Bitcoin returned yesterday to its favorite level of $112,000 and seems poised to continue rising—especially after large Asian purchases that boosted investor confidence. Ethereum also remains within a formation that allows for the continuation of the bull market.

Meanwhile, according to several analysts, despite Ethereum's 100% growth this year, the upside potential remains. Tom Lee from Fundstrat, whose company BitMine is actively buying ETH and betting on explosive growth, believes that ETH will reach $5,000 within a few weeks, and that a true rally will begin in Q4 this year, potentially driving ETH up to $10,000–$12,000.

Such optimistic forecasts certainly fuel interest in Ethereum and the broader cryptocurrency market. However, one must remember the high volatility inherent to cryptocurrencies and take potential risks into account. Achieving ambitious targets, such as $12,000, would require sustainable capital inflows into the market, as well as a favorable regulatory environment. In addition, Ethereum's success directly depends on the development and successful implementation of new technologies aimed at improving the scalability and energy efficiency of the network. At the same time, a correction is possible, especially after such rapid growth. Macroeconomic factors, geopolitical risks, and changes in legislation could all have a significant impact on Ethereum's price. That's why investors are advised to exercise caution, diversify their portfolios, and conduct their own analysis before making investment decisions.

Also, it is essential to consider competition from other blockchain platforms, which are also rapidly developing and offering similar or even superior capabilities. Ethereum, of course, is the leader in the field of decentralized applications (dApps), but competitors like Solana, Cardano, and Polkadot also have their advantages and strong communities.

Regarding the intraday strategy on the crypto market, I'll continue to rely on major dips in Bitcoin and Ethereum, anticipating the ongoing medium-term bull market, which remains intact.

For short-term trading, the strategy and conditions are described below.

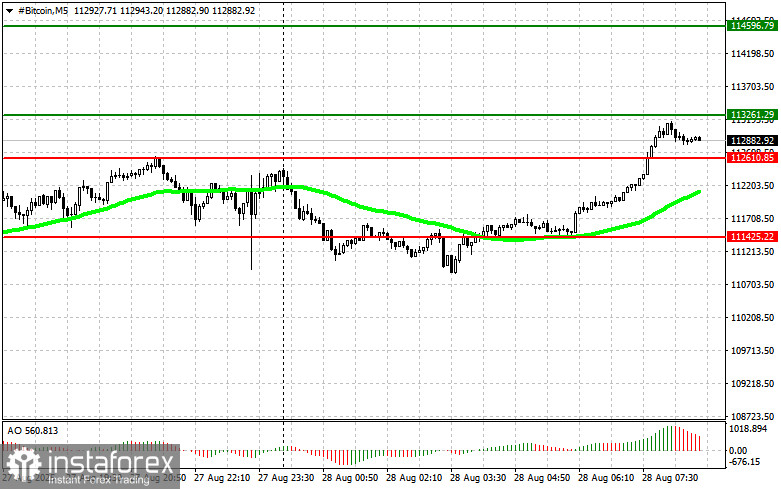

Bitcoin

Buy Scenario

- Scenario #1: I will buy Bitcoin today if it reaches an entry point around $113,200, targeting growth to $114,500. At around $114,500, I'll exit my long positions and immediately sell on the pullback. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: You can buy Bitcoin from the lower bound at $112,600 if there is no market reaction to a breakdown, aiming for a reversal toward $113,200 and $114,500.

Sell Scenario

- Scenario #1: I will sell Bitcoin today if it reaches an entry point around $112,600, targeting a drop to $111,400. Around $111,400, I'll exit short positions and immediately buy on the rebound. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: You can sell Bitcoin from the upper bound at $113,200 if there is no reaction to a breakout, targeting a reversal toward $112,600 and $111,400.

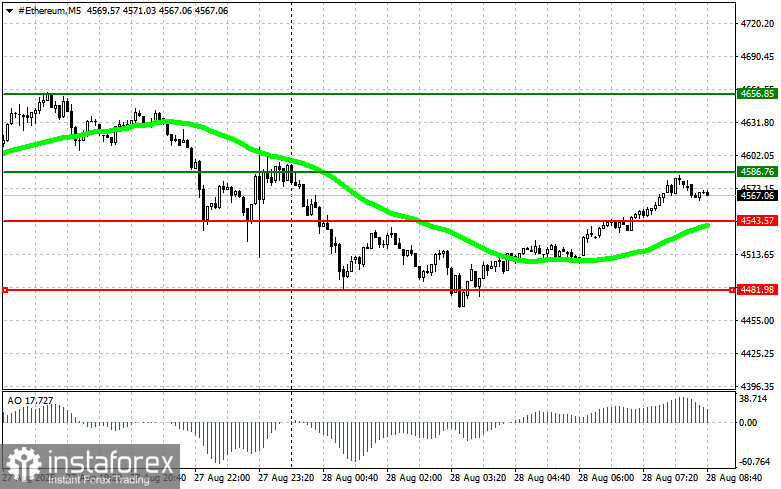

Ethereum

Buy Scenario

- Scenario #1: I will buy Ethereum today if it reaches an entry around $4,586, with a target of $4,658. At around $4,658, I'll exit my longs and immediately sell on the pullback. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario #2: You can buy Ethereum from the lower bound at $4,543 if there is no market reaction to a breakdown, aiming for a reversal toward $4,586 and $4,658.

Sell Scenario

- Scenario #1: I will sell Ethereum today if it reaches the entry of $4,543, with a target of $4,481. Around $4,481, I'll exit shorts and immediately buy on the bounce. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario #2: You can sell Ethereum from the upper bound at $4,586 if there is no market reaction to a breakout, targeting a reversal toward $4,543 and $4,481.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română