The pair is consolidating above the 1.1685 support level as the market awaits US inflation data and the outcome of next week's FOMC monetary policy meeting. Unlike the Federal Reserve, which is expected to lower interest rates, today the European Central Bank is anticipated to keep its rates and all monetary policy parameters unchanged.

If today's US CPI report does not show inflation rising above the consensus forecast, the pair could receive support and continue its upward movement.

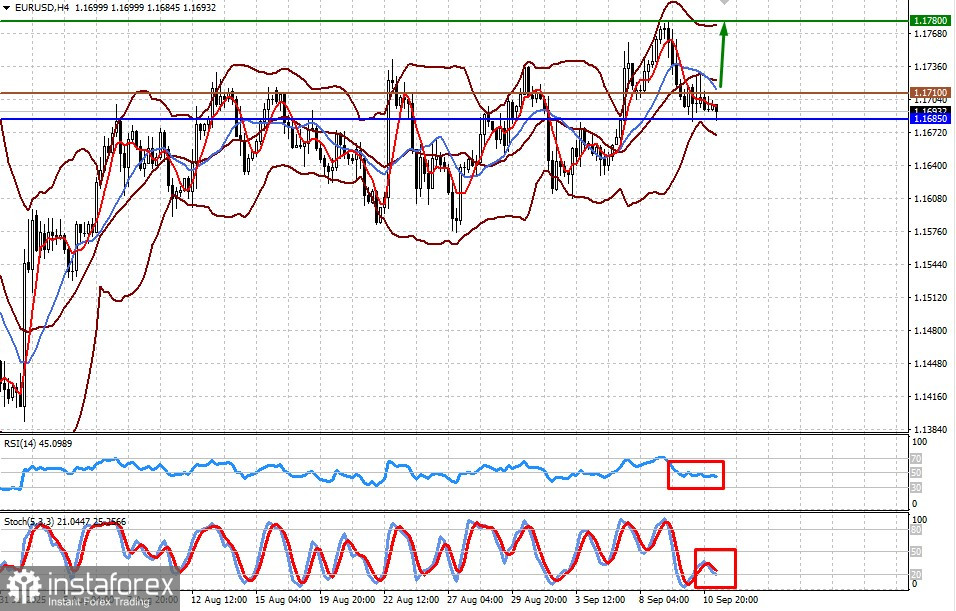

From a technical point of view, the pair is above the support level of 1.1685.

Technical View and Trade Idea:

- The price is below the middle line of the Bollinger Bands, below the 5-SMA, and 14-SMA.

- RSI is moving sideways below the 50% level.

- Stochastics are declining, but still above the oversold zone.

If dollar-negative news emerges, the pair may bounce off the 1.1685 support and head toward 1.1780. The 1.1710 level can serve as a buy entry point.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română