EUR/JPY

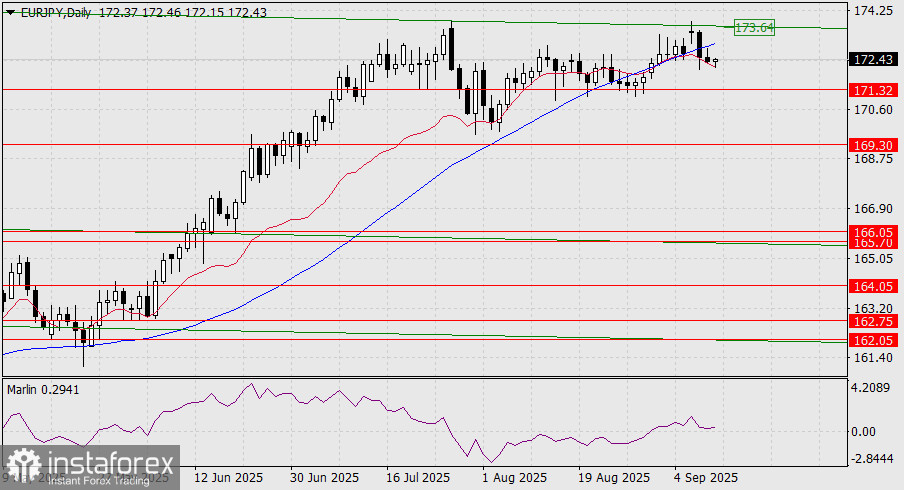

The EUR/JPY pair has reversed for the second time from the upper boundary of the price channel and is now holding below the MACD line on the daily chart. The signal line of the Marlin oscillator remains in positive territory but is hesitating in front of the zero line, viewing it as a significant barrier. This likely reflects the price's indecision in overcoming the balance indicator line, where it has lingered for a second day.

Today, the market is waiting for the release of US inflation data for August (CPI). If the data supports yen strengthening, the support level at 171.32 (the first target) could be reached today. In this case, the Marlin indicator would move into negative territory, opening the way to the next target at 169.30. This is the main scenario. Alternatively, there is a chance for another return to the price channel boundary (173.64) or slightly above.

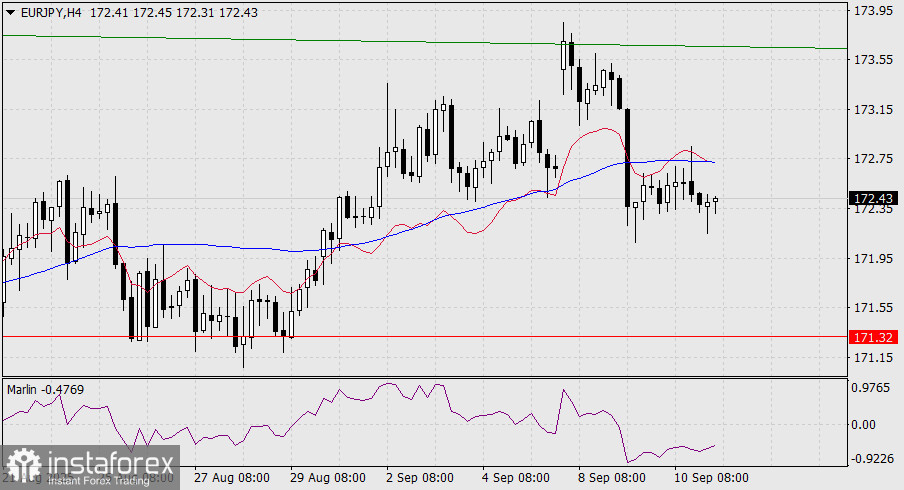

On the H4 chart, the price has consolidated below the balance and MACD indicator lines. The Marlin oscillator is showing slight growth as the price consolidates beneath these indicator lines. Market expectations ahead of today's US CPI release are restraining any major price moves.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română