If the Producer Price Index gave the green light to sell EUR/USD on the rise, the Consumer Price Index triggered the exact opposite reaction. The main currency pair was bought as prices fell. Twice in a row, it experienced a rollercoaster ride due to inflation. The ECB was relegated to the sidelines. The euro didn't react at all to new forecasts nor to Christine Lagarde's comments at the press conference.

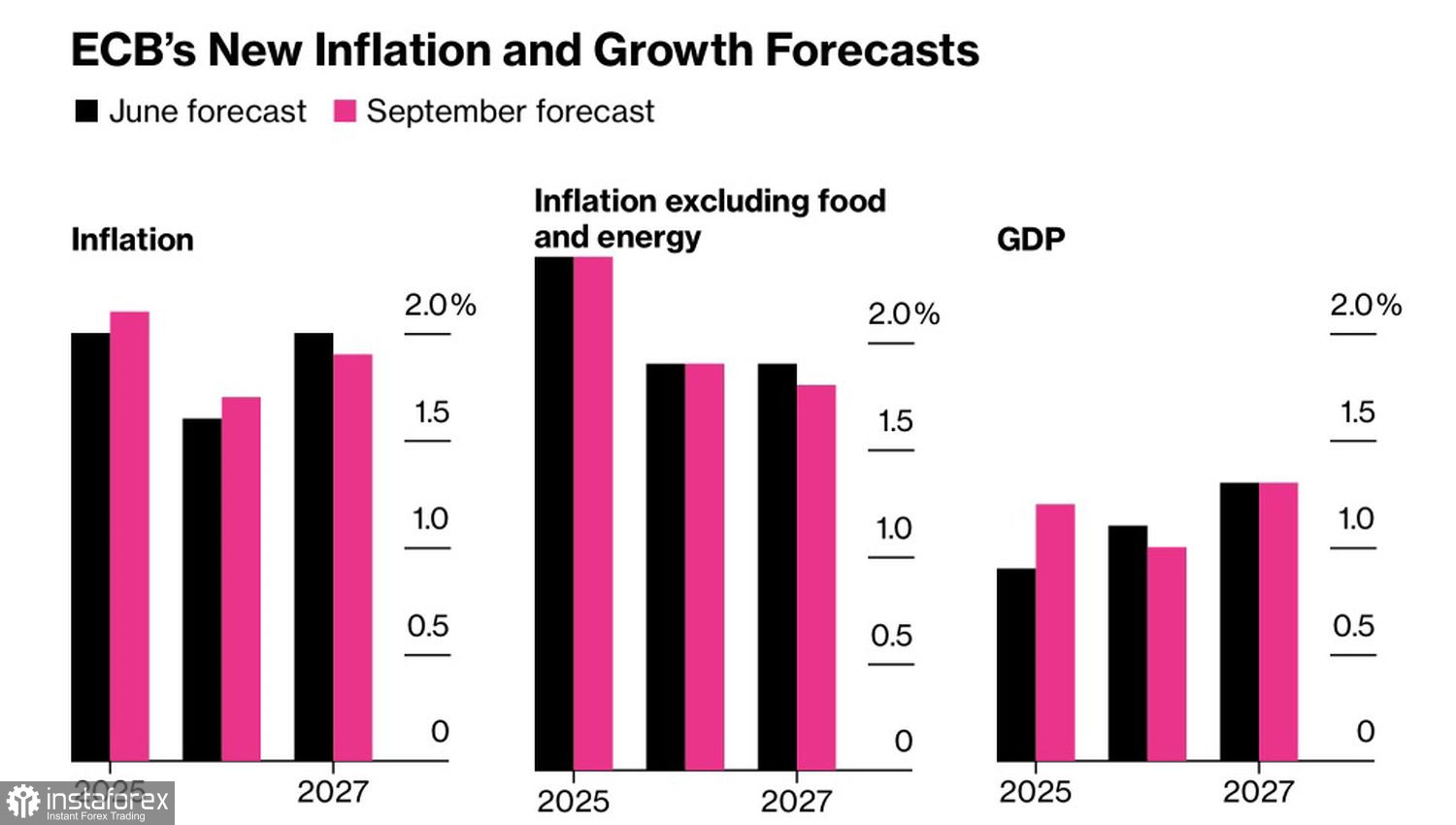

ECB Forecasts for GDP and Inflation

The European Central Bank raised its inflation outlook for 2026 from 1.6% to 1.7%, and lowered its 2027 forecast to 1.9%. GDP is expected to expand by 1.2% this year and by 1% next year. Lagarde noted strong domestic demand, which allowed initial tariff problems to be resolved. The Frenchwoman considers the eurozone economy's risks to be balanced, although she previously mentioned they were skewed to the downside.

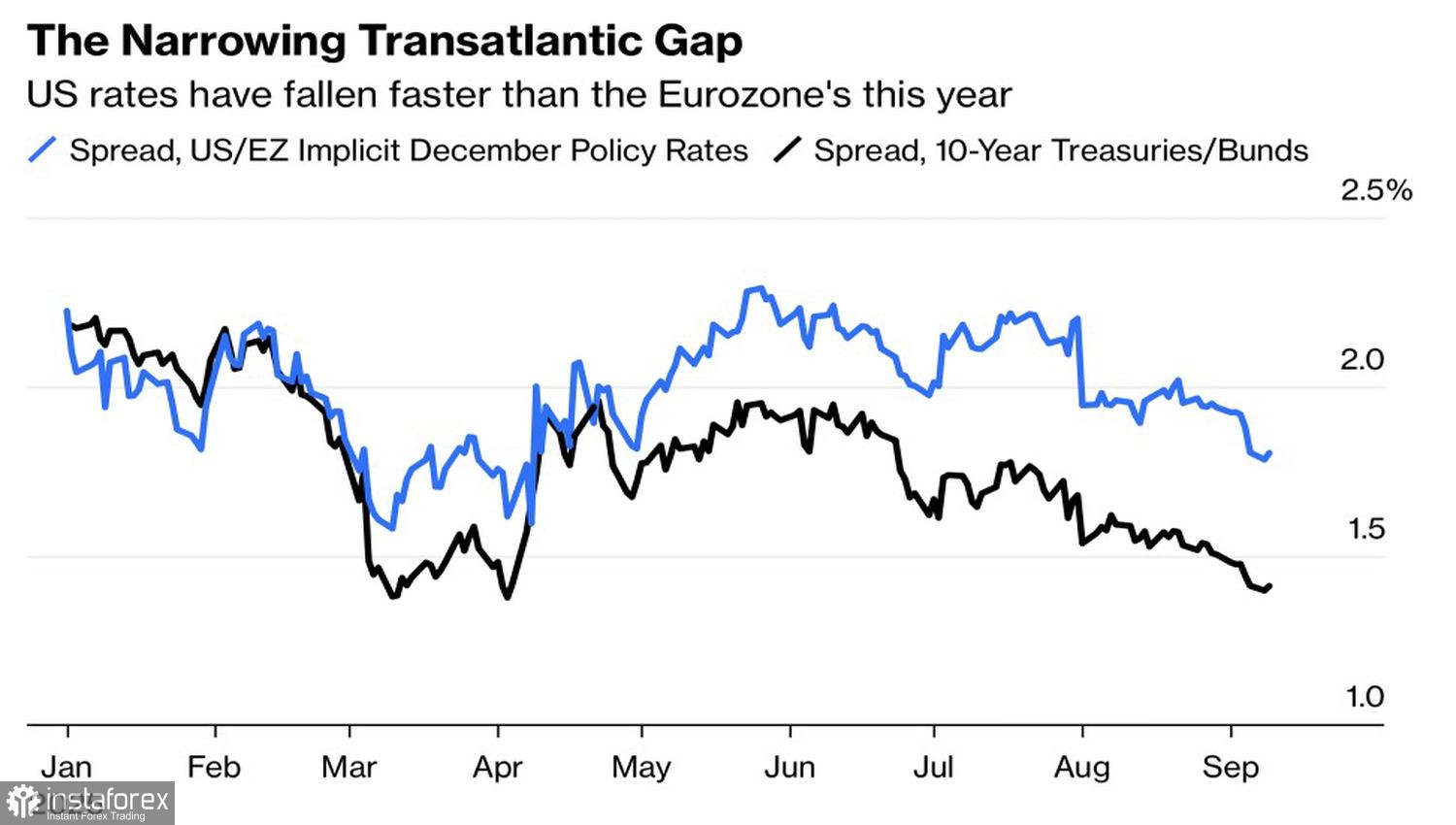

Bloomberg believes that the main difficulties from tariffs are still ahead and predicts a deposit rate cut in December. This contradicts the view of surveyed experts, who believe the ECB has ended its rate cycle. If the Fed eases monetary policy, the yield differential between US and German bonds will narrow. As a result, EUR/USD should rise.

Central Bank Rate and Bond Yield Spread Dynamics

Recent US inflation data fits this scenario. In August, consumer prices accelerated 0.4% m/m—faster than forecasts—but matched estimates year-over-year, as did core inflation. This suggests the Fed will most likely resume monetary easing in September and will move at a reasonably brisk pace. Especially since the labor market continues to cool, initial jobless claims have jumped to the highest since October 2021.

Judging by the policy divergence between the Fed and ECB, EUR/USD should confidently move higher. However, the euro has plenty of vulnerabilities that are holding it back. The political crisis in France is in full swing. Will the new prime minister be able to reach agreements with the parties, or will there be early parliamentary elections? The armed conflict in Ukraine is far from over, and Russian drones are starting to enter Polish territory. Geopolitics weighs heavily on the regional currency.

Add to this the potential for rising oil prices due to secondary Western sanctions against Moscow, and it becomes clear why the euro is in no hurry to restore its uptrend against the US dollar.

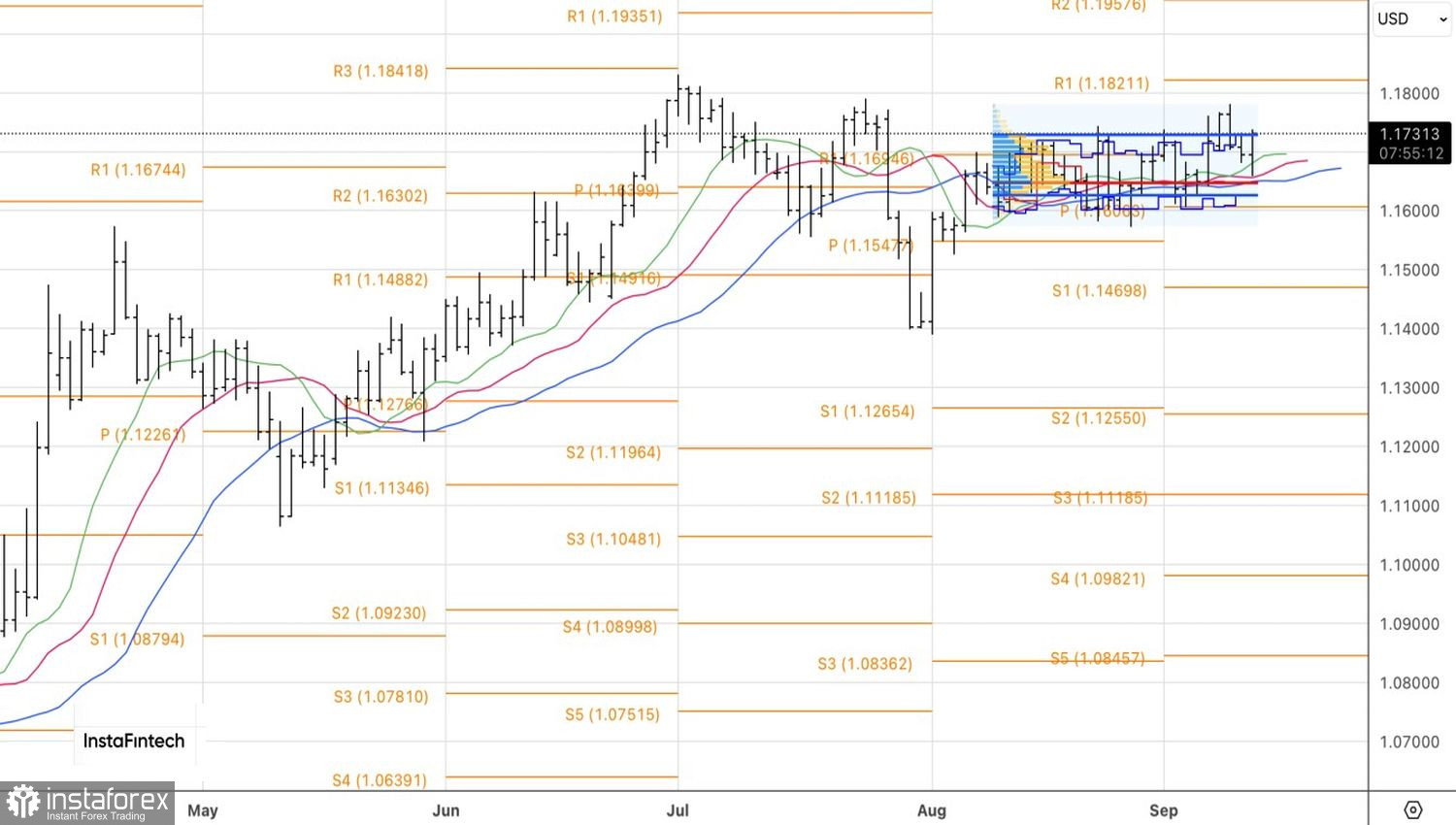

Technically, on the daily EUR/USD chart, there has been a bounce from dynamic support in the form of moving averages, close to fair value. The initiative is back with the bulls. If they manage to hold quotes above the upper boundary of the 1.1625–1.1725 trading range, the risk of a continued rally will increase. The focus should remain on buying.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română