The case concerning Donald Trump's tariffs has reached the US Supreme Court. Initially, the lawsuit brought by 12 Democratic governors and several private businesses was heard by the International Trade Court, which handed down a clear verdict: the tariffs were illegal. Donald Trump immediately appealed, and the case went to the US Court of Appeals, which also decided unequivocally—Trump had overstepped his authority in imposing tariffs on 185 countries. Yet Trump did not give up and requested that the Supreme Court review the case. The hearing is scheduled for November 9, which means the tariffs will certainly remain in place until that date.

Donald Trump cites the 1977 Emergency Powers Act, claiming this law allows him to impose "reciprocal tariffs," though in fact, these are unilateral. The US President believes many countries are "suffocating" American exports by imposing various duties, taxes, and tariffs—all the while benefiting from the US economy. Trump insists he is simply restoring fairness by enacting counter-tariffs. However, many disagree with the President, and the Emergency Powers Act does not directly authorize imposing tariffs on entire countries.

US Treasury Secretary Scott Bessent has already stated that the probability of the court issuing a negative ruling is 40–50%, and such a decision would be disastrous for the US budget and economy. First, all illegally collected tariffs would have to be refunded to those who paid them, returning the US to the budget deficits everyone had become used to. Second, the White House would lose its main lever of pressure over other countries—"tribute" payments. Trump recognizes the US market as the world's richest, leveraging this advantage to achieve US objectives on the global stage.

If the court finds all presidential tariffs illegal, the trade war is over. Of course, the Trump team would attempt to restore tariffs via other laws, which also do not explicitly ban such actions. But those attempts could end the same way. November will be decisive. For the dollar, it would be very positive if the Supreme Court in Washington ruled to revoke all tariffs. Otherwise, expect another drop in demand for the US currency.

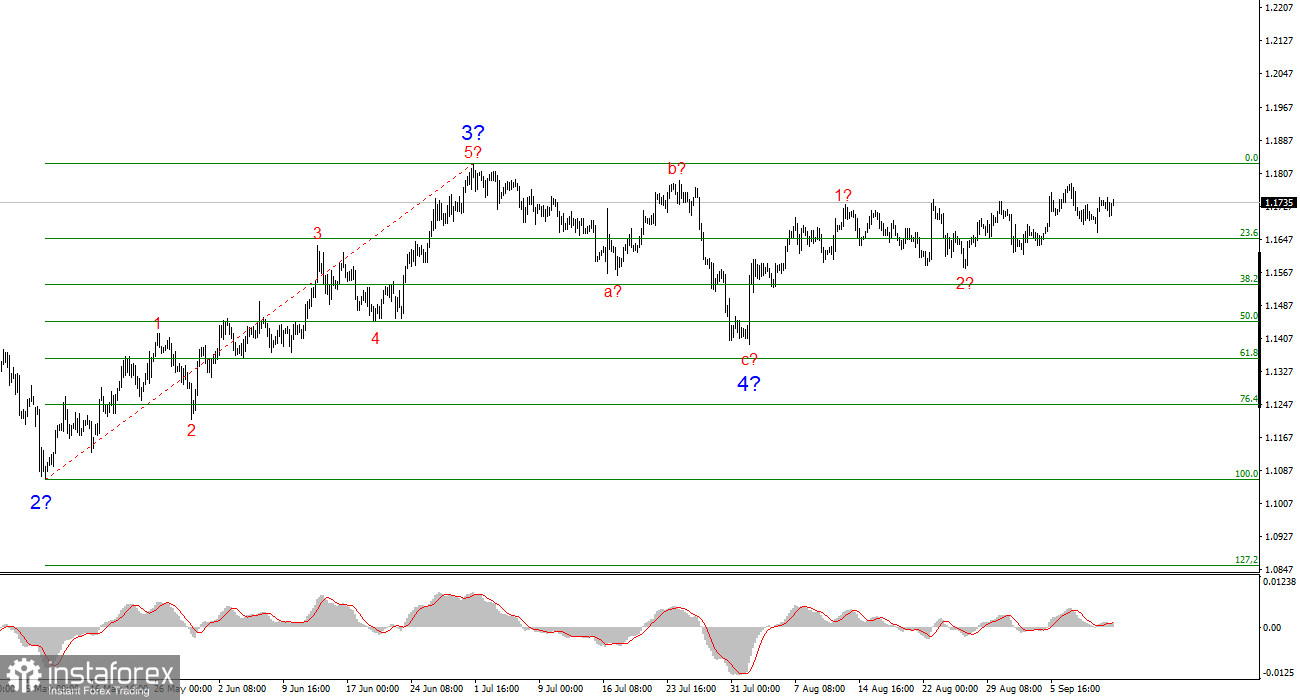

Wave Picture for EUR/USD

Based on my analysis, EUR/USD continues to develop its upward trend segment. The wave structure still completely depends on the news flow regarding Trump's decisions, as well as the external and internal politics of the new Administration. The wave's target may reach the 1.25 area. Given the consistent news environment, I continue to consider long positions, targeting levels near 1.1875 (the 161.8% Fibonacci level) and above.

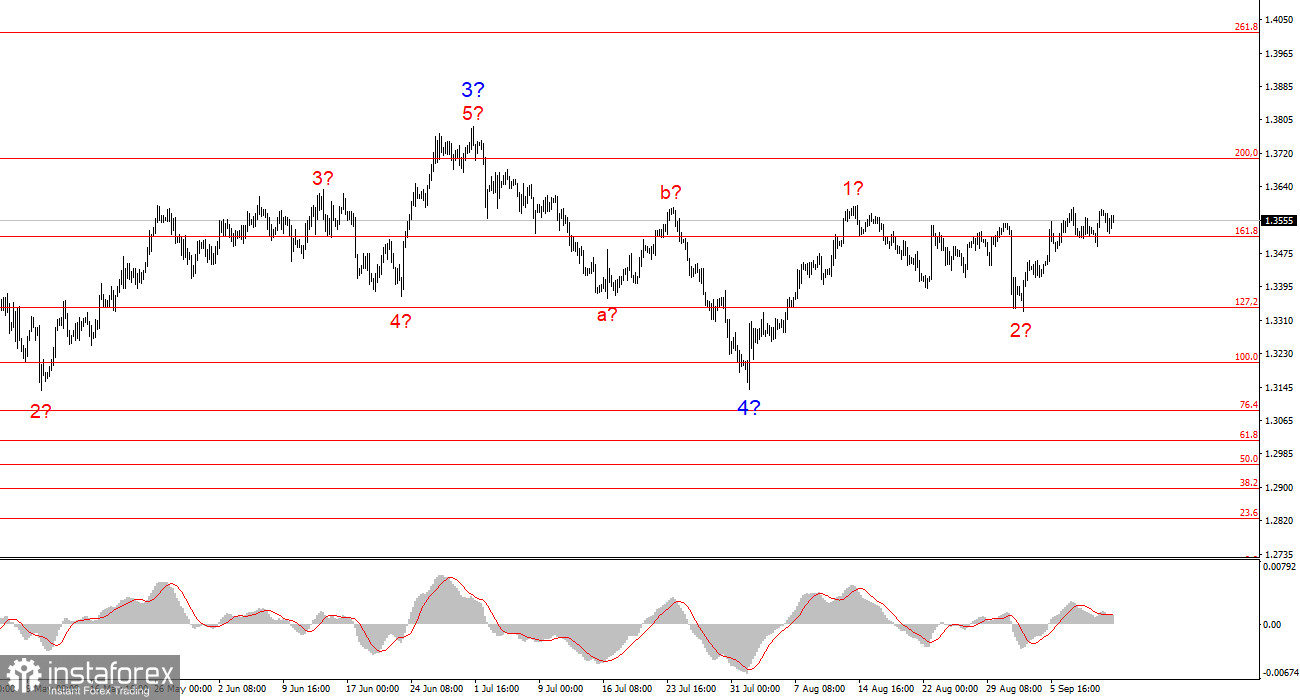

Wave Picture for GBP/USD

The wave structure for GBP/USD remains unchanged. We are dealing with an upward, impulsive trend segment. Under Donald Trump, markets may see plenty of shocks and reversals, which could notably impact the wave pattern, but for now, the working scenario remains intact, and Trump's policy remains unchanged. The upward trend segment's targets are near the 261.8% Fibonacci level. Currently, I expect continued growth within wave 3 of 5, aiming for 1.4017.

My Key Analytical Principles:

- Wave structures should be simple and clear. Complex structures are harder to trade and tend to change.

- If you are not confident about the market situation, it's better to stay out.

- There is never 100% certainty in market direction. Do not neglect protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română