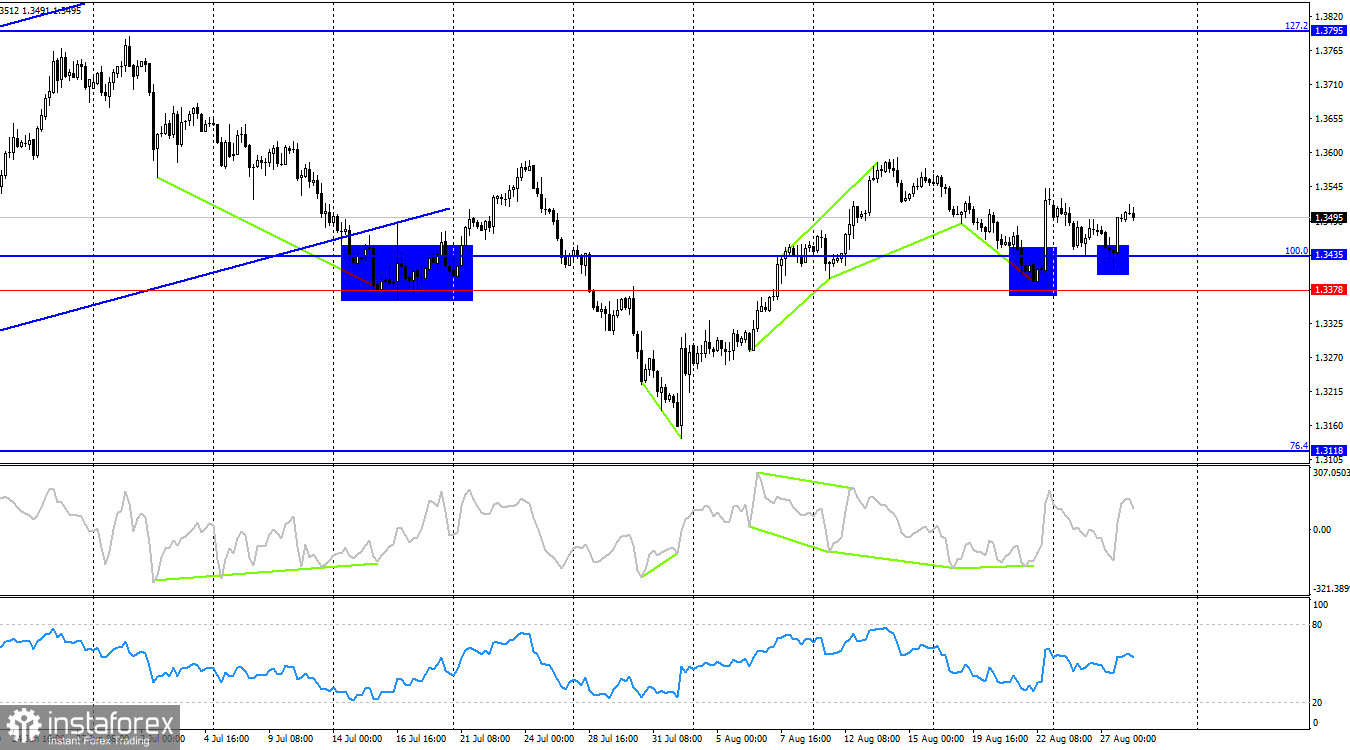

On the hourly chart, the GBP/USD pair on Wednesday fell to the support zone of 1.3416–1.3425 after rebounding from the 1.3482 level, turned in favor of the pound, and rose above the 76.4% Fibonacci level at 1.3482. Consolidation above 1.3482 allows for expectations of further growth in the British currency and supports holding open long positions. Conversely, consolidation below 1.3482 would once again work in favor of the U.S. dollar and a return to the 1.3416–1.3425 zone.

The wave structure remains "bearish," strange as that may sound after the recent strong upward movement. The last completed upward wave did not break the previous peak, and the last downward wave did not break the previous low. The news background has played a huge role in shaping the waves seen in recent weeks. In my view, the background has already turned the pair toward the bulls, so the trend may soon become "bullish" again.

On Wednesday, there was no news background, while today the U.S. will publish Q2 GDP data. I do not consider this report important, since it is released in three estimates. The first matters because it can differ significantly from traders' expectations. The final matters because the first estimate can be heavily revised. The second estimate, however, is generally ignored. Therefore, I do not see any major reasons for the dollar to rise today. Donald Trump continues to wage trade battles across half the world, pushing for favorable deals and pressing the Fed. None of these factors are positive for the bears. Thus, I expect growth to continue today. However, trading should be done from the 1.3482 level. Next week will be decisive, as key U.S. labor market and unemployment data will be released.

On the 4-hour chart, the pair performed a second rebound in favor of the pound after bouncing off the support zone at 1.3378–1.3435. Thus, growth may continue toward the next retracement level of 127.2% at 1.3795. No emerging divergences are observed in any indicator today. Consolidation below the 1.3378–1.3435 zone would again favor the dollar and some decline toward the 76.4% Fibonacci level at 1.3118.

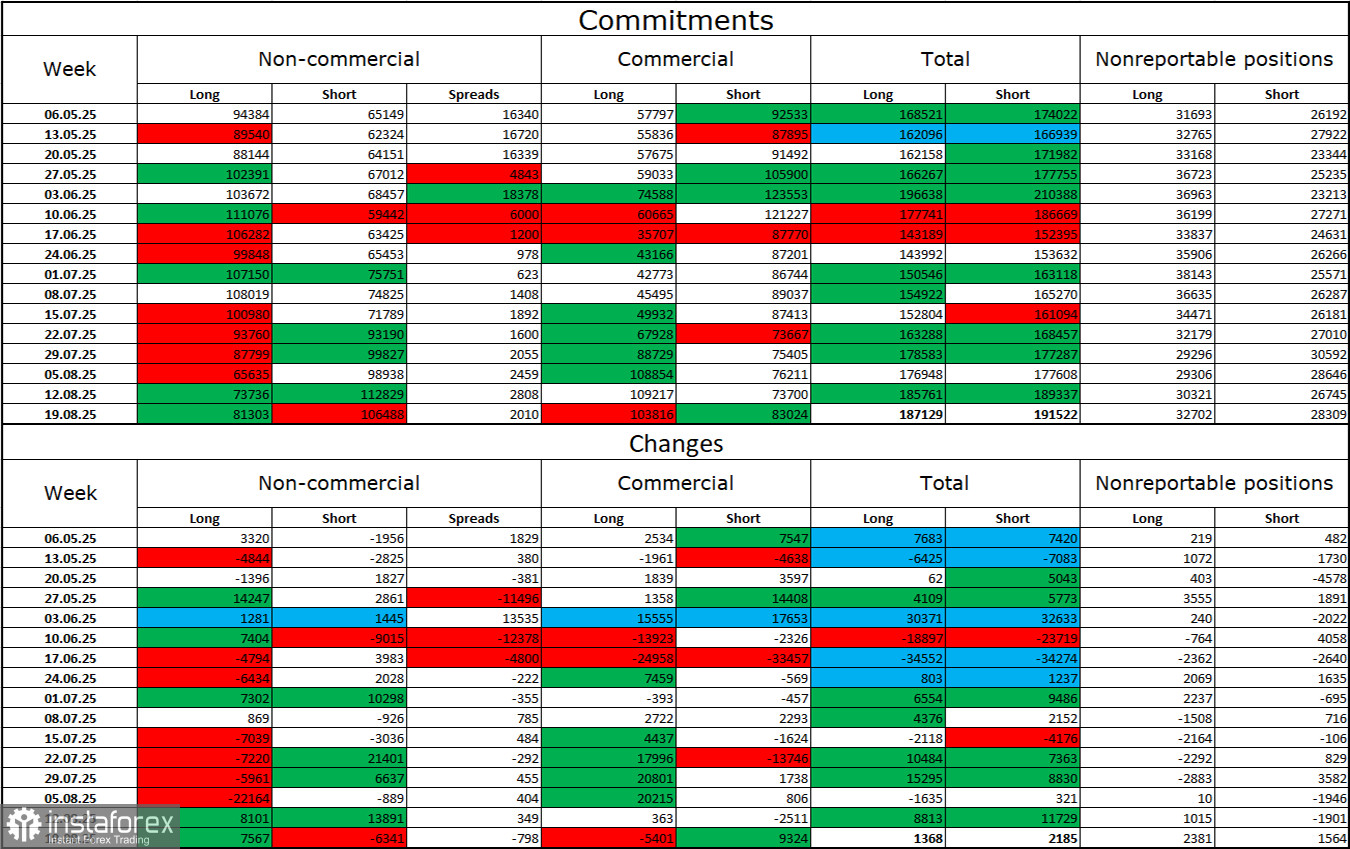

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category became more bullish over the last reporting week. The number of long positions held by speculators increased by 7,567, while short positions decreased by 6,341. The current gap between longs and shorts is 81,000 versus 106,000. As we can see, the pound leans toward growth, and traders lean toward buying.

In my view, the pound still faces prospects for decline. The news background for the U.S. dollar during the first six months of the year was terrible but is slowly improving. Trade tensions are easing, major deals are being signed, and the U.S. economy is recovering in Q2 thanks to tariffs and various investments. At the same time, the outlook for Fed monetary easing in the second half of the year has already started putting serious pressure on the dollar. Thus, I do not yet see grounds for a "dollar trend."

News calendar for the U.S. and the UK:

- U.S. – Q2 GDP change (12:30 UTC).

- U.S. – Initial jobless claims (12:30 UTC).

On August 28, the economic calendar contains two entries that are not particularly significant. The impact of the news background on market sentiment Thursday will be very weak.

Forecast for GBP/USD and trader recommendations:

Sales of the pair were possible from the rebound at 1.3482 targeting 1.3416–1.3425. That target was reached. For buying, a rebound from 1.3416–1.3425 with a target of 1.3586 was required. These trades can now be held open until a close below 1.3482.

Fibonacci grids are built from 1.3586–1.3139 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română