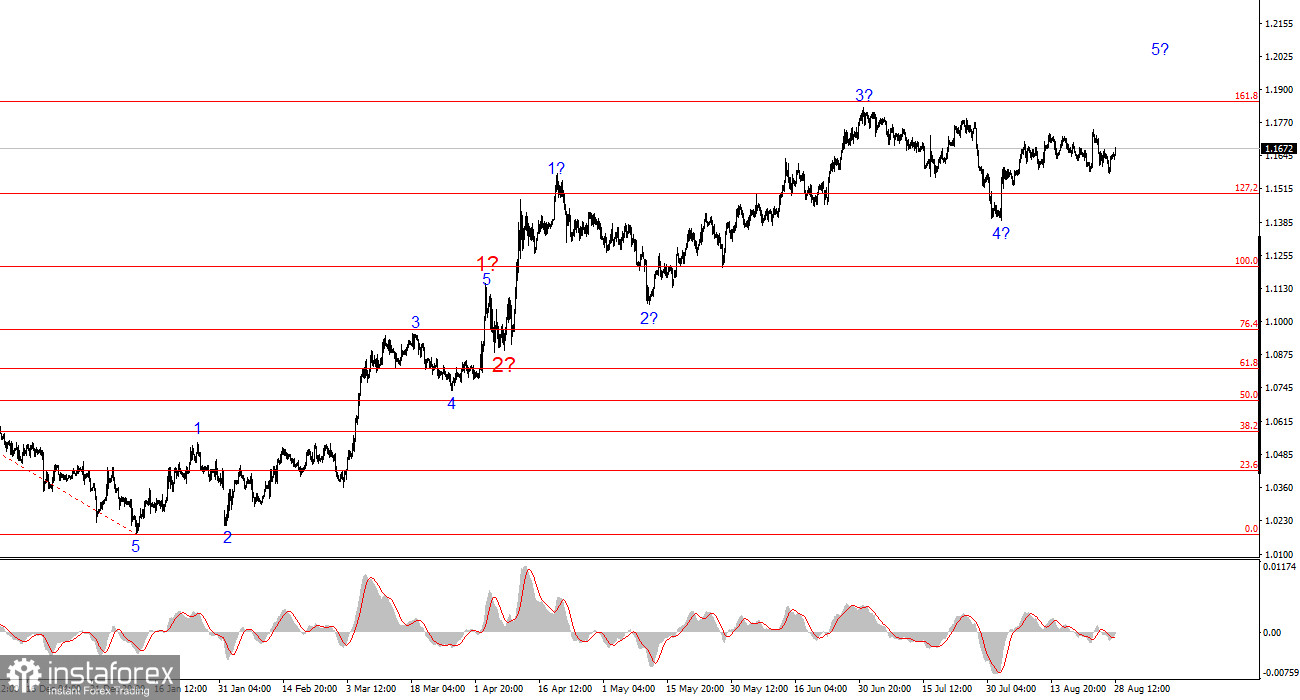

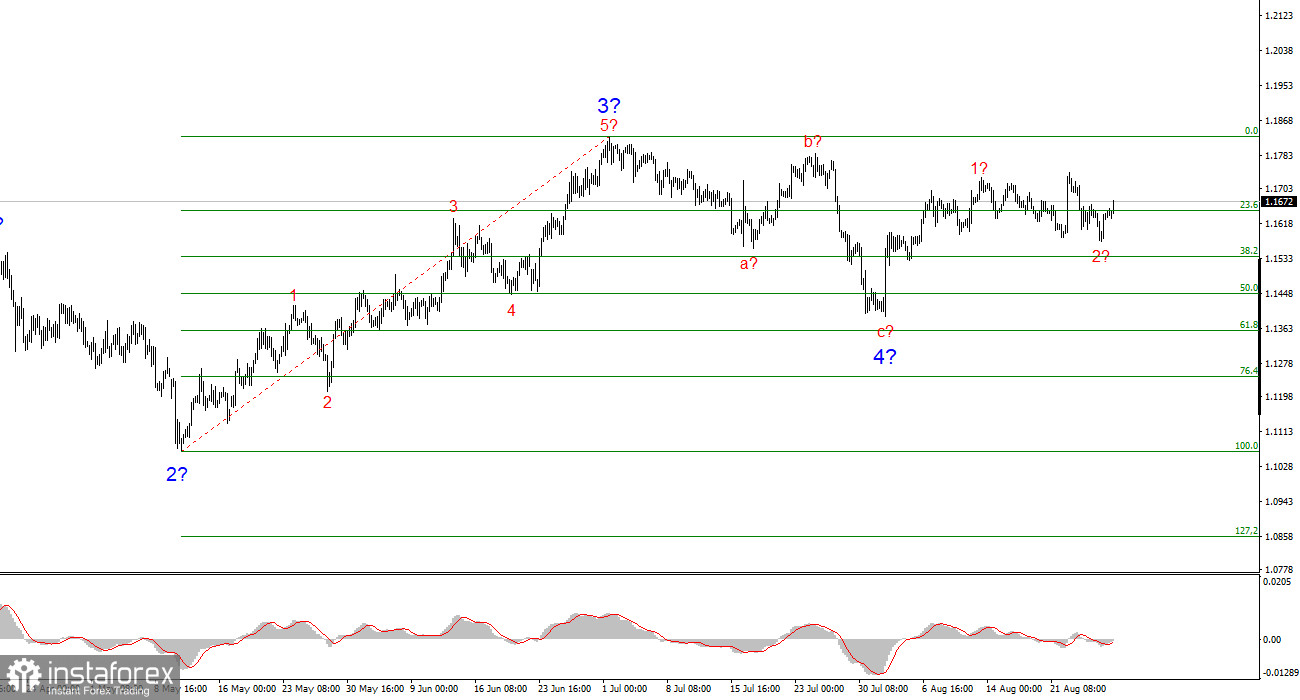

The wave structure on the 4-hour chart for EUR/USD has remained unchanged for several months, which is very encouraging. Even during the formation of corrective waves, the integrity of the structure has been preserved, allowing for accurate forecasts. It should be noted that wave patterns do not always look like textbook examples, but at the moment, the structure is clear and reliable.

The construction of the bullish trend segment continues, and the news background largely supports not the dollar. The trade war launched by Donald Trump is ongoing. The confrontation with the Fed continues. Dovish expectations are increasing. Trump's "One Big Law" will add 3 trillion dollars to the U.S. national debt, while the president continues to raise tariffs and introduce new ones. The market has a rather low view of Trump's first six months in office, despite U.S. GDP growth of 3% in Q2.

At present, it can be assumed that wave 4 has been completed. If so, the formation of impulse wave 5 has begun, with potential targets reaching as high as the 25th figure. Of course, wave 4 could still take the form of an extended five-wave correction, but the most likely scenario remains the beginning of wave 5.

The EUR/USD exchange rate rose by 40 basis points on Thursday by the start of the U.S. session, which I consider a completely natural move. In my view, the news coming out of the U.S. leaves the dollar with no support. The fact that the currency is not falling every single day is already remarkable.

Today, the U.S. released its second estimate of Q2 GDP. Recall that in Q1, the economy contracted for the first time since the pandemic, largely due to the global trade war initiated by Trump. In Q2, however, the U.S. economy posted one of the strongest growth rates in years. Some readers may wonder: why isn't the dollar strengthening when the economy is strong? The assumption is usually that strong economic growth equals a strong currency.

That logic worked until Donald Trump became president for the second time. For nearly two decades prior, the U.S. – outpacing the Eurozone or the UK in growth – could indeed boast a strong currency, as investors preferred economies with faster growth. Now, however, many investors prefer almost any economy over the U.S. The Q2 GDP growth is, in a sense, "artificial," while the administration turns a blind eye to other important indicators, chasing only headline growth. As I have written earlier, rapid growth can be achieved in many ways, but who really values strong growth when inflation runs in double digits?

General conclusions

Based on my EUR/USD analysis, I conclude that the pair continues to build a bullish trend segment. The wave pattern still depends entirely on the news background tied to Trump's decisions and U.S. foreign policy. Trend targets may extend up to the 25th figure. Therefore, I continue to consider long positions with targets around 1.1875, which corresponds to the 161.8% Fibonacci level, and higher. I assume wave 4 has been completed. Accordingly, now remains a good time to buy.

Key principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often transform into other forms.

- If there is no confidence in the market outlook, it is better to stay out.

- There can never be 100% certainty about market direction. Always use protective Stop Loss orders.

- Wave analysis can be combined with other methods of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română