Bitcoin renewed its weekly high today, reaching $116,300. However, it's still too early to say the previous bear cycle is broken. To do that, price needs to firmly break through $118,000, which would open the way to $120,000 and $124,000. Ethereum is also up modestly.

Yesterday's crypto market rally was fueled by news that US inflation, while still rising, is doing so at a very slow pace. This allows the Federal Reserve to consider rate cuts as soon as next week, providing support for crypto. Investors, tired of the Fed's tight stance, saw this as a long-awaited glimmer of hope. Lower interest rates are likely to spur capital flows out of traditional assets like bonds and stocks and into riskier but potentially more lucrative vehicles such as cryptocurrencies. Bitcoin, as the flagship of the crypto industry, reacted first by breaking important resistance and pulling up altcoins as well. Ethereum also showed impressive growth, supported by the anticipation of its upcoming protocol upgrade.

However, despite this optimism, it's important to remember that risks remain. Inflation, although slowing, is still above the Fed's target. Any unexpected spike could force a policy reversal, sending rates higher and causing an immediate crypto sell-off.

Strong inflows into spot BTC ETFs also suggest continued accumulation by traders.

I will continue to treat any major pullbacks in Bitcoin and Ethereum as potential entry opportunities, betting on the ongoing medium-term bull market trend.

Short-term trading scenarios and conditions are summarized below:

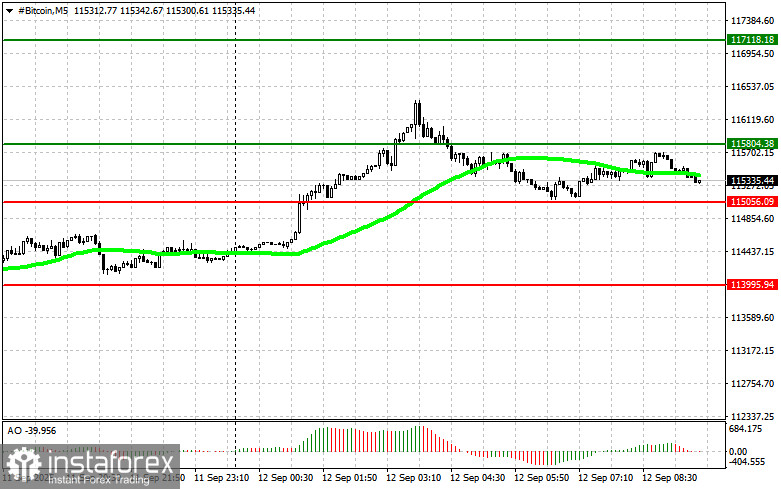

Bitcoin

Buy Scenario

- Scenario 1: I will buy Bitcoin today if the price reaches the entry area around $115,800, targeting a rise to $117,100. In the $117,100 area, I plan to take profits and immediately sell on a bounce. Before breakout buying, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: Buying is also possible from the lower boundary at $115,000, if there's no price reaction to a breakout down, expecting a return to $115,800 and $117,100.

Sell Scenario

- Scenario 1: I plan to sell Bitcoin today if the price reaches the entry around $115,000, targeting a decline to $114,000. Around $114,000, I'll close shorts and immediately buy on a bounce. Before breakout selling, confirm the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: Selling is also possible from the upper boundary at $115,800, if there's no reaction to its breakout, expecting a return to $115,000 and $114,000.

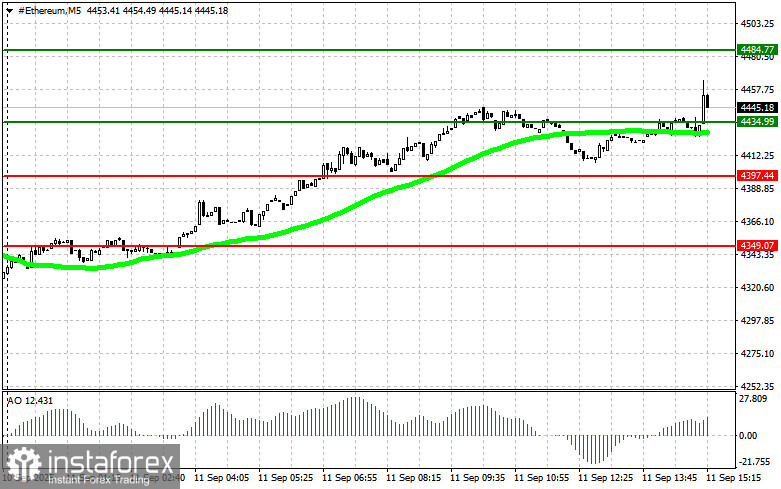

Ethereum

Buy Scenario

- Scenario 1: I will buy Ethereum today if the price reaches the entry area around $4,434, targeting a rise to $4,484. Around $4,484, I'll close longs and immediately sell on a bounce. Before breakout buying, ensure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

- Scenario 2: Buying is possible from the lower boundary at $4,397, if there's no reaction to a downside breakout, looking for a return to $4,434 and $4,484.

Sell Scenario

- Scenario 1: I will sell Ethereum today if the price reaches the entry around $4,397, targeting a decline to $4,349. Around $4,349, I'll close shorts and immediately buy on a bounce. Before breakout selling, confirm the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

- Scenario 2: Selling is possible from the upper boundary at $4,434, if there's no reaction to its breakout, expecting a return to $4,397 and $4,349.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română