bank is so far refraining from abrupt changes to its monetary policy, which is supporting the euro. However, risks associated with trade wars and slowing global growth also continue to weigh on the European currency.

Today, figures for private sector lending in the eurozone and changes in the M3 money supply aggregate are expected to be released in the first half of the day. The ECB's monetary policy meeting report will be released a bit later. These data serve as indicators of the health of the European economy. An increase in private sector lending may signal a revival of business activity and consumer demand. Growth in M3 indicates an expanding money supply in circulation, which can potentially lead to inflation but can also stimulate economic growth.

Analysts and investors will carefully study the ECB report. It contains detailed information on the discussions within the ECB as well as its views on the current economic situation and future policy measures.

There's no economic data from the UK today, so the pound may get a chance to continue the upward trend seen since yesterday.

If the data matches economists' expectations, it's preferable to use a Mean Reversion strategy. If the data comes in much higher or lower than expected, the best approach is to use a Momentum strategy.

Momentum Strategy (Breakout):

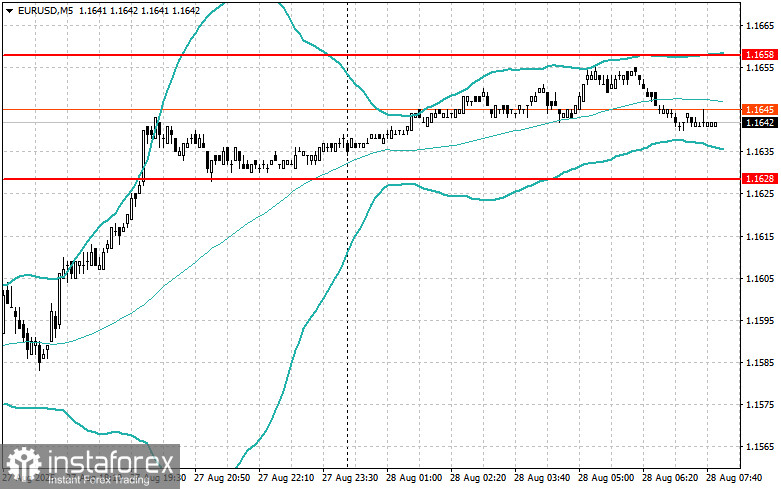

EUR/USD

Buying a breakout above 1.1660 may lead to euro growth toward 1.1700 and 1.1740

Selling a breakout below 1.1625 may push the euro down to 1.1580 and 1.1530

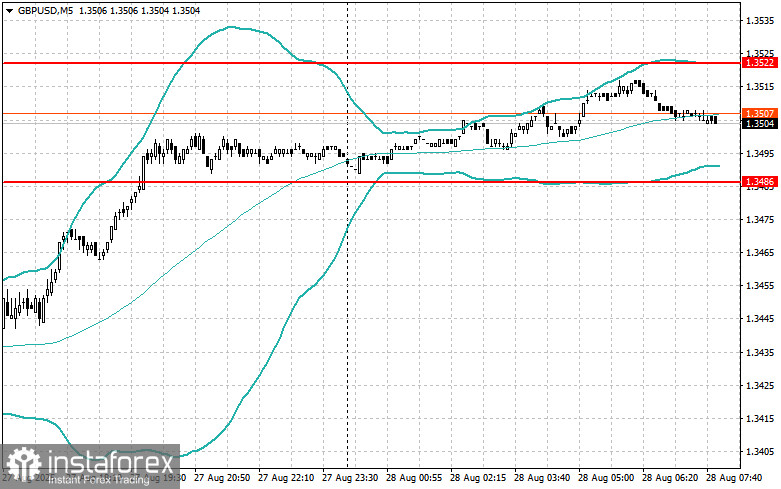

GBP/USD

Buying a breakout above 1.3520 may push the pound up to 1.3550 and 1.3580

Selling a breakout below 1.3490 may send the pound down to 1.3460 and 1.3420

USD/JPY

Buying a breakout above 147.25 may drive the dollar up to 147.55 and 147.90

Selling a breakout below 147.00 may trigger dollar selling toward 146.75 and 146.50

Mean Reversion Strategy (Pullbacks):

EUR/USD

Sell after a failed breakout above 1.1658, once the price returns below that level

Buy after a failed breakdown below 1.1628, once the price returns above that level

GBP/USD

Sell after a failed breakout above 1.3522, once the price returns below that level

Buy after a failed breakdown below 1.3486, once the price returns above that level

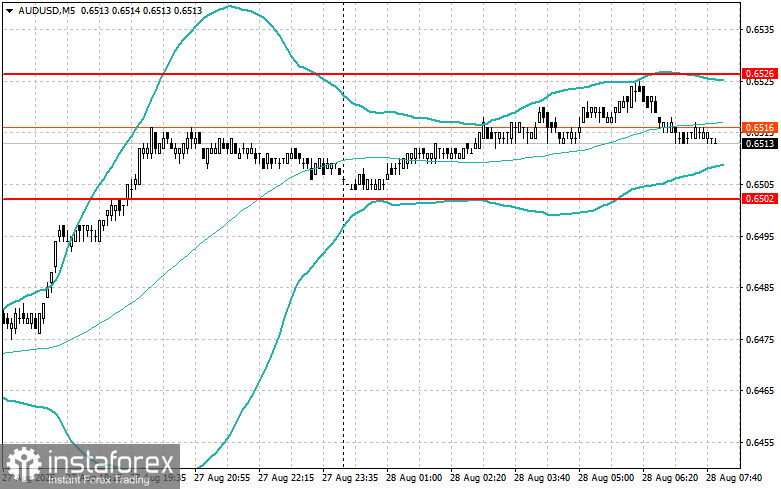

AUD/USD

Sell after a failed breakout above 0.6526, once the price returns below that level

Buy after a failed breakdown below 0.6502, once the price returns above that level

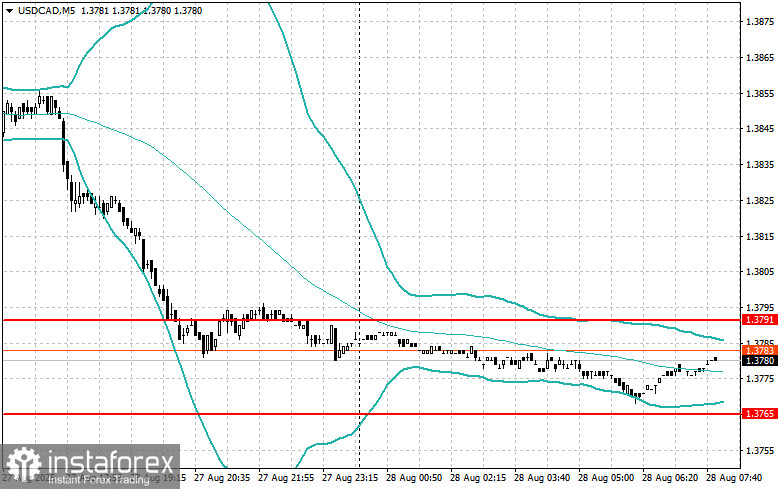

USD/CAD

Sell after a failed breakout above 1.3791, once the price returns below that level

Buy after a failed breakdown below 1.3765, once the price returns above that level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română