Wave Structure:

The wave structure of the EUR/USD pair in 2025 is quite simple across all charts. Beginner traders who are just starting to study wave analysis should remember that textbook patterns are rarely seen on real charts. Wave analysis provides many variations of structures, each with its own potential and characteristics. However, non-standard structures are difficult to trade and interpret. Therefore, I recommend beginners start with simple structures: the five-wave impulse and the three-wave correction.

Beginners should also keep in mind that any structure can be broken under the influence of the news background. For this reason, major news events should be considered separately from wave counts.

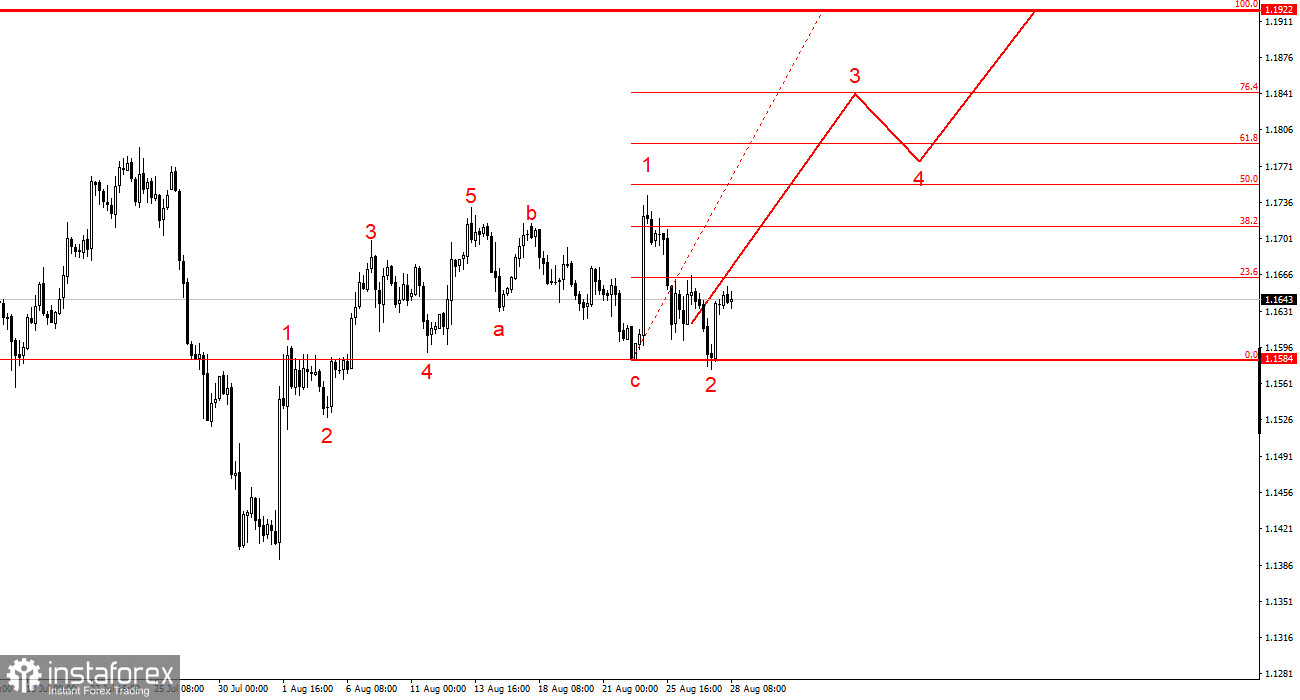

Over the past trading day, the price moved down to the low of the assumed wave c and then rebounded upward. Thus, the corrective structure that began on August 13 has already become more complex. The question is, in what way? One assumption is that we are seeing the construction of the same three-wave a-b-c structure, where wave a itself consists of sub-waves a-b-c. If that is the case, the latest decline is wave c, not 2.

What does this assumption give us? I still believe that the news background supports the continuation of the upward trend segment. The corrective structure turned out slightly more complicated, but such situations must be expected. I do not anticipate EUR/USD moving below 1.1584. A successful attempt to break this mark would cancel the current wave scenario and likely shift the instrument toward forming a more complex set of waves. Therefore, the trading plan remains the same: expecting the formation of a new five-wave impulse structure, which may take the euro to the 1.18–1.19 level. A Stop Loss can be placed below 1.1584.

Alternative scenario: a break below the low of wave c and the construction of a more complex sideways corrective structure.

Trading Recommendations: In the current situation, I can advise beginners to consider long positions during the corrective wave, expecting the formation of an upward set of waves. The target is 1.1922, which may be refined as the wave structure develops. A successful breakout below 1.1584 will cancel the current trading plan.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex ones are difficult to trade and often transform into other patterns.

- If you are not confident in the market situation, it is better not to enter.

- Absolute certainty in market direction never exists. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

- Always remember the news background, which c

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română