Macroeconomic Report Review:

Very few macroeconomic releases are scheduled for Monday. In fact, the only reports worth noting are those on imports, exports, trade balance, and industrial production in Germany. These reports are not the most important ones, as they concern just one Eurozone country, which may have only a minimal impact on the euro. Event calendars in the Eurozone, the UK, and the US are empty on Monday.

Fundamental Events Review:

There is absolutely nothing to highlight in terms of fundamental events on Monday. However, the market does not currently need speeches from Bank of England, European Central Bank, or Federal Reserve representatives—central bank intentions are crystal clear at this point. The BoE cannot continue monetary easing, as UK inflation is already approaching 4%. The ECB has essentially finished its rate-cut cycle, with inflation near 2%. The Fed is forced to resume rate cuts, with the US labor market showing four consecutive months of weak results. Thus, there is no intrigue surrounding the upcoming central bank meetings. The dollar remains under strong fundamental and macroeconomic pressure. The fact that it hasn't been falling against the euro and pound in recent weeks is nothing more than a pause.

General Conclusions:

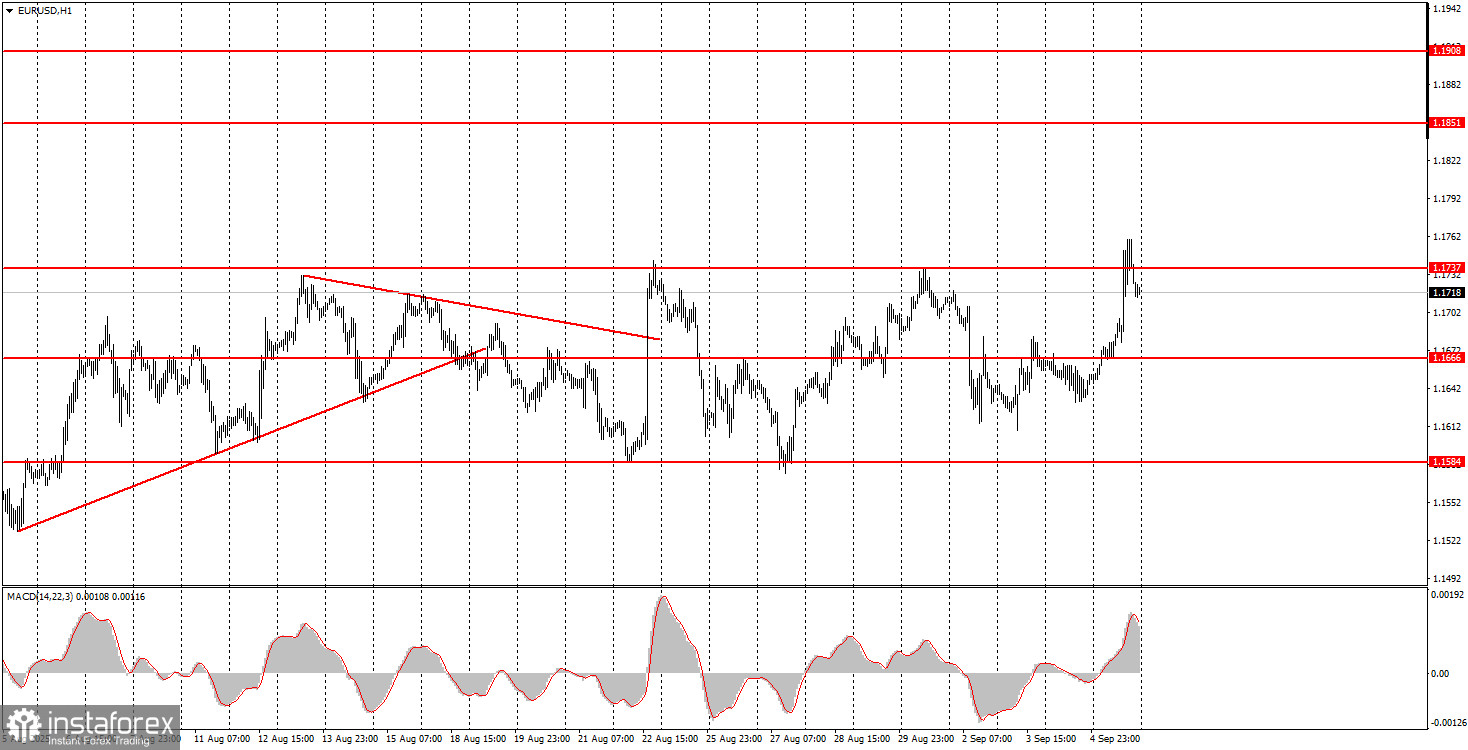

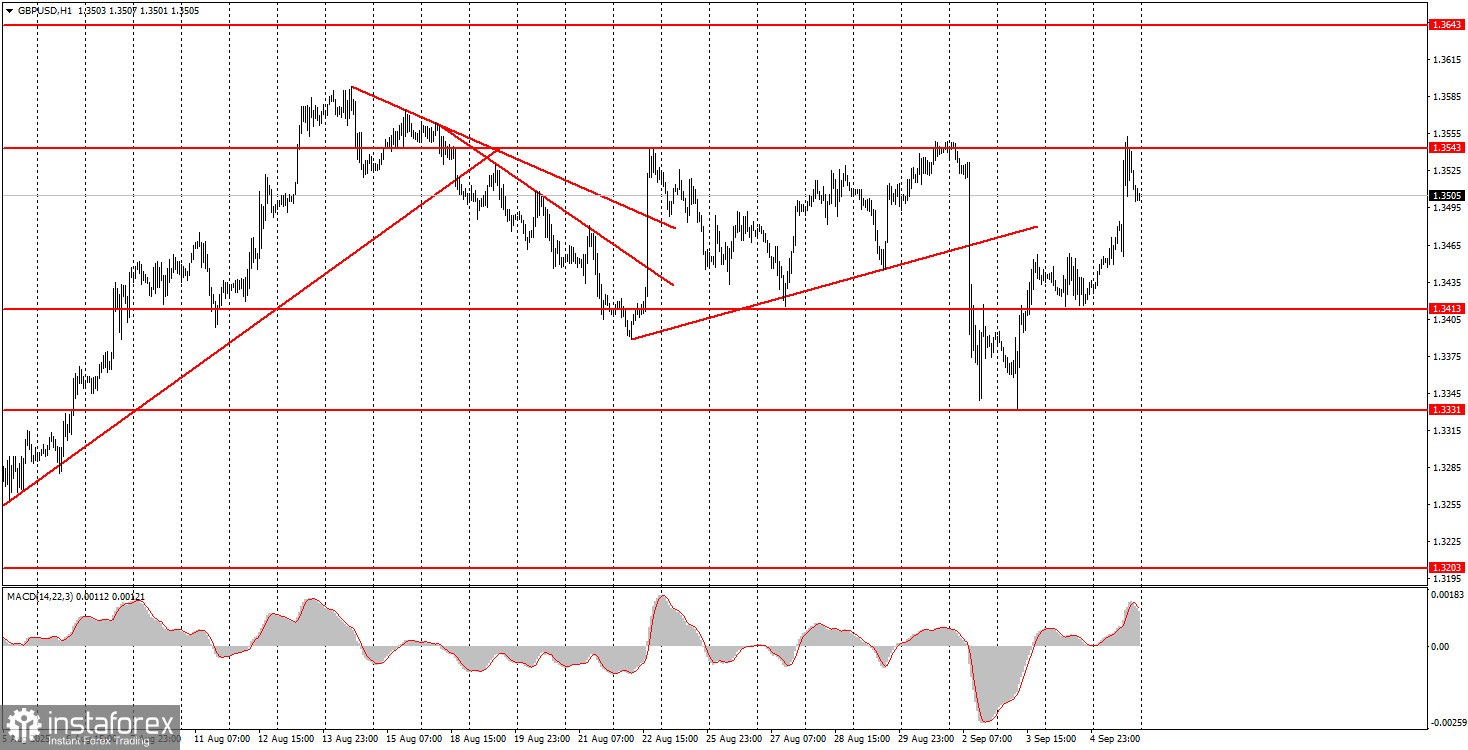

Over the first trading day of the week, both currency pairs may pull back slightly. With no important events scheduled, volatility is likely to be low. Both pairs remain in a flat, so movements may be choppy. The pound has formed decent sell signals in the 1.3529–1.3543 area, so there is a higher chance of a decline from those levels.

Key Rules for the Trading System:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15–20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română