On Monday, Steven Mirran may officially become one of the members of the Fed's Board of Governors. Recall that in August, Adriana Kugler decided to leave her post under rather strange circumstances, six months before the end of her term. In my opinion, this did not happen without Donald Trump's influence. And since Kugler had only a few months left at the Fed, she chose not to start a legal battle with the President of the United States—unlike Lisa Cook, who is only just beginning her story at the Fed.

Thus, as of Monday, there will be three known "doves" on the FOMC. The first two are Christopher Waller, who remains one of the candidates for the role of Chair after Powell, and Michelle Bowman, whom Trump appointed. A trend is already emerging where only Trump's proteges are ready to vote in favor of rate cuts. What is Trump trying to achieve next? Naturally, to increase the number of his proteges on the FOMC.

If with Kugler Trump won an easy victory, with Cook he has a tough struggle ahead. This week the Supreme Court ruled that Cook's dismissal was unlawful, and found the grounds for her removal insufficient. Note that this is a Fed governor, not a McDonald's worker—formal grounds are not enough for her removal. Cook's guilt was not proven, and Trump might as well have cited "traffic violations" as the reason for firing her.

The Court explicitly ruled that the administration provided no evidence of Cook's guilt, and removal from office cannot happen based on conjecture or speculation. Moreover, the Court pointed out that any alleged violation of the law with her mortgage occurred before Cook took office at the Fed. Trump's team announced it will appeal this decision, which doesn't surprise anyone. Trump is ready to contest any decision that goes against him to the very end. The only question is, will that end be victorious?

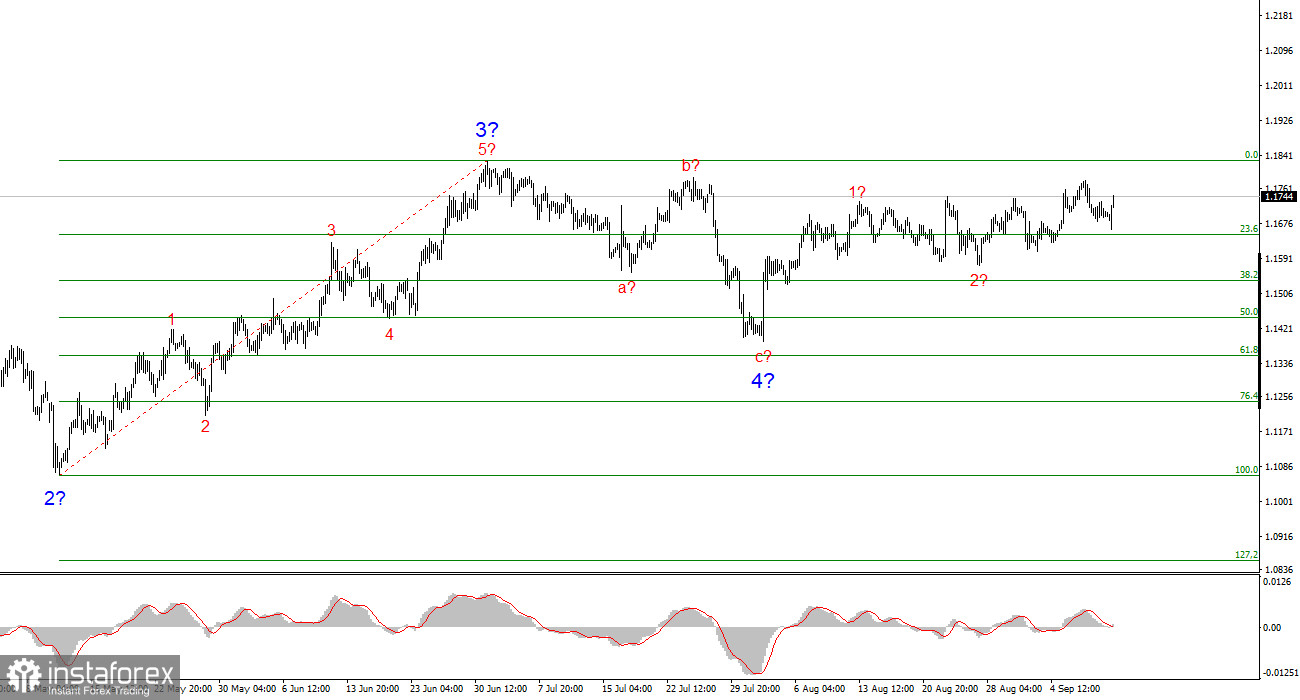

Wave Picture on EUR/USD:

Based on my analysis of EUR/USD, the instrument continues to build a bullish trend segment. The wave structure still entirely depends on the news background related to Trump's decisions, as well as the internal and external politics of the new Administration. The objectives of the trend segment could extend to the 1.2500 area. Therefore, I continue to consider buying the pair with initial targets near 1.1875, which coincides with the 161.8% Fibonacci level, and above.

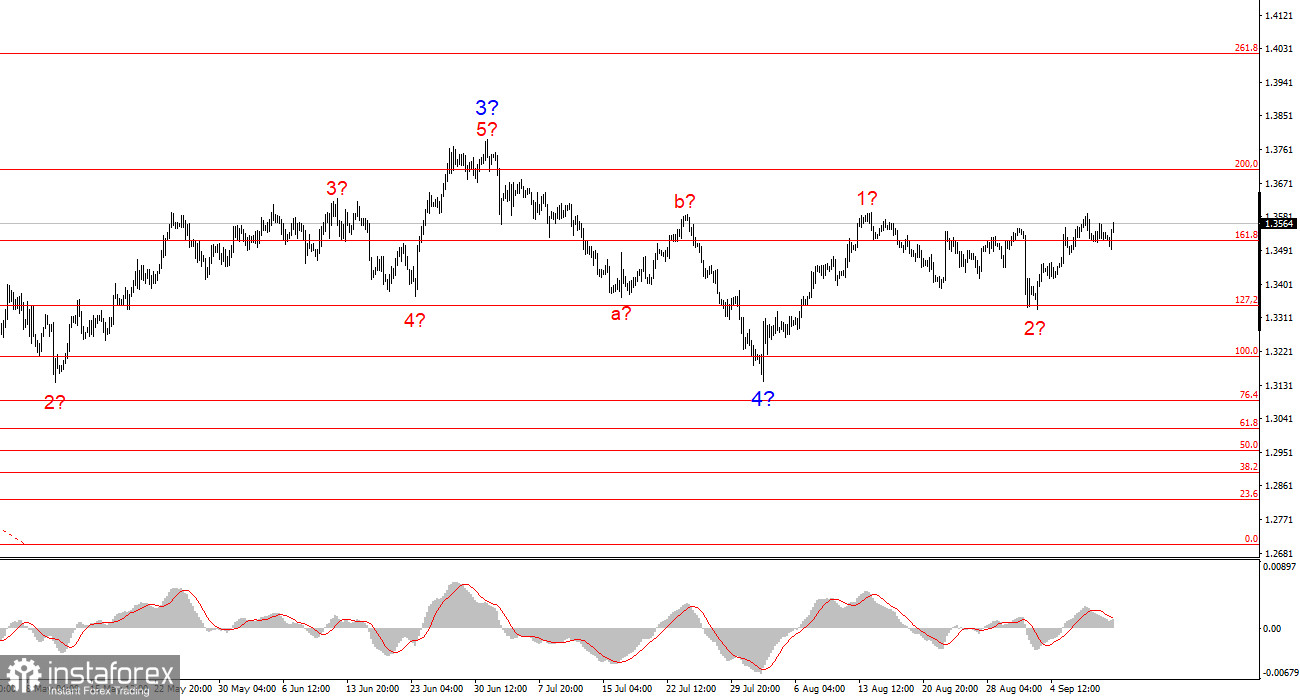

Wave Picture on GBP/USD:

The wave structure of the GBP/USD instrument remains unchanged. We are dealing with a rising, impulsive trend segment. Under Trump, the markets can expect a significant number of shocks and reversals, which may have a substantial impact on the wave picture. However, at the moment, the working scenario remains intact, and Trump's policy is unchanged. The objectives for the bullish trend segment are near the 261.8% Fibonacci level. At this time, I believe the corrective wave 2 in 5 has ended. Thus, I still advise buying with a target of 1.4017.

The Basic Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are harder to trade and often involve changes.

- If you are not confident about the market situation, it's better not to enter.

- Absolute certainty about price direction never exists. Always use protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română