Only the Australian dollar was traded today using the Mean Reversion strategy. Through Momentum, I traded the Japanese yen, which once again rose sharply against the U.S. dollar.

The bullish momentum in risk assets persisted during the first half of the day. Industrial production data from France came out better than expected, helping the euro advance. The pound continued its trend amid the absence of negative U.K. statistics. However, despite positive signals from France, the overall picture for the euro remains mixed. France's political issues and the ECB's cautious stance are sending traders conflicting signals on how to proceed.

At the same time, the outlook for the U.S. economy is also causing concern. A weak labor market keeps risks of slower economic growth in play, while high interest rates and inflation make this scenario more likely.

In the second half of the day, focus will be on the NFIB Small Business Optimism Index. While not one of the top-tier indicators, it serves as a barometer for assessing U.S. growth prospects. Small businesses are usually more sensitive to changes in the economic environment, and their level of optimism directly impacts investment decisions, hiring, and the overall condition of the labor market.

Publication of NFIB data could trigger short-term volatility, especially if the actual figures deviate significantly from forecasts. Positive results confirming resilience among small businesses could support the U.S. dollar, as this would indicate a strong domestic economy capable of withstanding higher interest rates.

However, it is important to view the NFIB index in the context of other macroeconomic data, such as inflation, employment, and consumer spending.

In case of strong statistics, I will rely on implementing the Momentum strategy. If the market shows no reaction to the data, I will continue to use the Mean Reversion strategy.

Momentum Strategy (Breakout) for the Second Half of the Day:

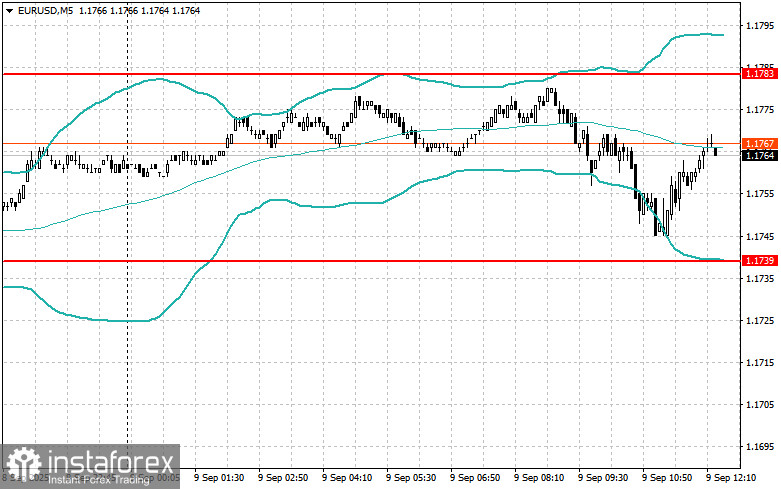

EUR/USD

- Buying on a breakout of 1.1781 may lead to growth toward 1.1825 and 1.1866;

- Selling on a breakout of 1.1740 may lead to a decline toward 1.1705 and 1.1668.

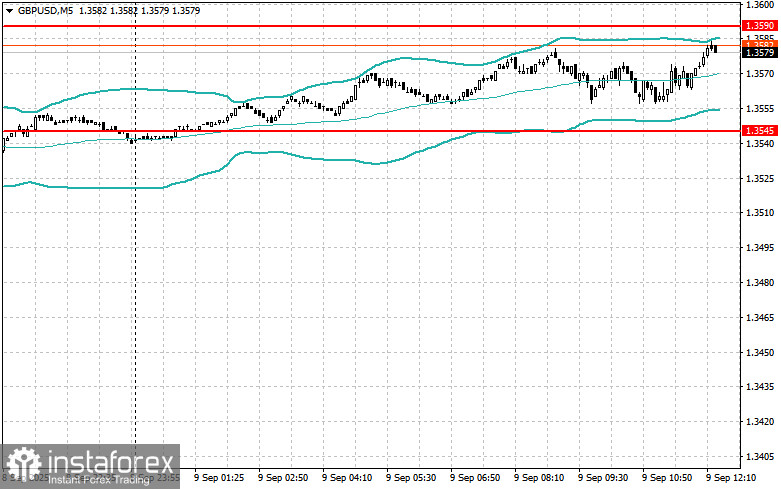

GBP/USD

- Buying on a breakout of 1.3587 may lead to growth toward 1.3615 and 1.3645;

- Selling on a breakout of 1.3555 may lead to a decline toward 1.3520 and 1.3484.

USD/JPY

- Buying on a breakout of 146.66 may lead to growth toward 146.98 and 147.46;

- Selling on a breakout of 146.30 may lead to a decline toward 145.92 and 145.60.

Mean Reversion Strategy (Reversal) for the Second Half of the Day:

EUR/USD

- I will look for selling opportunities after a failed breakout above 1.1783 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.1739 with a return above this level.

GBP/USD

- I will look for selling opportunities after a failed breakout above 1.3590 with a return below this level;

- I will look for buying opportunities after a failed breakout below 1.3545 with a return above this level.

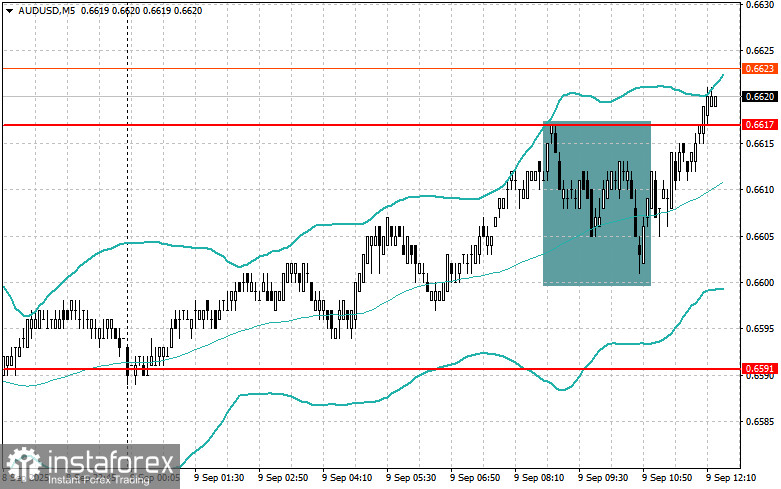

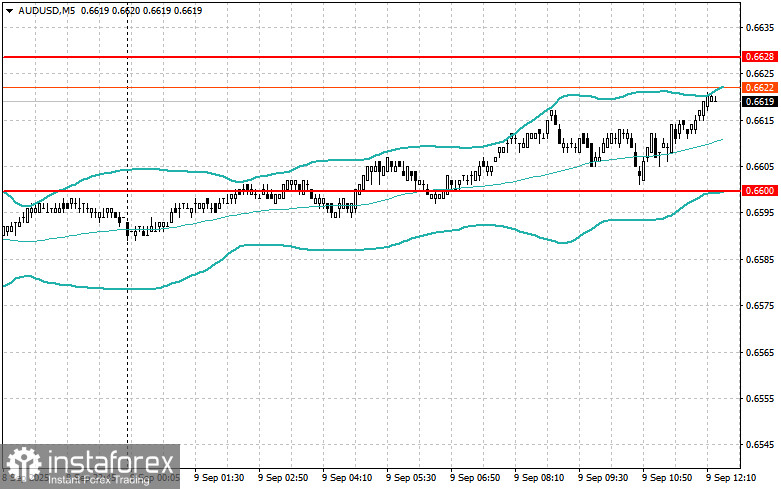

AUD/USD

- I will look for selling opportunities after a failed breakout above 0.6628 with a return below this level;

- I will look for buying opportunities after a failed breakout below 0.6600 with a return above this level.

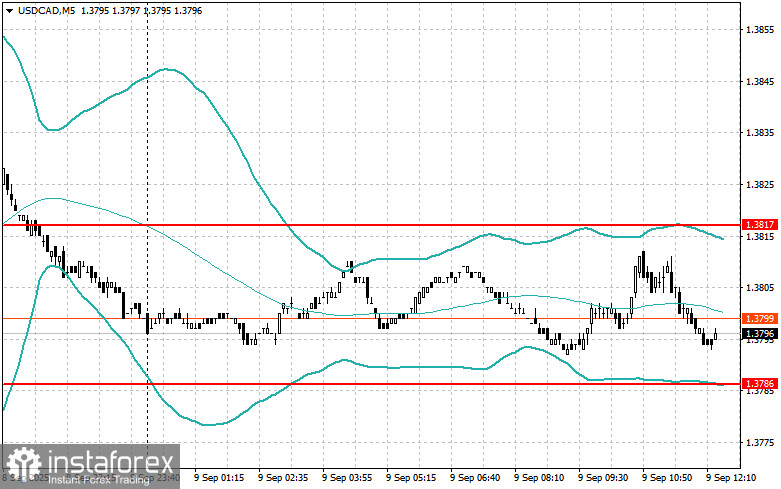

USD/CAD

- I will look for selling opportunities after a failed breakout above 1.3817 with a return below this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română