The euro, British pound, and Australian dollar all remained within sideways channels, and all these instruments could be traded using a Mean Reversion strategy. I did not trade through Momentum, as no strong directional moves were expected in the first half of the day.

Eurozone lending and money supply data fully matched economists' forecasts. This highlights the region's economic resilience and the stability of its financial institutions, providing a foundation for further growth. However, despite the absence of sharp currency market fluctuations, some experts express concerns about potential risks tied to global economic conditions. Lending dynamics show that the level of new loans remains high, indicating consumer and business confidence in the economic outlook. With interest rates low, credit availability continues to rise, supporting economic activity.

In the second half of the day, data will be released on weekly initial jobless claims, U.S. Q2 GDP, and pending home sales. These indicators play a key role in shaping market expectations and may significantly impact exchange rates.

Since the labor market remains one of the pillars of the economy, unemployment data provides valuable insight into the overall state of the economy. On the other hand, GDP data reflects the broader condition of the economy. If reports show growth, this may push the Federal Reserve to adopt a more cautious stance on monetary policy, which would support the dollar.

Equally important are real estate figures. Pending home sales can provide analysts with insights into the sector's stability. An increase in transactions may point to improving conditions, which are important for overall economic growth.

In the case of strong statistics, I will rely on implementing the Momentum strategy. If the market does not react, I will continue using the Mean Reversion strategy.

Momentum Strategy (breakout) for the second half of the day:

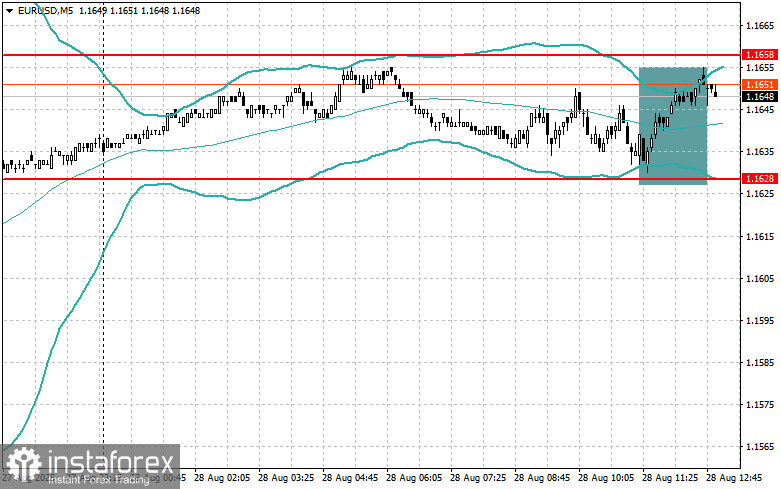

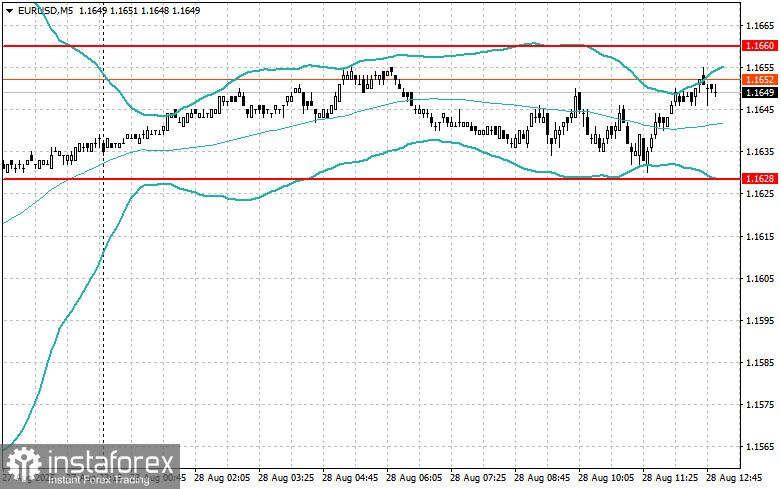

EUR/USD

- Buying on a breakout of 1.1661 could lead to growth toward 1.1701 and 1.1740;

- Selling on a breakout of 1.1630 could lead to a decline toward 1.1580 and 1.1530.

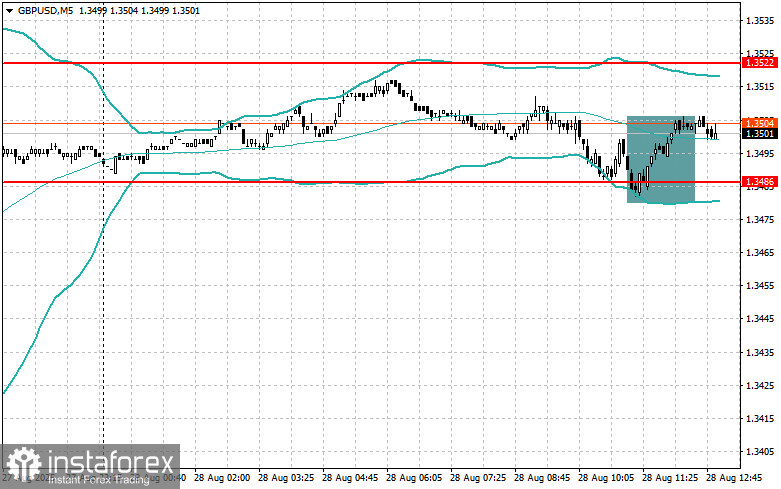

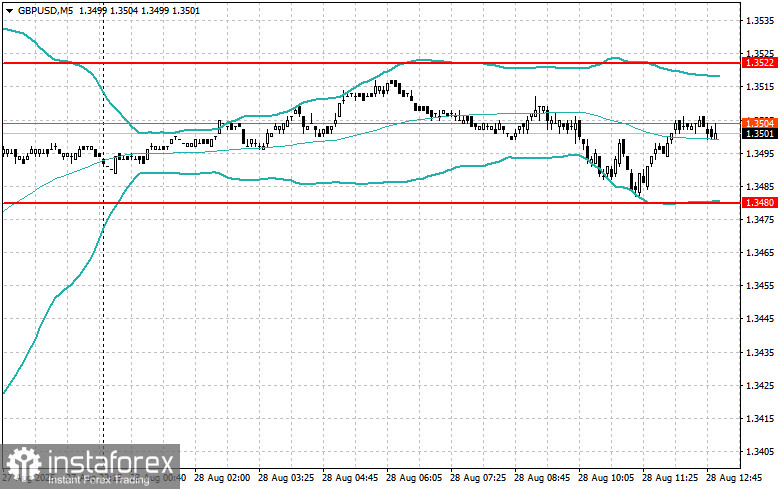

GBP/USD

- Buying on a breakout of 1.3523 could lead to growth toward 1.3560 and 1.3590;

- Selling on a breakout of 1.3485 could lead to a decline toward 1.3452 and 1.3418.

USD/JPY

- Buying on a breakout of 147.00 could lead to growth toward 147.65 and 148.30;

- Selling on a breakout of 146.90 could lead to a decline toward 146.65 and 146.30.

Mean Reversion Strategy (return) for the second half of the day:

EUR/USD

- Look for sales after a failed breakout above 1.1660, returning below this level;

- Look for purchases after a failed breakout below 1.1628, returning back to this level.

GBP/USD

- Look for sales after a failed breakout above 1.3522, returning below this level;

- Look for purchases after a failed breakout below 1.3480, returning back to this level.

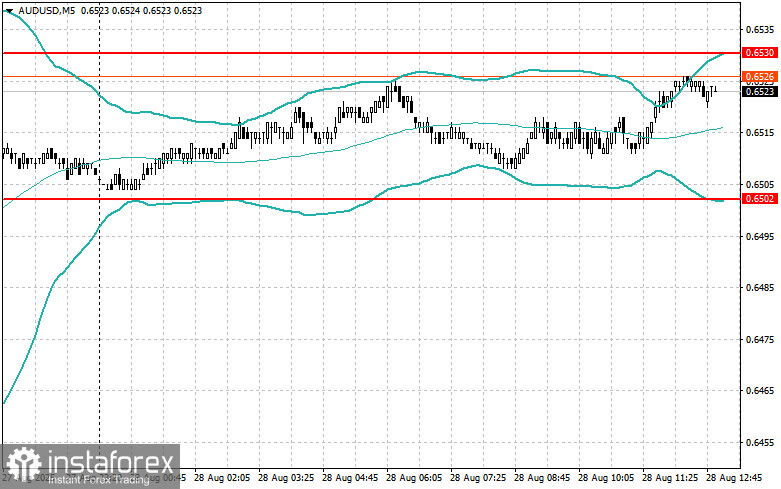

AUD/USD

- Look for sales after a failed breakout above 0.6530, returning below this level;

- Look for purchases after a failed breakout below 0.6502, returning back to this level.

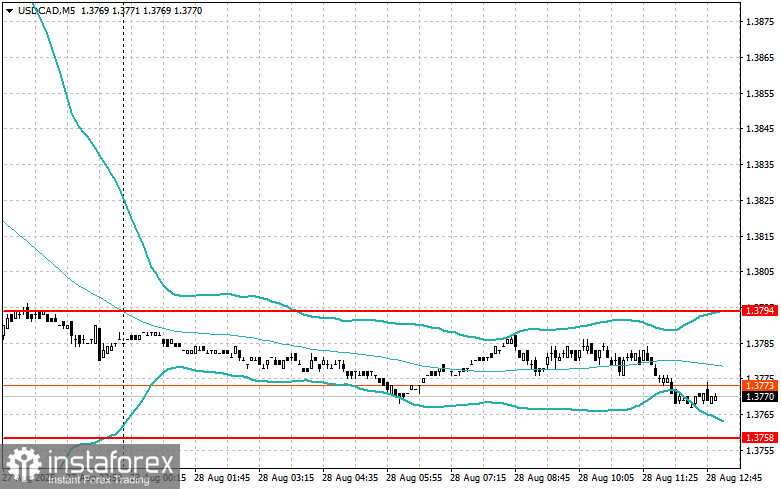

USD/CAD

- Look for sales after a failed breakout above 1.3794, returning below this level;

- Look for purchases after a failed breakout below 1.3758, returning back to this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română