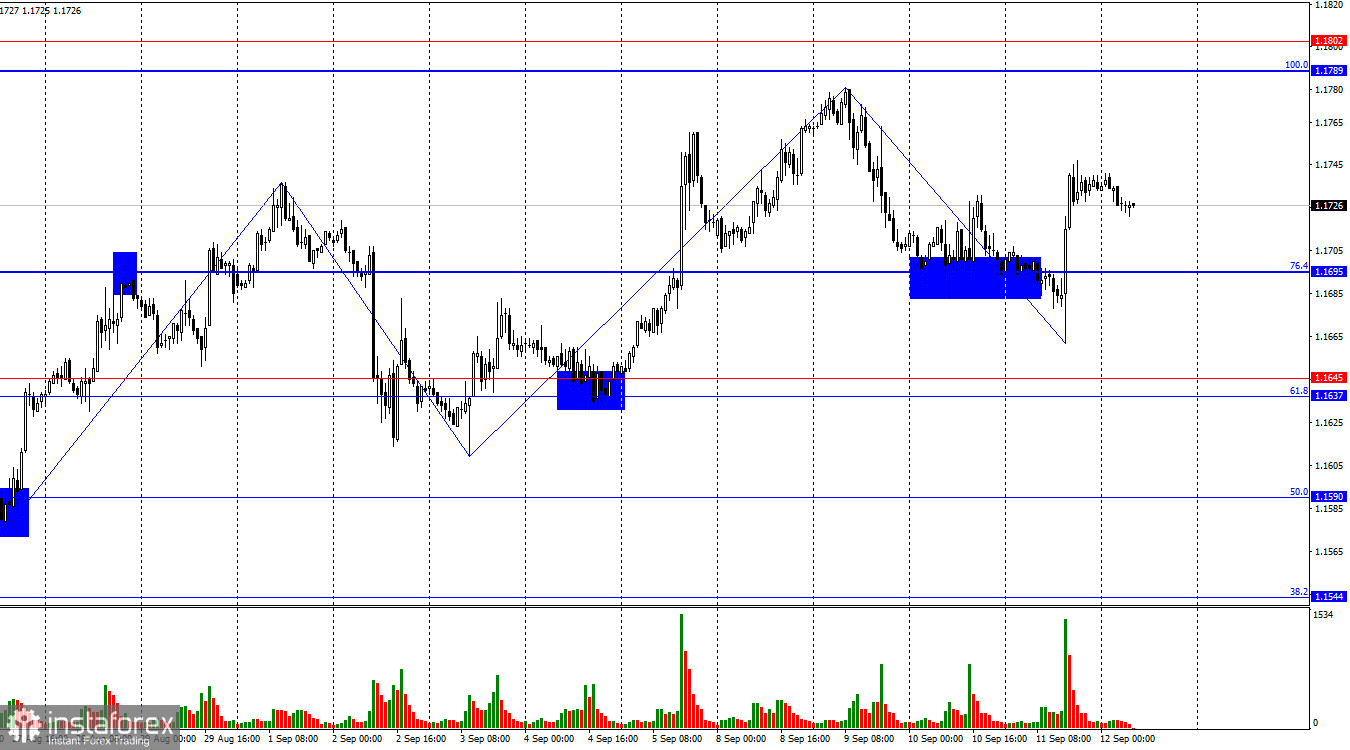

Good afternoon, traders! On Thursday, the EUR/USD pair reversed in favor of the euro and consolidated above the 76.4% Fibonacci level at 1.1695. Initially, traders were focused on selling and even achieved consolidation below 1.1695. However, the news flow dramatically shifted market sentiment. Thus, the upward movement may continue today toward the next 100% Fibonacci level at 1.1789.

The wave structure on the hourly chart remains simple and clear. The last completed upward wave broke above the previous wave's peak, while the most recent downward wave did not break the previous low. Thus, the trend remains bullish—though not particularly strong or confident. The latest labor market data and the changed outlook for the Fed's monetary policy support only the bulls for now.

On Thursday, the ECB held its policy meeting, but that wasn't the catalyst for increased activity among traders. The ECB maintained policy as expected. Instead, the U.S. inflation report surprised the market. Recall that Donald Trump and U.S. Treasury Secretary Scott Bessent continue to insist that inflation in America is low and demand that the Fed cut rates. However, official reports continue to show a rising CPI—and currently, it seems everyone has a different definition of "low." For Trump and Bessent, even 5% might be considered low. For the Fed, this is high inflation—2.5 times the target. Notably, there is increasing discussion that the target should be revised. As the saying goes, if the mountain won't come to Mohammed, Mohammed will go to the mountain. If you can't hit the target, just move it. This is the approach advocated by Republicans, loyal Trump supporters, for whom economic growth and a full government purse are far more important than low inflation. Meanwhile, since April (when tariffs began), CPI has climbed from 2.3% to 2.9%.

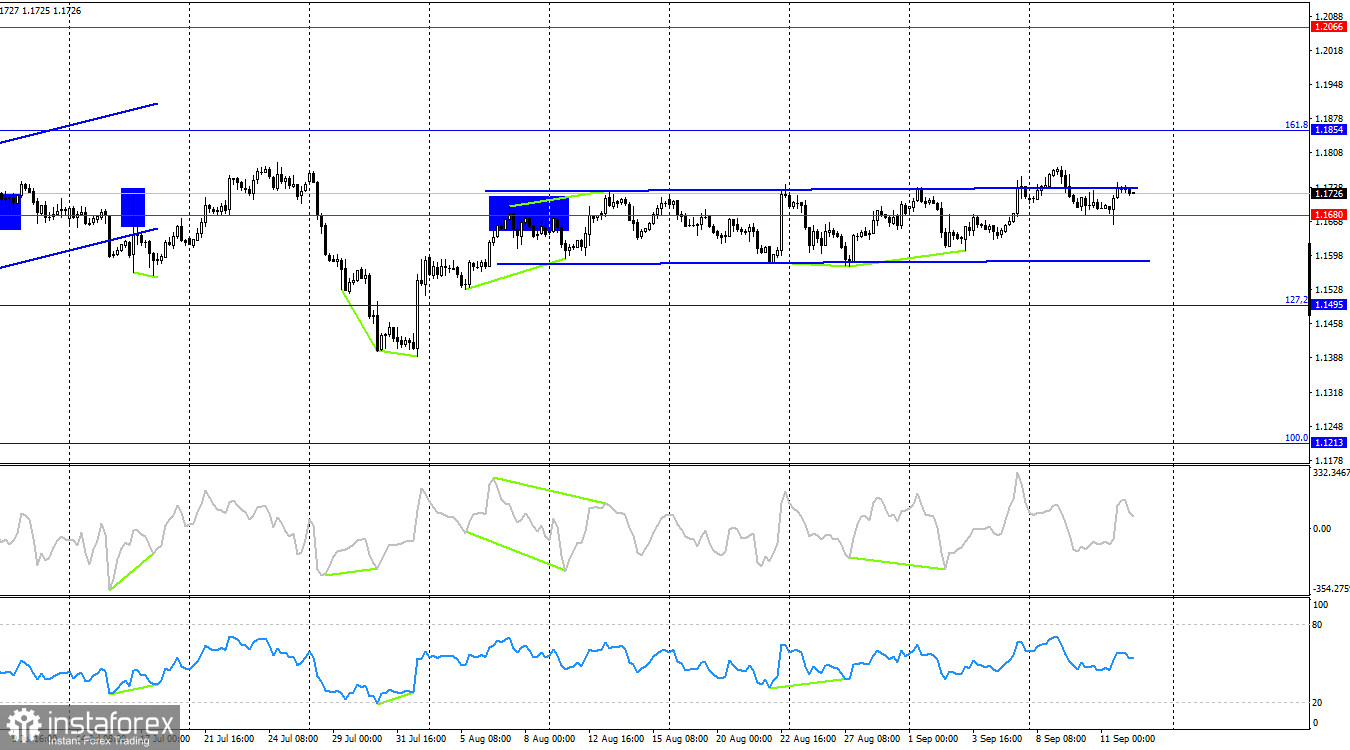

On the 4-hour chart, the pair consolidated above the horizontal range, allowing traders to look for further growth toward the 161.8% Fibonacci level at 1.1854. There are no looming divergences on any indicator today. A bounce off 1.1854 may work in the dollar's favor and spur some decline, whereas consolidation above 1.1854 will increase the pair's chances for further growth toward 1.2066.

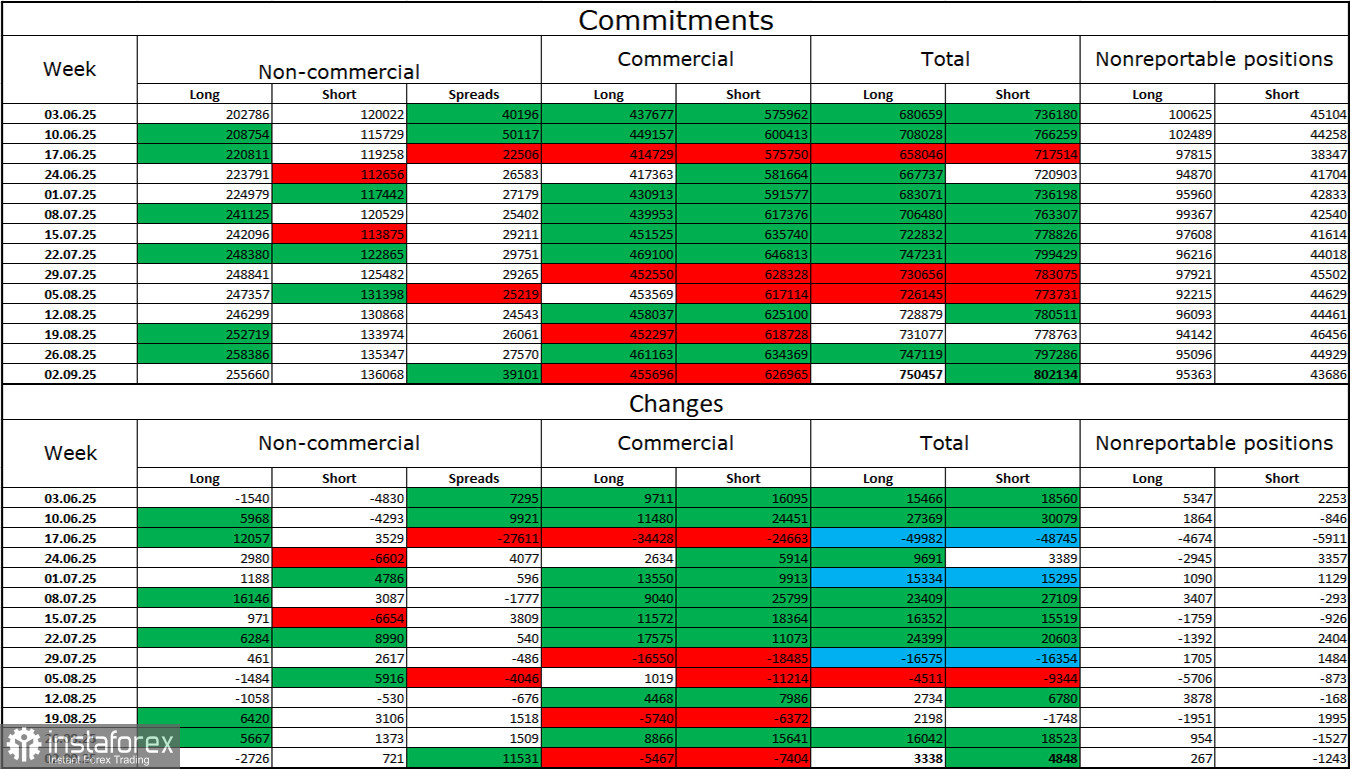

Commitments of Traders (COT) Report:

During the last reporting week, professional traders closed 2,726 long contracts and opened 751 short contracts. The "Non-commercial" group's sentiment remains bullish thanks to Trump and only grows stronger over time. The total number of long contracts held by speculators is now 255,000, and short contracts—136,000. The gap is practically twofold. Also, note the number of green cells in the table above, which reflects strong position buildup in the euro. In most cases, interest in the euro keeps rising, while interest in the dollar keeps falling.

For 30 weeks in a row, large players have reduced shorts and increased longs. Trump's policy remains the biggest factor for traders, as it may lead to structural, long-term problems for the US. Despite several key trade deals being signed, some crucial economic indicators are still declining.

News calendar for the US and Eurozone:

- Eurozone — German Consumer Price Index (06:00 UTC)

- US — University of Michigan Consumer Sentiment Index (14:00 UTC)

September 12's economic calendar contains just these two entries, neither of which is significant. The influence of news flow on market mood this Friday will be weak.

EUR/USD Forecast and Trading Tips:

Selling of the pair can be considered today on a close below 1.1695 on the hourly chart, aiming for the 1.1637–1.1645 zone. Buying the pair was possible on Thursday on a close above 1.1695, targeting the 1.1789–1.1802 area. Today, keep these trades running by setting the Stop Loss to break even.

Fibonacci levels are drawn from 1.1789–1.1392 on the hourly and from 1.1214–1.0179 on H4.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română